JPM CEO Dimon Dumps $140 Million In Shares After Slamming Fed Forecasts

For the first time in his long and tempest-ful tenure at the CEO of JPMorgan, Jamie Dimon has decided the time is right to dump 1 million shares in the mega-bank.

According to a regulatory filing Friday, Dimon and his family will dispose of 1 million of the bank’s shares, which amounts to around a $140 million haul, and the CEO’s “first such stock sale during his tenure at the company.”

It has been a great trade as Bloomberg reports, the increase of more than 250% in JPM’s shares during Dimon’s tenure has helped turn the executive into a billionaire.

In early 2009, Dimon bought 500,000 shares in the bank as a sign of confidence amid a stock slump. He made an identical move in 2016, spending about $38 million on the two rounds of purchases.

Dimon and his family currently hold about 8.6 million JPMorgan shares, meaning the planned sale would represent less than 12% of their holdings in the New York-based bank. His net worth totals about $2 billion, according to the Bloomberg Billionaires Index.

Of course, Dimon’s filing claims this is all pre-planned and being done for tax reasons and diversification (etc., etc.) with the bank reassuring investors in a statement that Dimon “continues to believe the company’s prospects are very strong and his stake in the company will remain very significant.”

But, we couldn’t help but notice the coincidental timing of the stock sale, just hours after Dimon highlighted the fact that forecasters have missed the mark on their economic outlooks, and there’s still reason for caution moving forward.

In a panel at the Future Investment Initiative Summit in Riyadh, Saudi Arabia, the banker called out governments and central banks, and said some more humility should be in order.

“Prepare for possibilities and probabilities, not calling one course of action, since I’ve never seen anyone call it,” Dimon said, per multiple media reports.

“I want to point out the central banks 18 months ago were 100% dead wrong,” Dimon added.

“I would be quite cautious about what might happen next year.”

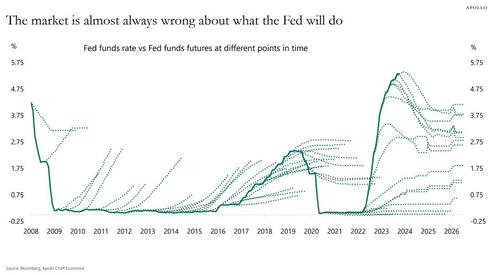

Ironically, as Apollo’s Torsten Sløk points out in his latest note, it’s not just The Fed that is as often as always wrong, the market is also almost always wrong about what the Fed will do beyond the next FOMC meeting.

The market is currently pricing that the FOMC will start cutting rates in June 2024

As Sløk notes, looking at the chart, it is remarkable how mean reverting the error is.

When rates are low, the market is systematically pricing that the Fed will soon hike.

When rates are high, the market is systematically pricing that the next move from the Fed is to cut.

Maybe the Fed will cut rates next summer. Maybe not.

For now, Sløk warns, investors should be planning on rates staying higher for longer.

Does Dimon’s stock dump signal his lack of faith in The Fed’s ability to pilot the ship through the stagflationary storm ahead?

“Fiscal spending is more than it’s ever been in peacetime and there’s this omnipotent feeling that central banks and governments can manage through all this stuff,” Dimon said.

“I am cautious about what will happen next year.”

…or is it all just coincidental timing? Will Dimon ‘diversify’ away from the dollar into bitcoin? Oh, the irony.

Tyler Durden

Fri, 10/27/2023 – 09:15

via ZeroHedge News https://ift.tt/U6Z0QRs Tyler Durden