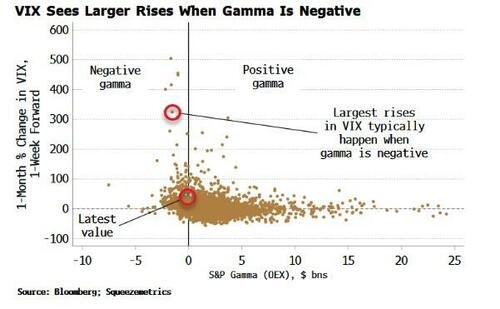

Stocks tried to stage a modest rally overnight after the US government shutdown was postponed by 45 days, but failed after the global bond selloff resumed on Monday, with 10-year Treasury yields back to the highest since 2007, as investors waited for another speech by Fed chair Jerome Powell to provide clues on the direction of interest rates. As of 7:30am ET, S&P futures traded unchanged from Friday’s close after earlier gaining as much as 0.6% and following a September to forget in which they lost 4.7%; Nasdaq futures were 0.2% higher and continue to be disconnected with tighter financial conditions in rates as Treasury 10-year yields rose five basis points to 4.62% and back to the 16-year highs seen on Friday. The US dollar rose against most Group-of-10 currencies. Brent edged higher and traded around $92 buoyed by widespread bets that global demand will continue to run ahead of supply. Gold fell and Bitcoin gained for a third-straight day, surging above $28K. This week, we will have a busy calendar for macro data with ISMs and NFP being the focus; we will hear from 10 Fed speakers.

In premarket trading, cryptocurrency-exposed stocks rose as Bitcoin advanced to a six-week high as inflows picked up at the start of October. Riot Platforms +9%, Marathon Digital +8%. Here are some other notable premarket movers:

- Clorox rises 0.7% ahead of the bell after D.A. Davidson & Co. analyst Linda Bolton Weiser raised her recommendation on the household products company to buy from neutral.

- FedEx shares are up 0.9% after Susquehanna Financial upgraded the package-shipping company to positive from neutral.

- Invitation Homes gains 1.1% after analysts at Evercore ISI upgrade the company to outperform from in line, citing better supply and demand trends coupled with the recent pullback in shares.

- Invitae jumps as much as 58% after the US FDA granted a marketing authorization for the firm’s test to help detect genetic variants linked with higher risk for certain cancers.

- Insulet is upgraded to buy from hold at Jefferies with analyst Matthew Taylor saying he only sees the potential for GLP-1 weight-loss drugs to have “a modest drag or no drag” on the insulin-pump opportunity. Shares rise 4.1% ahead of the open.

- Macerich rose 1.3% in premarket trading as Piper Sandler raised the recommendation on the real estate investment trust’s stock to neutral from underweight, saying the “strong labor market is key to economic growth, driving real estate demand.”

- Rivian rose 3.6% as Evercore ISI raised the recommendation on the electric-vehicle maker to outperform from inline.

- SmileDirectClub declines 57% after the maker of dental aligners filed for Chapter 11 bankruptcy protection.

- Sphere Entertainment rose 6.1% after the company’s Sphere venue in Las Vegas opened on Friday with a show by rock band U2. If the gains hold, the stock will be set for its biggest rise in over a year.

- Syndax Pharmaceuticals rose as much as 24% after the drug developer scheduled an event to reveal clinical data.

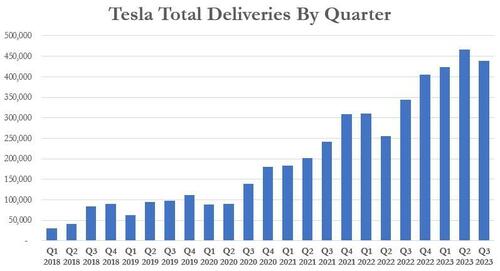

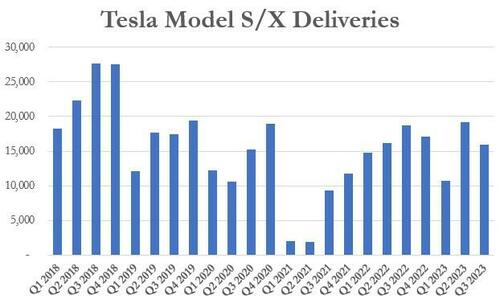

- US-listed shares of Nio, XPeng and Li Auto climbed after the Chinese electric-vehicle makers reported September delivery figures. Meanwhile, Tesla was up 0.8% ahead of its monthly delivery announcement.

