Jobs Shock: September Payrolls Unexpectedly Soar By 336K, Biggest Jump Since January And 6-Sigma Beat

The Biden administration has really outdone itself.

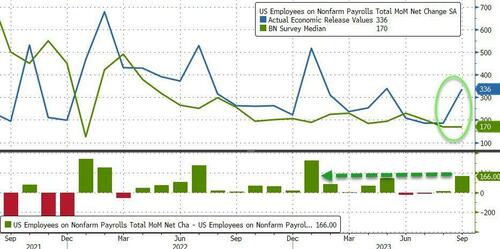

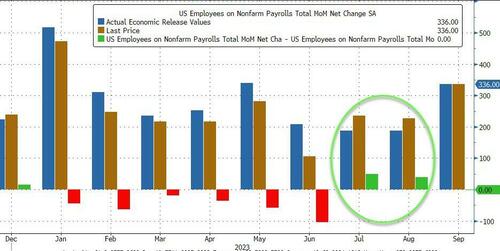

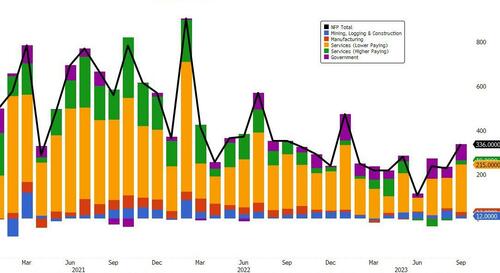

With everyone – even the most hardened bulls – expecting the September jobs report to be not only the weakest of 2023 but to presage a big drop in future payrolls data, moments ago the BLS reported that in September – a month when countless companies shut down due to labor strikes (i.e., people not working) – the US added a whopping 336K jobs, the highest monthly increase since January…

… and not only double the consensus estimate of 170K, but above the highest sellside estimate of 250K!

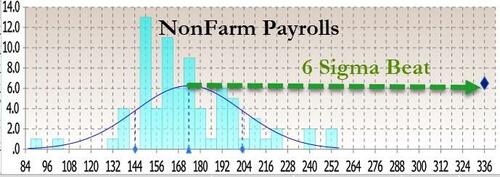

In fact, at 336K vs a median forecast of 170K, today’s print was the first 6-sigma beat of expectations in a long time.

Furthermore, having become the butt of all data goalseeking jokes in recent months after revising every single month in 2023 lower, the BLS decided to show people who is boss and revised not only August but also July higher: the change in total nonfarm payroll employment for July was revised up by 79,000, from +157,000 to +236,000, and the change for August was revised up by 40,000, from +187,000 to +227,000. With these revisions, employment in July and August combined is 119,000 higher than previously reported.

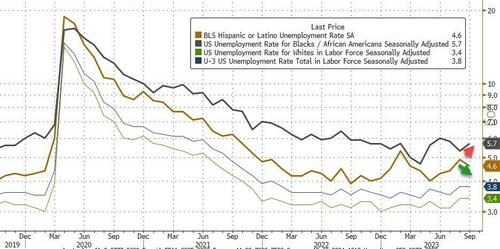

Looking at the unemployment rate, things here were not quite so good, with the rate unchanged at 3.8% from last month, above expectations of a modest drop to 3.7%, as Black unemployment increased while Hispanic unemp dropped.

Unemployment rates were as follows: adult men (3.8%), adult women (3.1%), teenagers (11.6%), Whites (3.4%), Blacks (5.7%), Asians (2.8%), and Hispanics (4.6%).

Meanwhile wage growth continued to cool, and in September average hourly earnings increased 0.2%, below the 0.3% expected, and resulted in a 4.2% increase YoY, down from 4.3% in August…

… as a result of a big bump in lower paying jobs.

But perhaps the most remarkable divergence in the report is that with headline payrolls surging 336K (establishment survey), the Household Survey indicated that the pain continues, as the number of people employed not only rose by less than 100K (86K to be precise), but it was all part-time workers, which increased by 151K. Full-time workers? Why, they dropped by 22K, and the lowest since February.

Some more highlights from the report:

- The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.2 million in September. The long-term unemployed accounted for 19.1 percent of all unemployed persons.

- Both the labor force participation rate, at 62.8 percent, and the employment-population ratio, at 60.4 percent, were unchanged over the month.

- The number of persons employed part time for economic reasons, at 4.1 million, changed little in September. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

- In September, the number of persons not in the labor force who currently want a job was 5.5 million, little different from the prior month. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force changed little at 1.5 million in September. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also changed little over the month at 367,000.

Here is the breakdown of jobs:

- Leisure and hospitality added 96,000 jobs in September, above the average monthly gain of 61,000 over the prior 12 months. Employment in food services and drinking places rose by 61,000 over the month and has returned to its pre-pandemic February 2020 level.

- In September, government employment increased by 73,000, above the average monthly gain of 47,000 over the prior 12 months. Over the month, job gains occurred in state government education (+29,000) and in local government, excluding education (+27,000).

- Health care added 41,000 jobs in September, compared with the average monthly gain of 53,000 over the prior 12 months. Over the month, employment continued to trend up in ambulatory health care services (+24,000), hospitals (+8,000), and nursing and residential care facilities (+8,000).

- Employment in professional, scientific, and technical services increased by 29,000 in September, in line with the average monthly gain of 27,000 over the prior 12 months.

- Social assistance added 25,000 jobs in September, about the same as the average monthly gain of 23,000 over the prior 12 months. Over the month, job growth occurred in individual and family services (+19,000).

- In September, employment in transportation and warehousing changed little (+9,000). Truck transportation added 9,000 jobs, following a decline of 25,000 in August that largely reflected a business closure. Air transportation added 5,000 jobs in September.

- Employment in information changed little in September (-5,000). Within the industry, employment in motion picture and sound recording industries continued to trend down (-7,000) and has declined by 45,000 since May, reflecting the impact of labor disputes.

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; financial activities; and other services.

While we will publish a longer reaction piece shortly, this kneejerk response stood out from Peter Tchir of Academy Securities:

Given the strength of the job market (according to the Establishment data) and the barrage of “strike” headlines, that seems somewhat surprising…. The unemployment rate stayed at 3.8%, as the Household survey showed decline in full-time jobs for the 3rd month in a row. Total jobs were positive for the Household survey, but driven by an increase in part-time jobs (which doesn’t seem overly consistent with a blow out jobs report).

Difficult to fight the algos which are going to drive yields higher based on the headline number, but expect, as the day goes on, for many in the markets to question the veracity of this report and for the early losses in bonds and stocks to be dramatically reduced, if not finish the day and the week in the green!

The bottom line seems to be that virtually nobody believes the goalseeked propaganda spewed by the Biden admin any more…

Tyler Durden

Fri, 10/06/2023 – 08:47

via ZeroHedge News https://ift.tt/HuitG62 Tyler Durden