“Cardboard Box Recession” An Ominous Sign Of Faltering Consumer, Schwab Warns

Earlier this year, Charles Schwab analyst Jeffrey Kleintop said the US was sliding into a “cardboard box” recession as consumers and small businesses were pressured by soaring interest rates and elevated inflation.

On Tuesday, Kleintop joined Morningstar’s The Long View podcast to warn, yet again, that slowing demand for cardboard boxes is an ominous sign of a coming recession. The reason behind this view is that cardboard boxes are used to transport nearly every good in modern society. So when box demand falls, it’s reflective of slowing purchases by consumers and businesses.

“Often, I find, in maybe nontraditional measures, I find more comfort in things that just make sense to me. Like the downturn that’s currently indicated in official manufacturing and trade data. Some of that’s kind of abstract. I find comfort looking at the plunging demand for cardboard boxes,” Kleintop told the podcast hosts.

The analyst said, “I’ve been referring to this as a cardboard box recession because things that are manufactured and shipped tend to go in a box and because demand for corrugated fiberboard, which is what most cardboard boxes are made from, has fallen just like it did in past recession. So, literally, cardboard boxes are in a recession.”

Last week, former Walmart CEO Bill Simon, who now serves on the Board of Directors for Darden Restaurants and Hanesbrands Inc., told CNBC that headwinds are mounting for consumers as inflation, high interest rates, and global tensions make consumers wary. He said, “For the first time in a long time, there’s a reason for the consumer to pause.”

If Simon is correct, this could spell disaster for Biden’s economy. Consumers are a significant driver in the US economy, accounting for about two-thirds of US GDP.

It appears the music has already stopped, and the party for consumers is grinding to a halt.

Last month, we laid out the various reasons why – according to JPMorgan and Goldman – sentiment on US consumer stocks had cratered and would continue to worsen in the months ahead.

A recent Citi note (full report available to pro subs) revealed consumer card spending is downright recessionary.

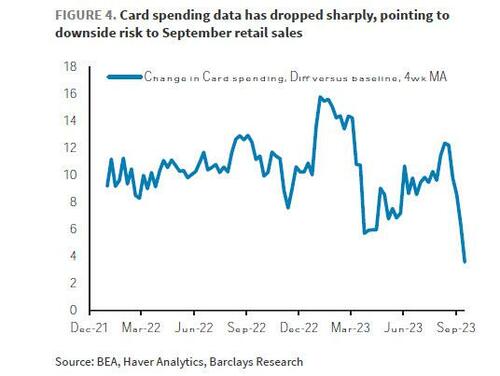

Also, a recent Barclay’s Global Rates Weekly note showed card spending has taken another leg lower as consumers falter.

And back to the cardboard boxes, FreightWaves has been warning all year about this alarming development:

- Cardboard Box Demand Plunging At Rates Unseen Since The Great Recession

- Big Drop In Cardboard Box Sales Scream Recession

Ending it with Kleintop, he told The Long View podcast: “So, I think all these signs are indicating that we’re seeing a bit of a slowdown in the services sector. And that’s important because there are 10 times as many services jobs as manufacturing jobs in the US So, if we start to see the service sector reflect more signs of this slowdown in demand, well, we might see a weakening labor market and then that could feed into the retail space and construction and so many other areas.”

… and then there is this: “Trucking Recession Deepens As Bezos, Gates-Backed Convoy Cancels All Shipments, Load Board Is Empty.”

Tyler Durden

Sat, 10/21/2023 – 16:55

via ZeroHedge News https://ift.tt/Qopg2IB Tyler Durden