Bitcoin Tops $35,000 – 6 Potential Catalysts For The Sudden Crypto Craze

As the world eyes the surge cryptocurrencies with Bitcoin topping $35,000 overnight…

…its highest since June 2022…

Catalysts for the sudden exuberance are manifold.

1. Imminent Spot ETF

The most obvious imminent catalysts for bitcoin’s sudden gains is the imminent SEC acceptance of a Spot Bitcoin ETF.

As CoinTelegraph reports, EY’s global blockchain leader Paul Brody believes that Bitcoin faces a lot of pent-up demand from institutions due to United States regulators not approving a spot Bitcoin ETF for years.

Brody discussed the outlook for the cryptocurrency adoption on CNBC’s Crypto Decrypted on Oct. 23, declaring that trillions of dollars in institutional money are waiting to enter Bitcoin once a BTC ETF is approved.

“But any of these other institutional funds, they can’t touch this stuff unless it’s an ETF or some other kind of regulatory blessed activity,” EY’s blockchain expert said, adding:

“If you look at people who are buying Bitcoin, they are buying it as an asset. They are not buying it as a payment tool. Those who are buying Ethereum, are buying it as a computing platform for business transactions and DeFi [decentralized finance] services.”

And it could be coming sooner than expected as Bloomberg Intelligence ETF analyst Eric Balchunas flagged on X that the iShares Bitcoin Trust “has been listed on the DTCC” with the ticker IBTC.

BlackRock, the world’s largest asset manager, operates the iShares business. The DTCC is the Depository Trust and Clearing Corp., which undertakes clearing and settlement in US markets.

“This doesn’t mean it’s technically approved,” Balchunas said in an interview.

“It’s not home free. But this is pretty much checking every box that you need to check before you launch an ETF. When we see a ticker added, those things are usually right before launch.”

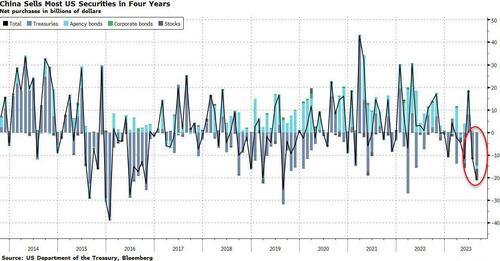

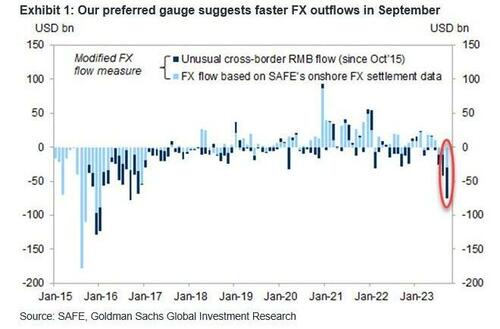

2. China capital outflows

As we detailed earlier in the week, China capital outflows have erupted:

“the unfavorable interest rate spread between China and the US will ‘likely imply persistent depreciation and outflow pressures in coming months’, or in other words, September’s biggest FX outflow in years is just the beginning…

…and very soon – in addition to geopolitics and central banks – the world will also be freaking out about the capital flight out of China…

…not to mention where all those billions in Chinese savings are going and which digital currency the Chinese are using to launder said outflows.“

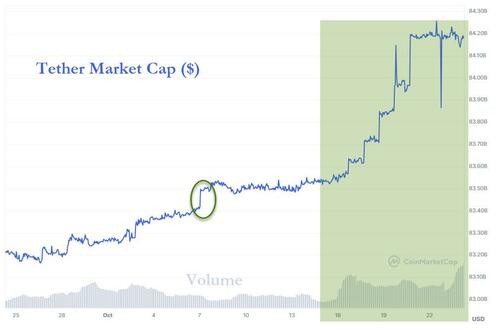

The mechanism for shifting from yuan to bitcoin goes through Tether and volumes and market cap in that cryptocurrency have soared in recent weeks….

..more to come there we suspect.

3. Middle East war

Safe-haven flows are evident in gold and bitcoin since the Hamas attacks on Israel prompted a more widespread unrest across the Middle-East. Most notably, the ‘shock’ higher in these ‘safe havens’ appears exogenous (new money) as the decoupling from real-rates – which have historically tracked inversely as an alternative – is extreme…

Additionally, crypto’s surge mirrors the shekel’s demise as anxiety over potential capital controls increases…

While there i sno data for Israel we do note that local volumes in Egypt suddenly exploded…

Is World War 3 bullish for bitcoin?

