Ikea Plans Worldwide Price Cuts After Warning: “Time To Buckle Up”

The world’s largest furniture retailer plans to cut the prices of sofas, beds, appliances, and much more across all locations as macroeconomic headwinds crush consumers.

“We came into 2023 with higher prices than we wanted. We have lowered prices at the end of 2023 and into 2024. Supply costs started to come down for us,” CEO Jon Abrahamsson Ring of Inter Ikea Group, the worldwide franchiser for the retailer, said in an interview with the Financial Times.

Jesper Brodin, CEO of IKEA Retail, added: “These are times to buckle up. It’s not going to be an easy ride in the next few years. What I see this year is due to interest rates being where they are our customers are challenged. So we have been taking down our prices, every market is investing in lower prices.”

Ikea executives pointed out that sharp price hikes in recent years are now reversing, allowing them to begin cutting furniture prices. However, they admitted price cuts might not be able to stoke demand as recession risks worldwide were materializing.

“In what ways does it stimulate consumption? Is it possible to generate growth through affordability? During the Lehman Brothers crisis [in 2008] it was possible in northern Europe, but not southern Europe,” said Brodin.

FT noted Ikea has moved away from big-box stores to offering small shops in metro areas and offering more services such as delivery, assembly, and planning with customers.

The timing of Ikea’s planned price cuts comes as the luxury market is deteriorating in the Western world. Rolex and diamond prices are cratering from post-Covid highs, Mercedes S-500s are experiencing slowing demand, and luxury conglomerate LVMH reported this week that demand for leather goods, perfumes, watches, and wine worldwide was sliding.

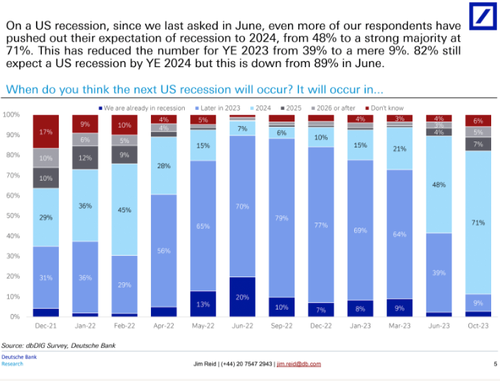

Meanwhile, a new market survey of Deutsche Bank clients found that more respondents were “nervous about yield-led global accidents.”

And a majority of respondents expect a recession in 2024.

Meanwhile, JPMorgan, Goldman, and Barclays have soured over the world’s largest consumer.

Tyler Durden

Fri, 10/13/2023 – 05:45

via ZeroHedge News https://ift.tt/81xXC4B Tyler Durden