Stocks got a boost earlier in the session, when investors briefly felt optimistic after US lawmakers reached a deal over the weekend to avoid a government shutdown. US lawmakers passed a last-minute spending deal on Saturday to keep the government running until mid-November. Sentiment was also helped by Chinese manufacturing PMI returning to expansion for the first time in six months, although the data was mixed suggesting there’s still room for caution despite green shoots in the economy.

However, the focus in markets quickly shifted back to interest rates, especially as rising oil threaten to fan inflation. Potentially adding fuel to the fire, Powell is due to speak at a roundtable discussion alongside Philadelphia Fed President Patrick Harker. Their views will be of particular interest after New York Fed boss John Williams suggested Friday interest rates should stay high for some time.

“Financial markets were bracing for a shutdown, so there’s an element of relief, but it’s only a temporary lifting of one of the clouds hanging over the markets now,” said Yung-Yu Ma, chief investment officer at BMO Wealth Management. “Interest rates and Fed hawkishness remain the name of the game and the main driver of the markets over the next few weeks.”

In Europe, benchmark indexes retreated, weighed down by losses in drugmaker stocks. The Stoxx 600 traded down 0.3% after earlier rising 0.4%. Asset manager Mandatum debuted on Helsinki’s stock market, the biggest listing in five years. here are some other notable European movers:

- Vivendi shares rose as much as 4.7%, briefly enjoying their highest jump since April after Barclays strategists upgraded their rating and said it was one of their favorite media stocks.

- BAE Systems rise as much as 3.4% after it was awarded almost £4 billion in funding from Britain’s Ministry of Defence for the next phase of the UK’s nuclear-powered attack submarine program.

- Pennon Group and United Utilities lead advances in the Stoxx 600 Utilities Index on Monday after the UK companies submitted their five-year business plans for the period 2025-2030. Pennon shares rose as much as +5.1%, United Utilities +3.5%

- XP Power slumps as much as 42%, the most on record, after the electrical components company warns on profit, citing weaker end-market demand. Jefferies says this may lead to a cut of about 15% to full-year consensus Ebit expectations.

- Fresenius SE drops as much as 3.8% after Reuters reported at the weekend that the German healthcare group is examining whether the state aid it received to offset high energy costs at its hospitals business would bar it from making management bonus and dividend payments.

- Teleperformance falls as much as 3.6% as Deutsche Bank cuts its recommendation on the French call center operator to hold from buy due to the rise of generative artificial intelligence.

- Flow Traders falls 8% to record low after Oddo BHF cut the recommendation on the market maker to neutral from outperform. The broker says Flow Traders is lacking short-term catalysts as it also sees sluggish exchange traded product and corporate credit market limiting the company’s earnings power.

Earlier in the session, Asian stocks gained as sentiment was buoyed by a temporary resolution to the US government shutdown situation, while many regional markets including China and South Korea were closed for holidays. The MSCI Asia Pacific Index rose as much as 0.4% on Monday, led by real estate and technology shares. Japanese equities led gains in the region after sentiment for non-manufacturers soared to the highest in 32 years as the economy continued to recover. Australian and Taiwanese stocks also advanced.

- Hang Seng and Shanghai Comp. were shut alongside closures in South Korea and India, with mainland China away the entire week for the National Day Golden Week celebrations.

- ASX 200 was lacklustre with many domestic participants absent in observance of Labour Day in Australia’s most populous state of New South Wales and ahead of tomorrow’s RBA meeting which is the first under Governor Bullock’s tenure.

- Nikkei 225 opened above 32,000 with the index boosted by a weaker currency and an encouraging Tankan survey which showed Large Manufacturers’ Sentiment at its highest since June last year and the Non-Manufacturing at its highest in over three decades, although the index later pared most of the gains and eventually slipped back beneath the aforementioned key level.