4. Short squeeze

The price surge also led to the liquidation of roughly $400 million worth of short positions.

Over the last 24 hours, 94,755 traders saw derivative positions liquidated.

The largest single liquidation order happened on Binance, worth $9.98 million.

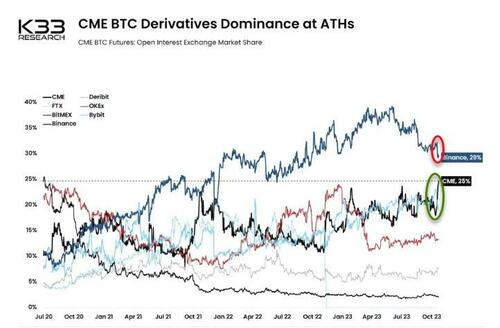

5. Institutional demand re-acceleration

The breakout coincided with a drop in open interest across crypto exchanges, according to Coinalyze data. The decline, which reflects retail investor interest, contrasts with open interest on the Chicago Mercantile Exchange (CME), a venue favored by institutions, topping 100,000 bitcoin ($3.4 billion) for the first time.

CME BTC futures OI has breached 100k BTC for the first time ever.

While offshore perp OI shrank by 26,735 BTC yesterday, CME’s OI grew by 4,380 BTC. pic.twitter.com/kjKBRYCoSX

— Vetle Lunde (@VetleLunde) October 24, 2023

CME’s market share has increased to around 25%, approaching that of Binance’s perpetual market, according to Vetle Lunde, a senior analyst at K33Research.

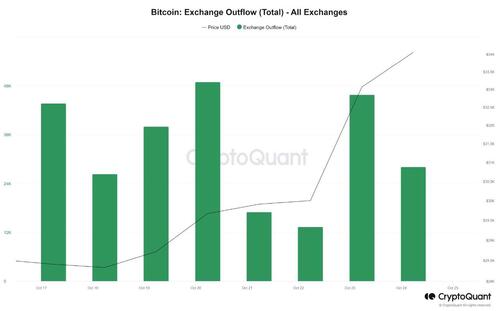

Adding to the bullish tone, CoinTelegraph reports considerable outflows of assets from crypto exchanges.

This is considered a bullish sign, as it indicates traders are moving their assets away from exchanges and no longer want to sell.

6. Argentina hyperinflation

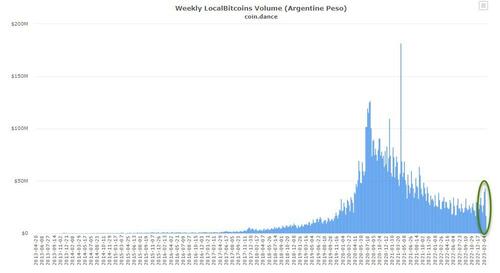

One final potential catalysts is the fact that Argentina’s Libertarian candidate Javier Milei – who proposes the dollarization of the nation’s currency should he be elected – did not perform as well as some had expected.

This could prompt a return to fears of more status quo hyperinflation (despite our misgivings about ‘dollarization’) as we note the blue dollar (informal peso rate) hit 1100/USD this week (compared to 350/USD official). This concern could be prompting more capital outflows and a look at the volume in LocalBitcoins transfers shows there has indeed been a surge from Argentina…

* * *

Of course, there is always regulatory actions to fear as these capital outflows accelerate (and the IRS’ crackdown).

On a side note, it’s not just bitcoin, as Ethereum has soared back above $1800…

But Bitcoin is notably outperforming…

Finally, while usage is down, the future of crypto looks bright thanks to adoption in up-and-coming economies, according to Chainalysis, with India leading the world in crypto adoption, followed by Nigeria and Vietnam.

“This could be extremely promising for crypto’s future prospects. LMI countries are often countries on the rise, with dynamic, growing industries and populations. […] If LMI countries are the future, then the data indicates that crypto is going to be a big part of that future.”

Tyler Durden

Tue, 10/24/2023 – 09:35

via ZeroHedge News https://ift.tt/4b2zxvk Tyler Durden