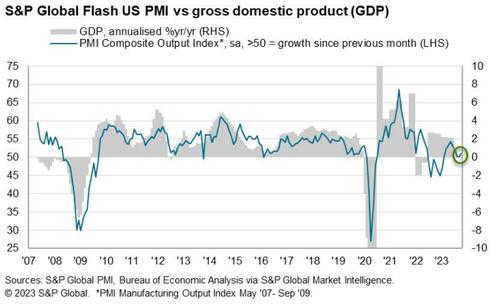

US PMIs Print Goldilocks Surprise In October: Growth Expansion & Slowing Inflation

Despite a plunge in ‘hard’ data in recent weeks, S&P Global ‘soft’ survey data shows ‘expansion’ for US Manufacturing and Services (both of which were expected to decline):

-

Manufacturing PMI: Oct Flash 50.0 (49.8 prior, 49.5 exp)

-

Services PMI: Oct Flash 50.9 (50.1 prior, 49.9 exp)

Source: Bloomberg

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Hopes of a soft landing for the US economy will be encouraged by the improved situation seen in October. The S&P Global PMI survey has been among the most downbeat economic indicators in recent months, so the upturn in US output growth signalled at the start of the fourth quarter is good news. Future output expectations have also turned up despite rising geopolitical concerns and domestic political tensions, climbing to the jointhighest for nearly one-and-a-half years.

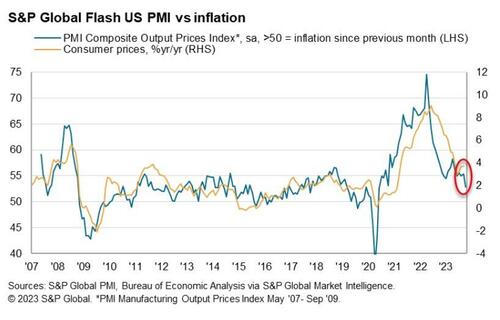

“Sentiment has improved in part due to hopes of interest rates having peaked, something which looks increasingly likely given the further cooling of inflationary pressures witnessed in October. In spite of higher oil prices, firms’ input cost inflation fell sharply to the lowest since October 2020, and average selling prices for goods and services posted the smallest monthly rise since June 2020.

“The survey’s selling price gauge is now close to its prepandemic long-run average and consistent with headline inflation dropping close to the Fed’s 2% target in the coming months, something which looks likely to be achieved without output falling into contraction. That said, the tensions in the Middle East pose downside risks to growth and upside risks to inflation, adding fresh uncertainty to the outlook.”

The US ‘beat’ comes as Europe’s PMIs were a shitshow.

The Euro area composite flash PMI decreased by 0.6pt to 46.5, below consensus expectations, driven by a decline in the services sector. Across countries, the weakness in the area-wide index was driven by a deceleration in Germany and the periphery, partially offset by an improvement in France. In the UK, the composite flash PMI improved marginally to 48.6, slightly above consensus expectations, on the back of a pickup in manufacturing activity. We see three main takeaways from today’s data.

First, we see persistent weakness in the Euro area, driven by renewed decline in the services sector, which saw only a brief trend reversal in September. Country press releases attributed lower output volumes to weak demand, client hesitancy and tighter financial conditions.

Second, inflationary pressures continue to moderate in the Euro area, as reflected by the continued decline in output prices, with input prices showing signs of renewed cooling, after a tick-up in September.

Third, while marginally better than last month, the UK growth momentum remains subdued across both sectors. This, in turn, is now being accompanied by an increase in output prices, despite continued cooling in input price pressures.

The US is now the only region not in contraction…

Thank you Bidenomics! (or is it just ‘seasonal adjustments’?)

Tyler Durden

Tue, 10/24/2023 – 09:54

via ZeroHedge News https://ift.tt/TcPwYba Tyler Durden