In FX, the dollar edged higher versus its Group-of-10 peers, after enjoying its best quarter in a year. Trading in most G-10 currencies was subdued with several markets including China and South Korea closed for holidays. The Swiss franc led Group-of-10 currency gains. The euro and sterling both fell as much as 0.2% against the dollar. USD/JPY briefly extended gains and touched a year-to-date high of 149.82 after the Bank of Japan said it would conduct an additional buying operation for five- to 10-year Japanese government bonds on Oct. 4

In rates, treasury futures remain near session lows into early US session after gapping down at the open, spurred by weekend accord by US lawmakers averting a government shutdown. Rate-hike premium also edged up, with around 15bp priced into the December policy meeting vs 11bp at Friday’s close. US session includes an appearance by Fed Chair Powell, slated to take part in a roundtable discussion alongside Philadelphia Fed President Patrick Harker at 11am New York time. US yields cheaper by 4bp-7bp across the curve with belly leading losses on the day, flattening 5s30s spread by ~2bp; 10-year yields around 4.63%, cheaper by ~5bp with bunds and gilts outperforming by 2bp in the sector. Treasury coupon auctions on hiatus until 3-year note sale on Oct. 10; dollar IG issuance slate empty so far; consensus forecast is for ~$85b of new bond sales for October, with projections wide ranging between $66b and $100b.

In commodities, crude futures advance, with WTI rising 0.4% to trade near $91. Spot gold falls 0.9%.

Bitcoin is firmer on the session continuing the marked gains seen at the commencement of APAC trade despite a lack of specifics. Action which has lifted BTC to a circa. USD 28.5k high, surpassing levels from the last few weeks with the next mark around USD 29k from mid-August.

Looking ahead, investors will focus on Fed Chief Jerome Powell’s speech later Monday; US economic data slate includes September S&P manufacturing PMI (9:45am), August construction spending and September ISM manufacturing (10am)

Market Snapshot

- S&P 500 futures up 0.5% to 4,349.25

- MXAP down 0.2% to 156.97

- MXAPJ little changed at 492.07

- Nikkei down 0.3% to 31,759.88

- Topix down 0.4% to 2,314.44

- Hang Seng Index up 2.5% to 17,809.66

- Shanghai Composite up 0.1% to 3,110.48

- Sensex up 0.5% to 65,828.41

- Australia S&P/ASX 200 down 0.2% to 7,033.21

- Kospi little changed at 2,465.07

- STOXX Europe 600 up 0.2% to 450.96

- German 10Y yield little changed at 2.87%

- Euro little changed at $1.0564

- Brent Futures up 0.4% to $92.54/bbl

- Gold spot down 0.3% to $1,842.73

- U.S. Dollar Index little changed at 106.28

Top Overnight News

- BOJ announced an extra bond-buying plan for this week following the unscheduled purchase on Friday as the central bank battles back against the recent yield rise. BBG

- Asia faces one of its worst growth outlooks in 50 years according to a new World Bank update, amid concerns that China’s slowdown could spill over into other countries. FT

- China’s economic momentum continued in September, with the NBS PMIs exceeding expectations: manufacturing was 50.2 (up from 49.7 in Aug and ahead of the Street’s 50.1 forecast) with non-manufacturing of 51.7 (up from 51 in Aug and ahead of the Street’s 51.6 forecast). While the NBS PMIs were solid, the Caixin PMIs fell short for September: manufacturing was 50.6 (down from 51 in Aug and below the Street’s 51.2 forecast) with services of 50.2 (down from 51.8 in Aug and below the Street’s 52 forecast). China’s new home prices rose slightly in Sept, ending a four-month streak of declines. RTRS

- ‘Last mile’ of disinflation the hardest, warns ECB deputy head. Luis de Guindos dismisses rates cuts and says getting back to 2% target will not be easy. FT

- Fed’s Barkin warns that strength in the housing sector means other parts of the economy may need to slow more in order to win the war on inflation. BBG

- Bill Ackman is “absolutely” interested in pursuing a deal with Elon Musk’s X through a new investment vehicle, the WSJ reported. Pershing Square received regulatory approval Friday for a SPARC, a blank-check firm which targets a company before raising funds, with the intention of taking it public. WSJ

