Unhappy Halloween: Here Are A Few Scary Stories For You

By Michael Every of Rabobank

Here’s a scary Halloween story in just two sentences: “The last man on Earth sat alone in a room. There was a knock at the door…” And here is another that is a little longer.

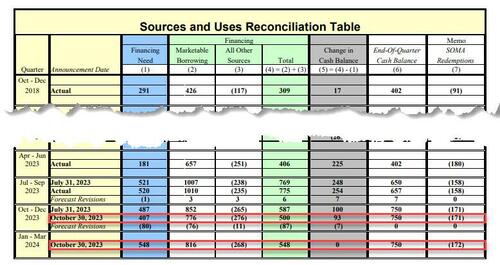

In the US, the Treasury borrowing target for Q4 set at $776bn, slightly lower than expected due to higher than anticipated revenues.

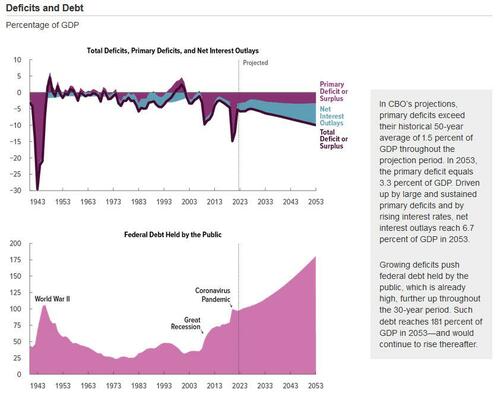

Even so, huge fiscal deficits are here to stay.

Tomorrow we find out how this will be financed, with Treasury Secretary Yellen likely to opt for short-term bill issuance. Druckenmiller just lambasted her for not locking in cheap long-term debt like “Every Tom, Dick, Harry, and Mary” in the US; and, elsewhere X quips, “Yellen’s husband explaining why economists like his wife are imbeciles w/o using her name”, quoting Akerlof’s 2020 article arguing “observations that contradict the existing paradigm will be dismissed if they violate the prescribed methodology,” are why economists didn’t see the GFC, or the rise in inflation and rates, coming. Yes, more bill issuance might take upwards pressure off longer-dated bond yields. However, Yellen would be doing it to splurge on spending over the next 12 months to try to ensure she stays in the job for another 62. In which case, US GDP growth will keep looking like it did in Q3, as will inflation, and the Fed may have to act again, raising both T-bill rates and Treasury bond yields.

On a related front, the details of the UAW pay deal with major US automakers are, if you will excuse the pun, striking: a 25% pay rise over the next 4 years, 8 months; Restored cost-of-living allowance of $8,800 over the contract that lifts this to 30%; Immediate 11% pay-rise for top earners, while the lowest paid get an effective 88% hike; A $5,000 ratification bonus and a $1,500 voucher towards a new car; Profit sharing, which would have been equal to $1,200 in 2022; Current temporary workers become full-time, new temps after nine months; Ford to raise 401K contributions to 10% from 6.4%; Right to strike over plant closures; An extra day off and two weeks paid parental leave; and $8.1bn new CAPEX by the firms. I recall recent conversations where I was told *the* litmus tests of whether we would see higher yields for longer was if we saw real-terms pay rises in the West. It’s certainly now a happy Halloween for the UAW, and others will surely be looking to follow that lead. Moreover, if we keep seeing income gains like that, and a more ‘income rich, asset poor’ world, maybe the declines we are seeing in consumer borrowing aren’t the same signals they used to be(?)

