“Midnight Massacre”: Tesla Slashes Model 3, Model Y Prices Yet Again

If ever there was a shred of doubt about Elon Musk’s intentions to move more volume at lower prices for Tesla this year, those thoughts should officially be put to bed.

Tesla shares are dipping slightly lower on Friday morning after it was reported late Thursday night that Tesla would be making even more price cuts to its Model 3 and Model Y vehicles.

The new cuts to model prices are as follows:

-

Model 3 Now $38,990 From $40,240

-

Model 3 Performance Now $50,990 From $53,240

-

Model 3 Long Range Price Cut To $45,990 From $47,240

-

Model Y Long Range Now $48,490 From $50,490

-

Model Y Performance Now $52,490 From $54,490

So far, the price cuts have been a winning formula for Tesla, allowing the automaker to remain at the tip of the demand spear in a global EV race that is now beyond super-saturated with competition.

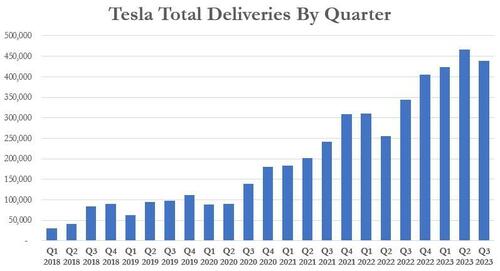

The price cuts come just days after Tesla missed its modest Q3 delivery estimates. In Q3, the company delivered 435,059 vehicles and produced 430,488 vehicles, missing consensus delivery estimates of 456,722.

The quarter marked the first sequential drop in total deliveries since Q2 2022. Prior to that, the last sequential drop in total deliveries occurred in early 2020, as the chart below shows.

The company acknowledged the miss and chalked it up to downtime, stating in its press release the “sequential decline in volumes was caused by planned downtimes for factory upgrades, as discussed on the most recent earnings call.”

CEO Elon Musk had said on the company’s last conference call that it would “continue to target 1.8 million vehicle deliveries this year.” However, he also warned about production numbers dwindling due to “summer shutdowns for a lot of factory upgrades.”

Analyst Gordon Johnson of GLJ Research called the price cuts a “Midnight Price Cut Massacre” in a note out Friday morning, and suggested that the Q3 miss was not due to line upgrades, but rather due to lack of demand.

“Tesla is already resorting to margin-destroying price cuts just five days into the fourth quarter of 2023,” he wrote. “Despite selling only 4,500 more cars than it produced in the third quarter and entering the fourth with a record inventory of 106,000 cars, it’s clear that Tesla’s issues rest mainly with lackluster demand.”

“This means to hit its goal of 1.8mn cars produced in 2023, Tesla may have to sell those cars at negative net income margins,” he continued.

Recall, back in mid-September, Goldman had both predicted that the company could lower prices further and questioned whether or not the constant price cuts from the EV leader could take its toll on the company’s bottom line. As a result, they lowered estimates.

Analyst Mark Delaney wrote in a note in September: “We believe that Tesla could further lower prices in 2024 to support higher volumes, which we believe will mitigate the EPS benefit from cost reductions.”

The note continued: “We lower our 2023 and 2024 EPS estimates for Tesla, mostly on lower ASPs and, in turn, auto gross margin ex-credit assumptions (driven by lower prices for S/X and, to a lesser extent, Model Y, and partly offset by higher Model 3 ASP assumptions).”

Goldman called the company’s price cuts into question, noting they could have a negative effect on Tesla’s bottom line, Teslarati reported:

“Tesla materially reduced S/X pricing on 9/1 by 15-19%, and reduced Model Y pricing in China in mid-August (and has been discounting inventory on hand in other markets like the US this quarter). However, Tesla raised pricing on the Model 3 with the refreshed version (Highland) that is now being sold in Europe and China.”

But it wasn’t all criticism over price cuts. Canadian VC and self-labeled “SPAC Jesus” Chamath Palihapitiya was out over Labor Day weekend praising the speed and aggressiveness of Tesla’s price cuts, which ultimately do seem to be moving metal.

“Some companies cut prices, but most keep prices flat or increase them,” he added. “Some companies improve products quickly. But no one has actually given you more for less on such a big ticket purchase so frequently.”

Recall, we also noted in August that Tesla had cut the price of its Model S Plaid in China by 19%.

Tyler Durden

Fri, 10/06/2023 – 08:25

via ZeroHedge News https://ift.tt/ZiX7QWd Tyler Durden