Dot-Com Bubble Redux? Charles Schwab Begins Layoffs Amid “Challenging Year”

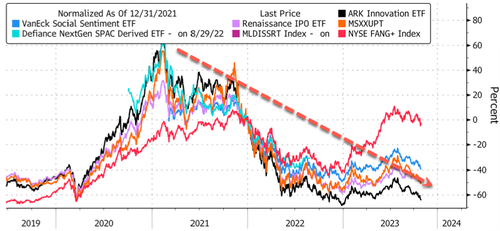

Charles Schwab, the largest publicly traded US brokerage firm, began laying off employees on Monday in an effort to streamline its business model by reducing expenses ahead of next year, which could be full of turbulence in financial markets. This comes as the market’s excitement in meme stocks, SPACs, IPOs, and crypto, which soared in 2020-21, has since plunged due to a rising interest rate environment.

The Wall Street Journal first revealed the Schwab layoffs on Monday night:

Charles Schwab on Monday began laying off employees across the company.

Schwab, the largest publicly traded US brokerage, didn’t disclose how many employees were affected in an internal message seen by The Wall Street Journal. Some remaining employees will have new jobs or managers, according to the message.

In the message, CEO Walt Bettinger and President Rick Wurster said:

“We know this has been a challenging year, and that today was hard. We also know the work needed to come through this change even stronger than before is just beginning.”

Perhaps trouble at Schwab comes as retail traders, badly bruised from holding worthless meme stocks, lost interest in financial markets this year.

Besides retail’s waning interest in markets, the company has been under scrutiny from shareholders about deposit flight driven by higher interest rates.

Schwab shares are down 40% since peaking at the $84 handle in March 2021.

In August, Schwab detailed in a regulatory filing about plans to slash its headcount and downsize corporate offices to reduce operating costs. These proposed cuts are expected to save the company $500 million annually.

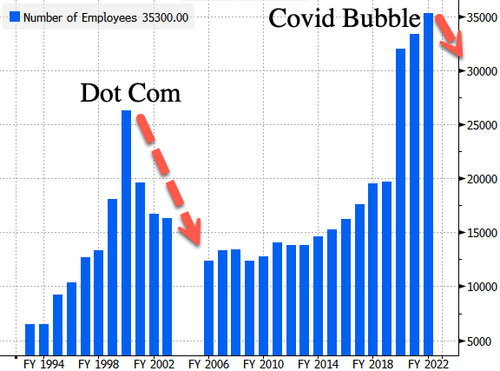

The last time Schwab hired too many people was during the Dot Com bubble. We all know what happened next…

Rumors on the anonymous jobs forum Blind said the layoffs at Schwab include “lots of people in the company’s tech division.”

Tyler Durden

Tue, 10/31/2023 – 10:40

via ZeroHedge News https://ift.tt/9sGiOxw Tyler Durden