Strike Threats Reemerge At Australian Chevron LNG Plants As Talks Falter

Workers at two natural gas plants owned by Chevron in Australia could announce plans to restart strikes as early as next week after the energy company “reneged” on pay and conditions demands in a new labor contract. The potential plan to resume strikes comes weeks after the unions ended a multi-week labor action after Australia’s labor market regulator mediated a settlement between both parties.

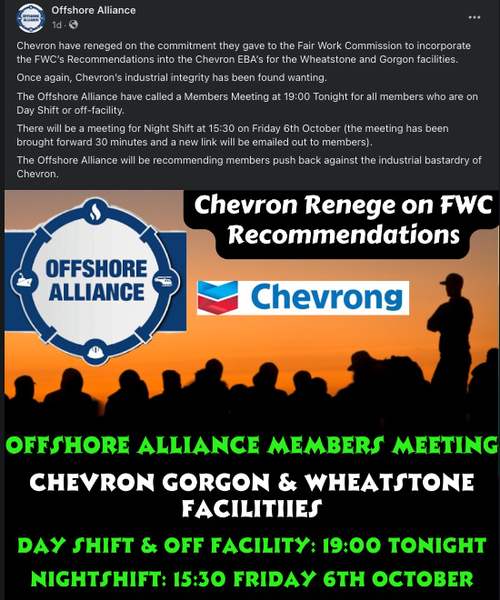

On Thursday, Offshore Alliance, a partnership between two local unions, alleged Chevron walked back an agreement recommended by Australia’s labor market regulator that ended the strikes at the Gorgon and Wheatstone LNG projects in late September.

“Chevron have reneged on the commitment they gave to the Fair Work Commission to incorporate the FWC’s Recommendations into the Chevron EBA’s for the Wheatstone and Gorgon facilities,” the union wrote in a statement on Facebook.

Bloomberg spoke with one union official, who requested anonymity because the talks were private and said workers met Thursday to approve plans to restart the strikes. They said the union might notify Chevron of a strike as early as Monday.

Meanwhile, Chevron told Bloomberg it has “consistently and meaningfully engaged in an effort” to formalize a labor contract with the unions.

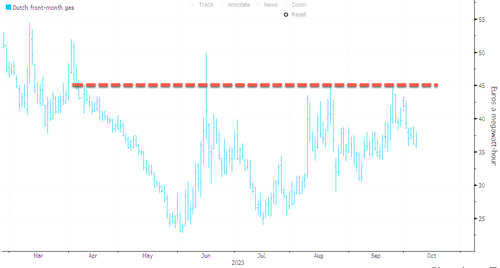

In September, strikes at Gorgon and Wheatstone plants – which accounted for 7% of global LNG supply last year (rivals Qatar as the world’s largest exporter of LNG) – did not dent exports but sparked volatility in NatGas markets over a potentially prolonged labor action that could have resulted in dwindling supply across Europe and Asia.

When strike risks first flourished in August, the benchmark front-month EU Natgas futures jumped by as much as 40%. Traders are closely watching the developments in Australia, though futures remained muted on Friday. Any confirmation of strikes resuming next week will send EU NatGas prices higher.

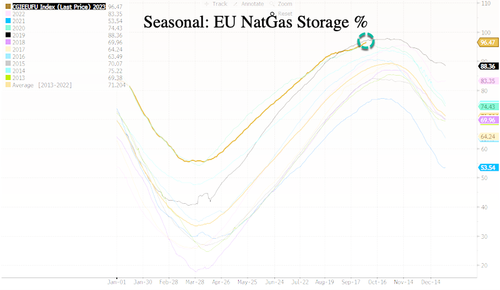

Europe is on the cusp of the heating season, as winter in the Northern Hemisphere is only a few short months away. The good news, so far, is weather reports forecasting mild weather while NatGas storage facilities on the continent are 96% full – well above average for this time of year.

Europe has become increasingly susceptible to supply disruptions after it slashed imports of cheap Russian pipeline NatGas for overseas supplies. And this only means it now has to compete with China, which is now making LNG purchases ahead of winter.

Tyler Durden

Fri, 10/06/2023 – 11:30

via ZeroHedge News https://ift.tt/3CtAEuP Tyler Durden