It’s Jim Jordan Vs. Holdouts As Speaker Battle Heads For Tuesday Vote

As the dysfunctional House eyeballs a Tuesday vote for Speaker, Rep. Jim Jordan (R-OH) faces at least 10-20 Republican holdouts who oppose his nomination, one of said holdouts told CBS News (so it could be like 5). CNN has also spoken with one senior Republican, who told the network that he’s spoken with 20 members willing to block Jordan’s path.

Jordan, who needs 217 votes to become Speaker, can only afford to lose four Republicans if every member votes, because a speaker requires a full House vote to be elected.

Last week, 55 Republicans voted against committing to supporting Jordan in a floor vote.

That said, on Monday, Rep. Mike Rogers (R-AL) announced that he had held “thoughtful, and productive conversations over the past two days” with Jordan, and has decided to throw his support towards the Ohio lawmaker.

As a result, I have decided to support Jim Jordan for Speaker of the House on the floor. (2/3)

— Mike Rogers (@RepMikeRogersAL) October 16, 2023

Jordan and his allies, meanwhile, have engaged in a “right-wing pressure campaign against Republicans opposed to electing him speaker,” according to the NY Times, which would of course frame it as such.

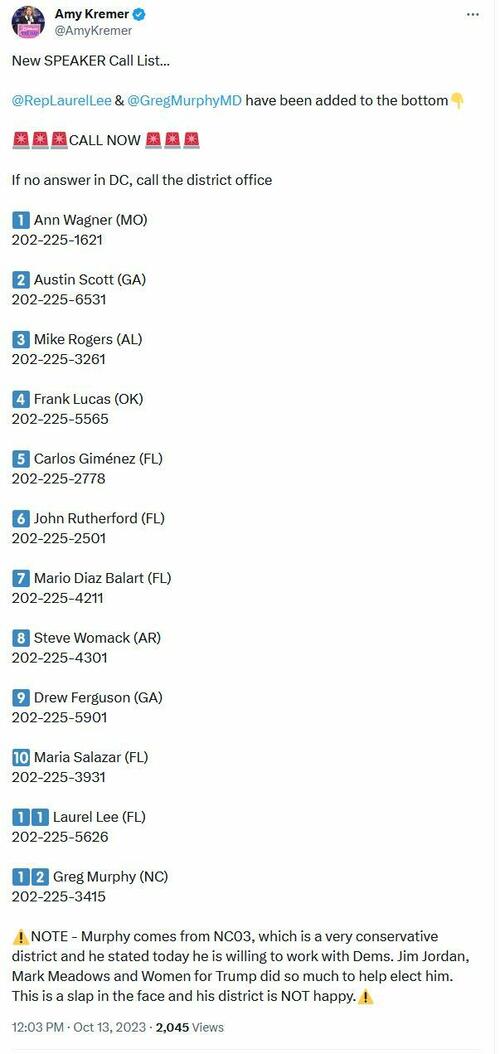

In efforts to close the gap, lawmakers and activists close to him have taken to social media and the airwaves to blast the Republicans they believe are blocking his path to victory and encourage voters to browbeat them into supporting Mr. Jordan.

It is an extraordinary instance of Republican-on-Republican fighting that underscores the divisions that have wrought chaos inside the party, paralyzing the House of Representatives in the process. Several of Mr. Jordan’s supporters have posted the phone numbers of mainstream G.O.P. lawmakers they count as holdouts, encouraging followers to flood the Capitol switchboard with calls demanding they back Mr. Jordan — or face the wrath of conservative voters as they gear up for primary season.

“You want to explain to your voters why you blocked Jordan?” Rep. Anna Paulina Luna (R-FL) wrote on “X”.

You guys want to go 15 rounds? Fine. Let’s do it. On the floor. For the country to see. This Monday.

You want to explain to your voters why you blocked Jordan? Then bring it.. because from the calls I’m getting, they are asking me what’s going on.