- Nearly 4,000 UAW members at Volvo-owned Mack Trucks reached a tentative pact to avoid a strike, the union said. BBG

- In a surprise move, House Speaker McCarthy reversed course and brought a “clean” extension of spending authority up for a vote on Sep. 30, after avoiding this course of action for weeks. Now that this extension has become law, federal agencies have funding until Nov. 17. A shutdown at that point is still a clear risk, though we think the odds of a shutdown at the next deadline are lower than they seemed heading into the Sep. 30 fiscal year end. GIR

- Regulators around the world are stepping up their campaign to reign in and regulate “shadow banks” (hedge funds, PE firms, etc.) as this part of the financial system captures a growing amount of market share from traditional banks. FT

- Mega-cap tech has struggled relative to the broader market in recent months despite improving earnings estimates. However, history suggests that the upcoming 3Q results may catalyze a momentum reversal in the largest tech stocks. Since 4Q16, the mega caps in aggregate have beaten consensus sales growth expectations 81% of the time and have outperformed in two-thirds of earnings seasons, typically by 3pp. Goldman

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in severely holiday-quietened conditions amid the mass closures in the region, while participants digested the key weekend developments including the US averting a government shutdown and mixed Chinese PMI data. ASX 200 was lacklustre with many domestic participants absent in observance of Labour Day in Australia’s most populous state of New South Wales and ahead of tomorrow’s RBA meeting which is the first under Governor Bullock’s tenure. Nikkei 225 opened above 32,000 with the index boosted by a weaker currency and an encouraging Tankan survey which showed Large Manufacturers’ Sentiment at its highest since June last year and the Non-Manufacturing at its highest in over three decades, although the index later pared most of the gains and eventually slipped back beneath the aforementioned key level. Hang Seng and Shanghai Comp. were shut alongside closures in South Korea and India, with mainland China away the entire week for the National Day Golden Week celebrations.

Top Asian News

- German Finance Minister Lindner said at the third German-Chinese financial dialogue in Frankfurt which was attended by Chinese Vice Premier He Lifeng that Germany and China are keen to further strengthen their cooperation on financial and economic issues, while he added that both sides want to create a fair and non-discriminatory market environment and strengthen the security of global supply chains. Lindner also pledged that Germany will continue supporting a Chinese state-backed development bank despite Canada’s decision to freeze ties, according to AA and Politico.

- BoJ Summary of Opinions from the September meeting noted a member stated they need to continue easing patiently and a member said they should maintain easy policy for now but in future exit, must consider what to do with non-JGB asset holdings. Furthermore, there was an opinion that there is no need to make additional YCC tweaks as long-term rates are moving fairly stably and it was also stated that they cannot currently determine the timing of the policy tweak as that would depend on economic and price conditions at the time, while a member said it is important to prepare for exit from a risk management perspective as they could have clarity around January-March next year on whether the 2% inflation target can be met in a sustained and stable fashion.

- BoJ Governor Ueda said the sustainable and stable achievement of the BoJ’s 2% inflation target is not yet in sight and there is still some distance before reaching an exit from easy policy. Ueda stated that the BoJ’s ability to conduct monetary policy is not impaired by a temporary decrease in profits and capital as long as it conducts appropriate monetary policy, while he added that given the current distance to exit, he believes it is the right time to discuss the topic of central bank finances and monetary policy conduct from an objective perspective.

- Japan reportedly put the brakes on the lucrative used-car trade with Russia which is valued at nearly USD 2bln annually, according to Reuters.

European bourses & US futures are a touch softer after starting the session with mild gains, though action overall is contained and tentative after a limited APAC handover ahead of data & Fed speak. Currently, Euro Stoxx 50 -0.3% with sectors mainly in the red and following suit to the above broader macro tone, but action the breadth of action is relatively modest. Stateside, futures are tilting into the red after faring marginally better than their European peers in the early part of the session; newsflow has been limited and focused on weekend fiscal developments ahead of Fed’s Powell and ISM metrics; ES +0.1%. EU antitrust regulators say there is no formal investigation into AI chips

Top European News

- UK PM Sunak said the government is making good progress on bringing down inflation, according to Reuters.

