IMF Warns Inflation To Remain Elevated Until 2025

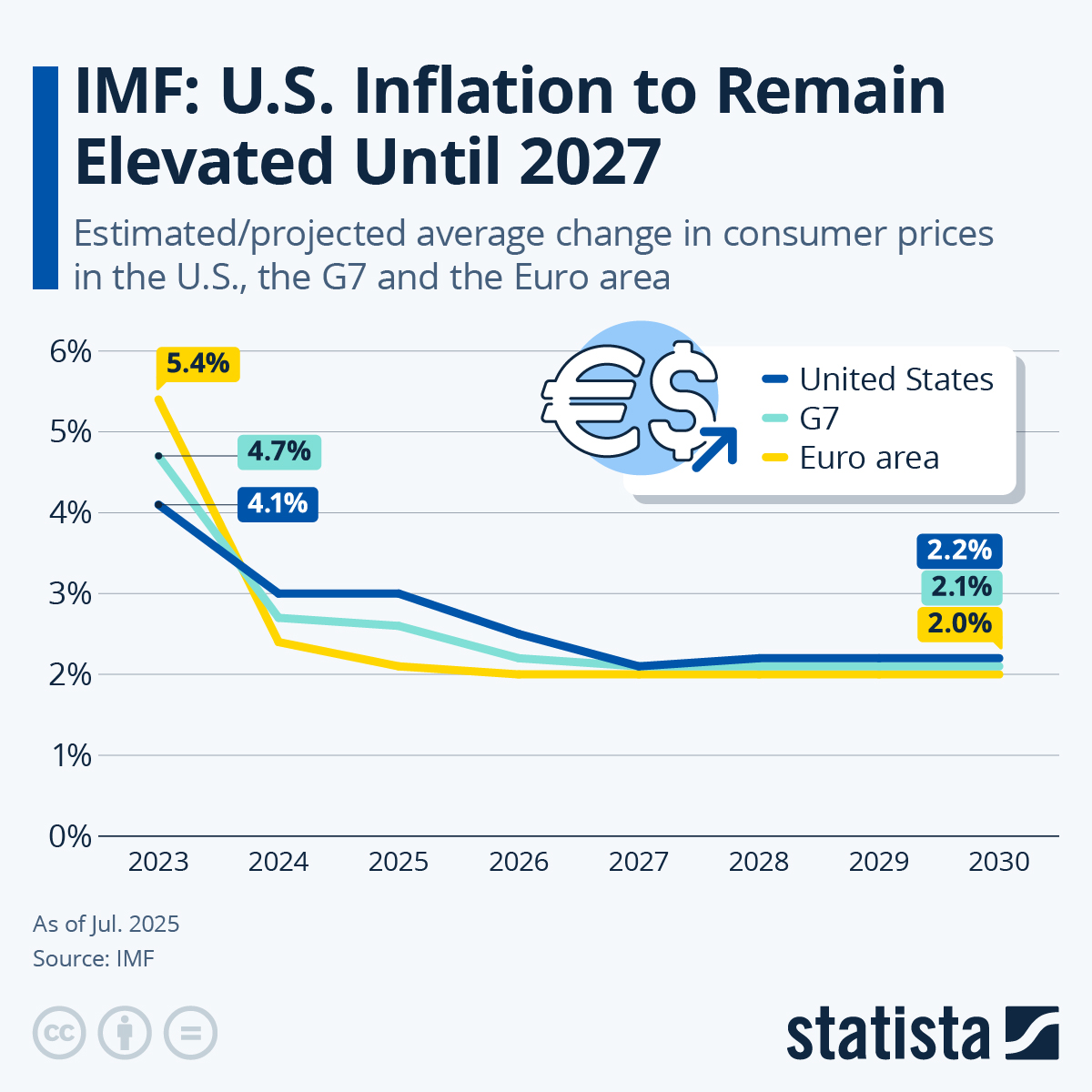

Despite inflation coming down notably from its 2022 highs in recent months thanks to gradual easing of supply chain disruptions and declining commodity prices,  You will find more infographics at Statista“>Statista’s Felix Richter reports that the International Monetary Fund doesn’t expect consumer price increases to return to the desired levels of around 2 percent before 2025 in most advanced economies.

You will find more infographics at Statista“>Statista’s Felix Richter reports that the International Monetary Fund doesn’t expect consumer price increases to return to the desired levels of around 2 percent before 2025 in most advanced economies.

According to its latest World Economic Outlook, the IMF predicts global inflation to reach 6.9 percent this year, down from 8.7 percent in 2022. For 2024, the organization expects inflation to decline further to 5.8 percent, which is 0.6 percentage points higher than its July ’23 prediction, as core inflation remains stubbornly elevated.

“Near-term inflation expectations have risen and could contribute – along with tight labor markets – to core inflation pressures persisting and requiring higher policy rates than expected,” the IMF finds.

Expectations play a crucial role in managing inflation dynamics, as expectations of future inflation influence price- and wage-setting processes which then feed into current inflation rates. And while long-term inflation expectations have remained well-anchored near the goal of two percent, short-term expectations have risen significantly since 2022, contributing to sticker-than-expected core inflation.

As the following chart shows, the IMF expects the United States and the Euro area to follow similar trajectories in their fight against inflation.

You will find more infographics at Statista

While inflation is projected to remain severely elevated this and moderately elevated in 2024, it is then expected to converge towards the long-term target of two percent.

Tyler Durden

Wed, 10/11/2023 – 11:10

via ZeroHedge News https://ift.tt/xjcF7qY Tyler Durden