Bidenomics “Bailed Out By Taylor Swift And Barbenheimer”: Q3 GDP Soars 4.9%, Highest Since 2021… It’s All Downhill From Here

One month after comprehensive retroactive adjustments revised GDP data sharply lower, especially for personal consumption, moments ago the Bureau of Bidenomics Economic Analysis reported that in Q3, US GDP rose to an outlandishly high 4.9% in Q3. up more than double from 2.1% in Q2, and the highest since Q2 2021; the GDP print was also well above the 4.5% consensus print (it beat 52 of the 69 forecasts in Bloomberg’s survey; Wrightson ICAP, Pantheon Macroeconomics and Bloomberg Economics nailed it) if not quite as high as the 5.5% whisper number floated by some. The surge was driven by a sharp rebound in personal consumption, which surged from 0.8% in Q2 to 4.0% annualized in Q3; at the same time investment was up 8.4% and government spending up 4.6%.

According to the BEA, “compared to the second quarter, the acceleration in GDP in the third quarter primarily reflected accelerations in consumer spending, inventory investment, and federal government spending and upturns in exports and housing investment. These movements were partly offset by a downturn in business investment and a deceleration in state and local government spending. Imports turned up.”

Taking a closer look at the increase in consumer spending, this reflected increases in both services and goods. Within services, the leading contributors were housing and utilities, health care, financial services and insurance, and food services and accommodations. Within goods, the leading contributors to the increase were other nondurable goods (led by prescription drugs) as well as recreational goods and vehicles. The increase in inventory investment primarily reflected increases in manufacturing and retail trade.

Illustrating just how silly strong this growth pace was, the US expanded at almost the same pace last quarter as China. China’s quarter-on-quarter real growth rate was 1.3%, not annualized. The US pace works out to 1.2%.

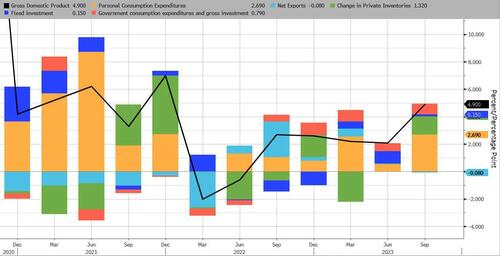

Here is a detailed breakdown of component contribution:

- Personal Consumption contributed 2.69% of the 4.88% GDP bottom line, up from 0.55% last quarter

- Final sales to private domestic purchasers – a key measure of domestic demand in the economy – rose 3.3% in the third quarter after increasing 1.7% in the second.

- Fixed investment saw its contribution shrink to 0.15% from 0.90%

- The Change in Private Inventories on the other hand added 1.32% to the GDP print, up from 0.00% in Q2.

- Net exports was a wash, subtracting just 0.07% to the bottom line print, a modest reduction from the 0.04% increase last month.

- Government consumption was the final contributor, and it added 0.79%, an increase from 0.57% last quarter.

Housing contributed to GDP in Q3 after being a drag for more than two years, adding a tiny 0.15%. The revival in residential investment though may prove to be short-lived given the recent surge in mortgage rates.

Investment spending was particularly strong, contributing 1.47 percentage points to growth, the most since late 2021 (when it was recovering from a contraction earlier that year). Most of this is a buildup in inventories. That’s not necessarily a sign of strength. Nonresidential fixed investment — think business investment — is actually flat.

While inventories did surge, this is not exactly great news: according to Capital Economics, “the acceleration in inventory-building in the third quarter leaves more scope for a reversal in the fourth quarter and beyond. That is a key reason why, despite the strength in the third quarter, we still expect GDP growth to slow to below potential soon with outright declines still a distinct possibility. That weakness, together with further signs of improvement in core inflation is why we expect the Fed to cut rates more aggressively next year than current market pricing assumes.”

And here, a curious observation from Bloomberg which notes that services were the bigger component of consumer spending, contributing 1.62 percentage point to the 4.9% growth pace. That’s the strongest since the third quarter of 2021, when “revenge” spending after the reopening was the theme. “This time around, the Taylor Swift concert effect as well as the Barbie and Oppenheimer movies played a role.“

That, and of course, the $2 trillion deficit spending in 2023, an amount that otherwise would suggest there was a major economic crisis this year.

Q3 GDP set to print at 4.5%.

All it took was a “crisis-era” $2 trillion budget deficit pic.twitter.com/vqnE09Jif4

— zerohedge (@zerohedge) October 24, 2023

Separately, household savings has been a central part of the recession debate. According to today’s release, it looks like personal savings have dipped: “Personal saving was $776.9 billion in the third quarter, compared with $1.04 trillion in the second quarter.”

Another negative indicator is that investment in equipment fell during the quarter — that according to BBG “chimes with the idea of a slowdown in manufacturing more broadly even as some sectors (especially related to electric vehicles) see strong growth. It’s the contradiction within the great manufacturing-revival story.”

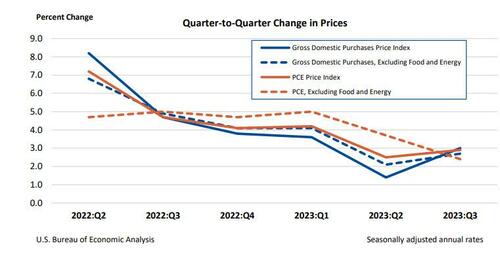

While the GDP report came in hotter than expected, the reason why yields dipped and stocks rose is because on the core prices side, things were cooler than expected: yes, the price index came in at 3.5%, higher than the 2.7% expected, but core PCE (ex food and energy) rose 2.4%, down sharply from the 3.7% in Q2 and below the 2.5% expected. This was the weakest reading since the end of 2020.

Commenting on the report, UBS noted that it was “a pretty chunky print for US GDP” even though UBS economist Jonathan Pingle anticipated an even larger print and thought the consensus number was far too low. The market, however, seems to be focused on core PCE printing a tick below expectations (2.4% versus 2.5% expectations). US jobless claims beat, too. The USD traded higher in a kneejerk reaction to the growth/durable goods beats, but because of the focus on the PCE metric, it has come back down.

It’s all downhill from here

Looking ahead, don’t expect this stellar performance to repeat: according to Lindsay Rosner, head of multi-sector investing at Goldman Sachs Asset Management, “while this number is unsurprising, our expectations are for slower GDP going forward as positive contributions from volatile net exports and inventories are unlikely to be repeated…. While this one number makes the Fed weary of cutting rates, it does not move the needle for the November FOMC meeting which is certainly a skip. Higher and hold, yes. Higher and hiking, no.”

Rubeela Farooqi, economist at High Frequency Economics, agreed: “We continue to forecast ongoing expansion in activity but expect the pace to slow quite significantly in the fourth quarter, as household spending slows, not only on payback for an unusually strong third quarter but also from the cumulative effects of rate hikes and tighter borrowing conditions, which should have a more material effect on both consumers and businesses going forward.”

Dennis DeBusschere, founder of 22V Research, echoed the sentimentL “This was objectively strong, but focus is on 4Q now (clearing event) and most think 4Q will be slower. Also some seemed worried about a 5+ handle on the number.”

It might also explain why despite the big beat, the market is actually higher: according to Lindsey Piegza, chief economist for Stifel Financial, stocks are discounting the third-quarter number and focusing on the latest central bank decisions, and what it might mean for what the Fed does next week.

Tyler Durden

Thu, 10/26/2023 – 09:15

via ZeroHedge News https://ift.tt/5ZnOXLB Tyler Durden