- UK Chancellor Hunt was reportedly caught in a secret recording suggesting that PM Sunak will call a general election once inflation falls below 3% which gives the strongest hint that the next general election could be held in Autumn next year, according to Sunday Times’ Wheeler.

- UK Housing Minister Gove said his opinion is wherever they can cut taxes that those cuts should fall on workers and he would like to see the tax burden reduced before the next election, while he added that they first need to be certain that inflation is coming down.

- England’s water companies are to pledge to invest GBP 90bln in water and sewerage networks in plans which would increase household bills, especially in the southeast, according to Sunday Times.

- ECB’s de Guindos dismissed talk of rate cuts and warned that getting back to 2% inflation will be difficult with the last mile of disinflation the hardest, according to FT.

- Slovakia’s former PM Fico’s leftist-populist Smer party won the election with 23.4% of votes, while the party is seen as pro-Russian after promising to stop sending weapons to Ukraine, according to Politico.

- Fitch raised Portugal’s sovereign rating from BBB+ to A-; Outlook Stable, while Moody’s raised Cyprus’s sovereign rating to investment grade of Baa2; Outlook Revised to Stable from Positive.

- Riksbank Minutes: prices are increasing at a rate that is not compatible with the inflation target; members emphasised the risks associated with the continued high underlying inflation and the weak krona; policy rate may need to be increased further.

FX

- DXY bid on dips within 106.040-490 range as Yen lags and offsets Franc outperformance, USD/JPY remains elevated after probing 149.80 as BoJ retains ultra-easy stance and Japanese officials stick to mere verbal intervention

- USD/CHF retreats from 0.9166 towards 0.9100 after better than forecast Swiss manufacturing PMI and not as weak as previous retail sales.

- Aussie and Kiwi cautious ahead of RBA and RBNZ policy meetings as AUD/USD probes 0.6400 from 0.6445 and NZD/USD touches 0.5975 from just over 0.6000.

- Euro, Pound and Loonie all lose ground vs Greenback within 1.0591-36, 1.2220-1.2162 and 1.3557-1.3612 respective ranges.

Fixed Income

- Bonds back in the firing line following a short squeeze into the end of September and Q3.

- Bunds hit buffers at 128.50 before testing psychological support at 128.00, Gilts retreat from 93.71 to 93.22 and T-note drifts back from 107-29+ to 107-19 awaiting US final manufacturing PMI, ISM and Construction Spending before Fed speakers including Chair Powell.

- Orders for the new BTP Valore 5yr hit EUR 1bln, via Reuters citing Bourse data.

Commodities

- WTI Nov and Brent Dec futures maintain modest gains but remain off best and worst levels within a tight consolidative range after the contracts settled lower by just under USD 1/bbl apiece on Friday.

- Spot gold remains shy of the USD 1850/oz mark though the recent modest deterioration in the risk tone has provided some slight assistance, while spot silver is the standout laggard with downside in excess of 2.5% intraday.

- Base metals are hampered by the USD, overall risk tone and the absence of Chinese participants for the regions week long holiday. Additionally, the mixed Chinese PMIs failed to provide any lasting support.

- Turkey’s Energy Minister says within the week they will recommence operating the Iraq-Turkey pipeline; subsequently, Iraq says the Kirkuk-Ceyhan oil pipeline cannot restart yet as there issues still need to be resolved on pipeline, according to an Iraqi official cited by Bloomberg

- India is not comfortable with current oil prices, according to the Indian Petroleum Secretary; OPEC has the right to cut output but it’s led to high prices.

- Iraq’s September oil exports averaged 3.4mln bpd and oil prices averaged USD 92.05/bbl.

- Five more cargo ships were reportedly headed towards Ukrainian Black Sea ports for further grain exports, according to Ukraine’s Deputy PM.

- UAE Energy Minister says they have decided to speed up the upstream expansion plan to reach 5mln/bpd by 2027 in order to counter for loss of supply from other producers; separately, says production capacity more than 4.2mln BPD and on track to produce 5mln BPD by 2027

- Morgan Stanley believes the oil market will be 1mln BPD undersupplied in Q4, according to CNBC.

