UMich Inflation Expectations Exploded Higher In October: “Consumer Frustration Appeared Everywhere”

In its preliminary October data, UMich inflation expectations for the next year surged to 3.8%.. by the end of the month, the final data showed it had spiked to 4.2% – the highest reading since May 2023 (with the medium-term expectation at 3.0%)…

Source: Bloomberg

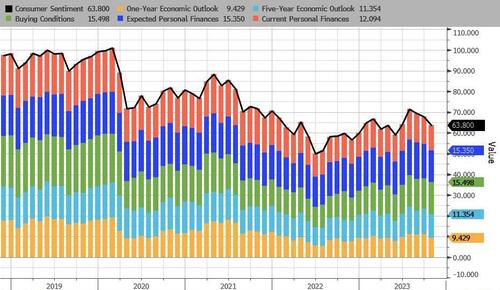

Consumer sentiment confirmed its early-month reading, falling back about 6% this October following two consecutive months of very little change.

Source: Bloomberg

This decline was driven in large part by higher-income consumers and those with sizable stock holdings, consistent with recent weakness in equity markets.

Source: Bloomberg

Across all consumers, one-year expected business conditions plunged 16% and expectations over consumers’ own personal finances in the year ahead fell 8%, reflecting ongoing concerns about inflation and, to a lesser degree, uncertainty over the implications of negative news both domestically and abroad.”

UMich Survey Director Director Joanne Hsu noted that:

“…signs of consumers’ frustration over inflation appeared throughout the interviews.

Year-ahead gas price expectations reached their highest reading since June 2022. Over 80% of consumers specified that inflation would cause greater hardship for consumers in the year ahead than unemployment, the highest share in 11 months.

About 47% of consumers blamed high prices for eroding their living standards, up from 39% last month and the highest share in 15 months.

While consumers recognize that inflation has slowed down from its peak last summer, they cannot ignore that their budgets remain stretched and their purchasing power reduced. Even so, strength in incomes continues to support aggregate spending.

Finally, we note that the overall index of economic news heard by consumers worsened about 15% between last month and this month, reaching its lowest reading since June 2023.

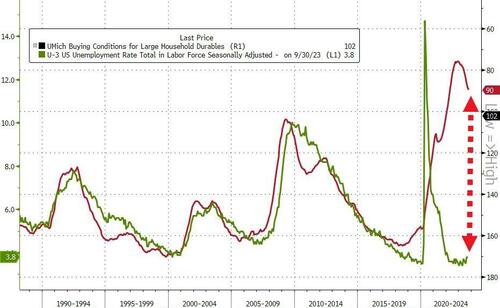

Oh, and one more thing. The historical relationship between buying-sentiment and unemployment has broken after almost 40 years…

Bidenomics’ magic.

Tyler Durden

Fri, 10/27/2023 – 10:10

via ZeroHedge News https://ift.tt/tOAHNXa Tyler Durden