I have an infant son and I…

— Anna Paulina Luna (@realannapaulina) October 14, 2023

Political activist Amy Kremer on Friday posted a list of 12 holdout Republicans blocking Jordan’s path – which Mike Rogers was on before supporting Jordan on Monday.

While Jordan has been branded a “legislative terrorist” with close ties to former President Donald Trump, the Ohio lawmaker has actually been aligning himself with moderate conservatives on several recent issues.

He backed the debt limit that former Speaker Kevin McCarthy struck with President Biden, and did not join the Freedom Caucus in opposition. He’s also said he intends to have the House vote on a stopgap spending measure to keep the government operating past mid-November.

That said, some mainstream Republicans are opposing him on principle, differing with Jordan on things such as continuing to fund the war in Ukraine, and rewarding what they see as ‘bad behavior,’ which led to McCarthy’s ouster.

“I’m a no on allowing Matt Gaetz and the other seven to win by putting their individual in as speaker,” said Rep. John Rutherford (R-FL), one of the holdouts on the above list.

Should Jordan fizzle out, Punchbowl News notes that there are several names bouncing around right now.

Mike Johnson (R-La.), the vice chair of the conference. The 51-year-old Johnson is a serious lawmaker who is well-liked in the conference.

House Majority Whip Tom Emmer is also mentioned repeatedly. Emmer, 62, has been in leadership for nearly five years, mostly as NRCC chair. Emmer has some allies on the right, but many in former President Donald Trump’s orbit who do not trust the Minnesota Republican.

Could McCarthy come back? We’re pretty bearish on this, but we wouldn’t be surprised if he starts thinking about this in the next few days. Some of the eight hardliners who voted against McCarthy may flip after another few days of chaos. But the question is whether other GOP lawmakers have taken up the anti-McCarthy mantle in the meantime.

Market impact?

The Speaker’s race isn’t just a game of musical chairs. It threatens to send global financial markets into a tailspin, warns Nigel Green, CEO of the financial juggernaut deVere Group.

The impending drama doesn’t just end with a potential government hiatus. Green forecasts a domino effect of economic tremors, rattling the already fragile skeletons in Uncle Sam’s closet. The new Speaker, less a deal-maker and more a political gladiator, might just thrust the government into a prolonged shutdown, seeking political gains while global markets gasp for air. The uncertainty looming over fiscal policies, budget allocations, and federal operations is a perfect recipe for market volatility, with investors scrambling for cover. And as if that’s not enough, Green anticipates a vicious cycle of eroding investor confidence, dwindling asset prices, and the specter of capital flight, as the world loses its appetite for American economic stewardship.

According to Green, a government shutdown could be the final nail in the coffin for America’s AAA credit rating. Moody’s might just follow in Fitch’s footsteps, which, citing America’s fiscal circus and debt-ceiling highwire acts, had already demoted its credit score.

“We expect that should a shutdown happen, it will prompt Moody’s to cut the US credit rating below AAA,” he said, adding “Over the summer, global rating agency Fitch downgraded the US government’s top credit rating to AA+ from AAA. Fitch cited fiscal deterioration over the next three years and repeated down-the-wire debt ceiling negotiations that puts at risk the government’s ability to pay its bills.”

“This was the second major rating agency (after Standard & Poor’s) to strip the US of its triple-A rating.”

A double whammy, considering it was the second humiliating downgrade by a major rating agency. And the dollar? Expect a bruising, warns Green. The currency’s tumble would resonate through exchange rates, international trade, and investment, not to mention throwing commodity markets for a loop, stirring up storms for oil and agricultural prices. The message is clear: the Speaker’s gavel might just set off a financial earthquake, and investors worldwide would feel the tremors. It’s time, Green advises, to keep a weather eye on the horizon, as the U.S. political saga continues to play Russian roulette with global financial stability.

“Investors need to closely monitor developments in the US government, as its stability and decisions have a profound influence on the global financial markets.”

Tyler Durden

Mon, 10/16/2023 – 11:05

via ZeroHedge News https://ift.tt/agE1Oj7 Tyler Durden