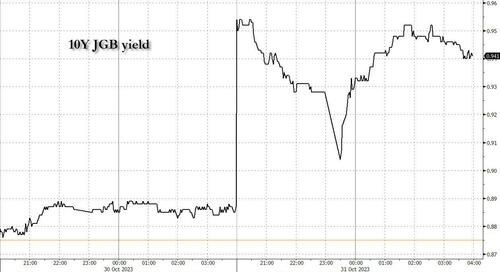

In Japan, today sees the BOJ meeting, with risks we could see an end to yield curve control. JPY already jumped on a report 10-year yields may be allowed to trade higher than their 1% ceiling – they were at 0.93% at time of writing. Yes, this is vastly lower than US yields at close to 5%, but not when FX hedged. In short, more bad news for bonds ahead, perhaps. Yet worse, if US yields rise further, the Dollar may benefit, leaving Japan with lower FX, higher imported inflation, higher bond yields, and higher debt servicing costs. And no way out.

The IMF argues ‘The temptation to finance all spending through debt must be resisted’, as Director Gopinath claims state spending above current levels could hit $6trn (7% of GDP) in DM and $5.3trn (8% of GDP) in EM by 2030 as sustainability, defence, and industrial policies require vast budgets. In other words, a global fiscal crisis may loom, albeit with the US better placed than most. She argues for global cooperation on a minimum corporate tax rate (going nowhere), a carbon tax (rejected at the ballot box in some places, as carbon tariffs are rolled out in others), and strengthened fiscal frameworks (i.e., austerity). In short, a world arming itself to the teeth and trying to seize control of supply chains is supposed to cut spending and cooperate on taxes.

We have a horror-story geopolitical backdrop. So much so that, “We must get used to the idea that there may be a threat of war in Europe – the German Minister of Defence”, a headline no Western newspaper is prepared to run, it seems. (What did Akerlof say? “Observations that contradict the existing paradigm will be dismissed if they violate the prescribed methodology.”) None of the EUR100bn Germany promised on defense has been usefully spent 18 months later.

The first of three Middle-East dominoes we’ve flagged as triggers for a regional escalation already toppled: an Israeli ground war in Gaza. However, this is so far still small scale. The second domino is the entry of Hezbollah once Israel commits its forces in full – on which front, social media clips of their hide-away leader Nasrallah making an appearance like a new end-credit scene Marvel villain may be worth noting. The third domino is Iran which, as the World Bank concludes three weeks after us, risks oil back at $150 a barrel and European gas at 2022 levels. While oil will remain on the back foot unless we see the next phase of escalation, there has already been an impact on European gas, with December TTF futures up 7.1% as LNG flows to Egypt from Israel dry up, meaning they cannot flow on to Europe.

Oil itself may also react to news from Iran- and Russia-ally Venezuela, where promises to allow free(er) elections in exchange for a sanctions roll-back have immediately been broken: President Maduro called opposition primary votes a “fraud”, and the electoral court suspends “all effects” of them. The issue is now whether the US will snap sanctions back, so oil prices rise, or blink to show geopolitical weakness, in which case risks are oil prices rise for other, worse reasons.

Relatedly, China has stated it will deepen military cooperation with Russia, and is sending larger naval forces to the waters around Taiwan, after reiterating: “Once the Chinese government is forced to use force to resolve the Taiwan question, it will be a war for reunification, a just and legitimate war supported, and participated in by the Chinese people… A war to crush foreign interference.” China is also again confronting Filipino ships in their own territorial waters (which it claims) despite US warnings it will defend the Philippines. Not too far away, South Korea is preparing for a possible Hamas-style provocation from North Korea. And Russia is escalating a push to take territory around Avdiivka, while Ukraine claims it hit Crimea again.

It should be clear to all except those who Akerlof critiques that the West is facing coordinated pushbacks against their hegemony: even in their own streets and from their fat, plush universities. As Hal Brands notes, ‘Biden’s Foreign Policy Vision Is Officially Dead’. He calls for the US (and, by extension, Europe!) to accept geopolitical reality and shift to a pre-war footing – which will be incredibly expensive, require guns vs. butter choices, and/or be very inflationary, as well as disruptive to the global trading architecture.

This Daily has long argued that in the face of these threats, and the inflation threat, we would see a fiscal and monetary policy, and trade and industrial policy, fusion: we have simplified this to “rate hikes and acronyms”, i.e., QE or MMT. However, it is crucial to understand that is not a true solution if you are thinking about asset prices going up or down.