Geopolitics

- UK Defence Secretary Shapps said UK troops will be deployed in Ukraine for the first time to start training Ukrainian soldiers on-site and not only at NATO bases under plans being discussed with military chiefs. Shapps also stated the UK signed contracts worth GBP 4bln to drive forward AUKUS submarines with the contracts signed with BAE Systems (BA/ LN), while the UK is deploying RAF typhoons to Poland and deploying forces to the UN peacekeeping mission in Kosovo, according to Reuters.

- US Central Command conducted a helicopter raid in Northern Syria on September 28th and captured ISIS facilitator Mamduh Ibrahim Al-Haji Shaykh, according to Reuters.

- Turkey’s Interior Minister said two terrorists attacked in front of the ministry building in which one was neutralised and the other blew himself, while Turkey stated that one of the attackers was a PKK member and Turkey later carried out air strikes in Northern Iraq and destroyed 20 targets of Kurdish militant group PKK, according to Reuters.

- Turkish President Erdogan said will continue the struggle against inflation, terror and the outlawed group FETO, while he also commented that Turkey has kept every promise to the EU although the EU did not, and Turkey does not have any expectations from the EU.

US Event Calendar

- 09:45: Sept. S&P Global US Manufacturing PM, est. 48.9, prior 48.9

- 10:00: Aug. Construction Spending MoM, est. 0.5%, prior 0.7%

- 10:00: Sept. ISM Manufacturing, est. 47.9, prior 47.6

- ISM Employment, prior 48.5

- ISM New Orders, prior 46.8

- ISM Prices Paid, est. 49.0, prior 48.4

DB’s Jim Reid concludes the overnight wrap

Welcome to Q4 with the markets relieved to see the end of September, and for that matter Q3, after a tough latter half to a quarter that promised a lot after a buoyant July. Henry has just published our monthly and quarterly performance review (see here) but in short, of the 38 non-currency assets we look at, only 11 were up in total return terms in Q3 and only 7 in September making it the worst month of 2023 so far. Some highlights were the +28.5% increase in WTI oil and the +73.5bps rise in 10yr US yields over Q3. 30yr USTs were +83.9bps, the largest move since Q1 2009. The S&P 500 was -4.8% in September and -3.3% in Q3 on a total return basis. YTD the index is still at +13.1% but with the equal weight only up +1.8%, a handful of stocks are providing nearly all the gains. See Henry’s piece for more.

So as we start October can we power out of the gravitational pull of bad September seasonals? September 2023 was the 4th year in a row that the S&P 500 and the STOXX 600 were down for the month, as well as the 7th year in a row that Bloomberg’s global bond aggregate was down for the month. The damage in bonds has been more severe and more sustained than for equities and you can’t help wondering where the real damage is. You can’t have this much value destruction in bonds without there being some stress somewhere. However, it’s near impossible to work out where exactly it might come to the surface.

The good news as we start the week and the new business month is that the US averted a shutdown just before the deadline on Saturday night which will keep the government running until November 17th. This gives negotiators more time to pass something more long standing. We will see if we’re in the same position in six weeks’ time though. This has helped lift US equity futures by around half a percent and US bond yields are 3-4bps higher across the curve.

For now no shutdown means that US data will get published on time this week. The highlight is clearly Friday’s payrolls. Before that, the JOLTS (tomorrow) and ADP (Wednesday) data will give us some early clues. The former is a month behind but is obviously a key report to assess labour market tightness by looking at the quits rate, hirings and vacancies etc.

The highlights for the rest of the week are the US ISM and a Powell roundtable discussion today, an expected hold from the RBA tomorrow, US services PMI, Euro Zone retail sales, Euro Zone PPI and a Lagarde speech on Wednesday, French IP on Thursday with German factory orders on Friday. The full week ahead is at the end, including a bevy of central bank speakers, but we’ll quickly preview today’s ISM and Friday’s payrolls below.

Our economists and the consensus are expecting +165k for headline payrolls (+187k previously) with the unemployment rate expected to dip back down a tenth to 3.7% after surprisingly increasing three tenths last month. A reminder that every headline payroll number has now been revised lower in 2023. In early summer we were on a run of 13 successive beats but some of that has now gone with revisions. We’ll do a fuller preview in Friday’s EMR.

