Real Estate Brokerages Zillow, RedFin Tumble After Jury Finds Realtors Conspired To Keep Commissions High

Real estate brokerages such as Zillow, RedFin, ReMex and others tumbled after a federal jury found the National Association of Realtors and large residential brokerages such as HomeServices of America and Keller Williams, liable for about $1.8 billion in damages after determining they conspired to keep commissions for home sales artificially high.

Under antitrust rules, the presiding judge could triple the damages verdict, which would total more than $5 billion. The plaintiffs also have asked the judge to order changes to how the industry operates.

The verdict came in the first of two major antitrust lawsuits that target decades-old industry practices and argue that unlawful industry practices have left consumers unable to lower their costs even though internet-era innovations have allowed many buyers to find homes themselves online. The two-week trial involved claims by home sellers in several Midwestern states; they sought to drive down commissions and change the way agents are compensated.

Two brokerages, HomeServices of America and Keller Williams Realty, were also defendants in the case. Two others, Anywhere Real Estate and Re/Max Holdings, settled before trial and agreed to pay almost $140 million combined.

Announced in a packed Kansas City courtroom, the verdict came after just a few hours of jury deliberations. The case was brought by home sellers in several Midwestern states. Their lawyers hugged and shook hands as the verdict was announced.

According to the WSJ, the verdict “could lead to industrywide upheaval by changing decades-old rules that have helped lock in commission rates even as home prices have skyrocketed—which has allowed real-estate agents to collect ever-larger sums.”

It comes in the first of two antitrust lawsuits arguing that unlawful industry practices have left consumers unable to lower their costs even though internet-era innovations have allowed many buyers to find homes themselves online.

For several years NAR has been fending off accusations by US antitrust officials and private litigants that it has conspired to keep home-sale costs high in the face of major technological upheavals. This verdict is by far the group’s biggest setback yet. An NAR spokesman said, “This matter is not close to being final as we will appeal the jury’s verdict.”

HomeServices of America, a subsidiary of Warren Buffett’s Berkshire Hathaway, said it intends to appeal. “Today’s decision means that buyers will face even more obstacles in an already challenging real estate market and sellers will have a harder time realizing the value of their homes,” a company spokeswoman said. Keller Williams said it is considering an appeal.

Under the current system, sellers pay their own agent a commission — typically 5% to 6% of a home’s selling price — which is in turn shared with the buyer’s agent. Over the course of the trial, plaintiffs’ attorneys argued this model has suppressed competition by making it difficult for buyers and sellers to negotiate for lower rates.

“NAR and corporate real-estate companies have had a stranglehold on real-estate commissions for too long,” plaintiffs’ lawyer Michael Ketchmark said outside of the courtroom.

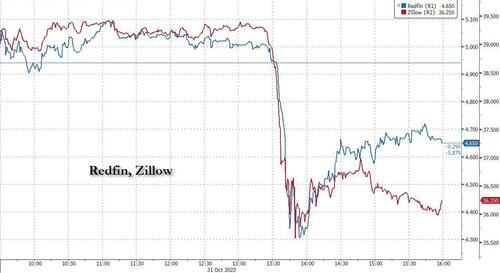

The news sent real-estate brokerage stocks tumbling: Redfin and Zillow both plunged as much as 10% before recovering some losses. Traditiona broker Re/Max was down 3%.

Tyler Durden

Tue, 10/31/2023 – 18:45

via ZeroHedge News https://ift.tt/d0FlywI Tyler Durden