As evidence, I share a discussion with Dominique De Villepin, former PM of France. He stresses:

“Hamas has set a trap for us, and this trap is one of maximum horror, of maximum cruelty. And so there’s a risk of an escalation in militarism… There’s also a second major trap, which is that of Occidentalism… which today is being challenged by most of the international community… the idea that the West, which for five centuries managed the world’s affairs, will be able to quietly continue to do so. And we can clearly see,… there is the idea that, faced with what is currently happening in the Middle East, we must continue the fight even more, towards what might resemble a religious or a civilizational war. That is to say, to isolate ourselves even more on the international stage.”

To follow, here are excerpts from a translated tweet from the President of Colombia, which until recently was a key LatAm US ally:

“The barbarity of consumption based on the death of others leads to an unprecedented rise of fascism, and thus to the death of democracy and freedom. It’s barbarism, or the global 1933, as I call it. 1933 was the year Hitler came to power. What we see in Palestine will also be the sufferings in the world of all the peoples of the South.

The West defends its overconsumption and its standard of living based on destroying the atmosphere and the climate, and to defend it, knowing that it will cause the exodus from the south to the north, and not only of the Palestinian people; He prepares to respond with death. It does not want to reform its economic system until the market goes to decarbonize it. And he knows that the effort will be minuscule to save life on the planet…

The right wing of the West sees the solution to the climate crisis as a “final solution”, the right wing dreams of Hitler again and conquers most of the rich and Aryan peoples of the West and our Latin American oligarchies, who see no other world in which to live than that of the “malls” of Florida or Madrid… We are going to barbarism if we don’t change power. The life of humanity, and especially of the peoples of the South, depends on the way in which humanity chooses the path to overcome the climate crisis produced by the wealth of the North. Gaza is just the first experiment in considering us all disposable.”

In short, the ‘Global South’, with a few key exceptions, is seething with anger at what it sees as Western attempts to retain economic hegemony and living standards through a ‘painless’ climate transition that they cannot afford. From the Southern side, this is a zero-sum game. Indeed, in a world where we admit there are finite resources, it literally *is* zero-sum – with all the negative impacts that has on a diverse society and its social psychology.

As I have argued before, this doesn’t mean the South can create a new economic and financial system; they can’t. But they can destabilise the current one. Yes, de-dollarisation is not viable in terms of any replacement, some EM are now happy not to recycle their dollars back to the US, and to barter and clear bilaterally while pricing in dollars (for now). The more heated geopolitics gets, the more these choices will be made.

Against that backdrop, if the West cut rates and/or does MMT dressed up as QE, do you think EM will accept that fiat currency for their commodities and products at an exchange rate that will maintain Western standards of living? Only if forced to. And force is very much where we are at right now. And it is where the MMT will have to be channelled.

This Middle East war, on top of the Ukraine War, will partly determine which financial system holds ahead, and where: US dollars, or EM commodities, as the base of the Eurodollar-accounting collateral pyramid.

For now, the US dollar is winning thanks to higher rates. But realpolitik logic says the West needs to win in the field of arms too, tragic as that is for so many individuals. Economic and financial power flow from military power, and vice versa, even if most don’t choose to see it until the barrel of a gun is pointed at them.

Indeed, the outcome of this cluster of wars will arguably speak to the long-run status of liberal democracy, or what’s left of it, and Occidentalism. See this cluster of interviews for some extra public intellectual firepower behind that view, and the belief that the West will have to do much, much more as a result – even if markets don’t like it.

In short, those enjoying a comfortable, middle-class Western lifestyle and hoping for a quick end to this new war, and an easy energy transition at low cost, and a Happy Halloween, are likely to be disappointed on all fronts.

How was that for a scary story?

Tyler Durden

Tue, 10/31/2023 – 11:00

via ZeroHedge News https://ift.tt/uKDBpwa Tyler Durden