Today’s US manufacturing ISM (47.5 expected at DB vs. 47.6 last) and Wednesday’s services ISM (54.1 vs. 54.5) are expected to be fairly stable. For the former our economists’ models suggest an uptick but the UAW strikes could offset that as perhaps foretold by a weak Chicago PMI last week. Note that it’s likely too early for this strike to impact payrolls but it could make a sizeable impact next month. For services watch for the employment index as this surprisingly soared 4 points to 54.7 last month.

Talking of such indices, the official China manufacturing PMI edged up to 50.2 (50.1 expected) over the weekend from 49.7 in August. Services also beat by a tenth to 51.7 from 51.0 in August. The private Caixin equivalents were at 50.6 and 50.2 respectively, below the 51.2 and 52.0 expected. So a mixed set of data as China starts a holiday week.

Staying in Asia, the Nikkei 225 is leading the way this morning (+0.74%) helped by the US government staying open and due to an upbeat reading for the Japan Tankan indices this morning (9 vs 6 expected for large manufacturers and 27 vs 24 for large non-manufacturers). The rest of the session is quiet with many markets closed for holidays.

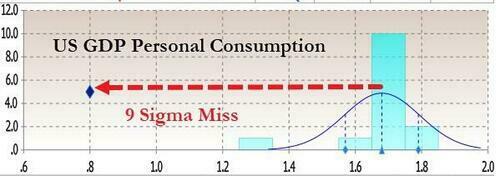

Turning back to last week now, on Friday we got some encouraging inflation news in what a challenging week for financial markets. On that inflation news, key metrics of monthly core inflation came in below 2% annualised on both sides of the Atlantic. In the US, the headline August PCE data release came in below expectations at 0.4% month-on-month (vs 0.5% expected). In year-on-year terms, the PCE result was as expected at 3.5%, up from 3.3% in July. Core PCE also surprised to the downside at 0.1% month-on-month (vs 0.2% expected). In year-on-year terms, core was at 3.9% as expected, down from 4.2% in the previous month.

The positive inflation news saw US 10yr Treasuries slightly pare back losses from earlier in the week, with 10yr yields down -0.4bps and 2yrs down -1.3bps. Week-on-week, 10yr yields gained +13.7bps to 4.57%, their highest weekly close since 2007. With short-end rates rallying over the week, the 2s10s curve steepened by +20.4bps week-on-week (and +0.9bps on Friday), reaching its least inverted since May (-47.6bps). It was 30yr Treasuries that underwent the greatest sell-off last week, rising +17.5bps to 4.70% (-0.5bps on Friday). Overall, it was frenetic week for US rates, with the MOVE index of rates volatility up +12.4pts (-1.7pts on Friday).

Meanwhile, in Europe, Euro Area September HICP came in below expectations at 4.3% year-on-year (vs 4.5% expected), down from 5.2% in August, while core inflation came in at 4.5% (vs 4.8% expected and 5.3% in July). Notably, the ECB’s estimate of the seasonally adjusted monthly core inflation rate was +0.1% mom, its lowest since spring 2021. This new evidence of slowing inflation momentum brought a breath of fresh air to the European fixed income market, with 10yr German bund yields down -9.0bps on Friday. They still rose +7.9xbps week-on-week to 2.84%, their highest weekly close since 2011. French OAT yields gained +11.2bps in weekly terms (-9.2bps on Friday) and Italian BTP yields were up +19.0bps (and -8.6bps on Friday) after concerns over their budget. 10yr gilt yields rose +18.8bps in their largest weekly increase since early July (-4.7bps Friday).

Rising rates were a dampener for equity markets, with the S&P 500 falling for the fourth week in a row, down -0.74%(and -0.27% on Friday) to its lowest since early June. Technology outperformed, with the NASDAQ seeing a marginal gain of +0.06% (+0.14% on Friday). NVIDIA spearheaded the tech resilience, gaining +4.54% last week (and +0.95% on Friday), with Tesla (+2.18%, and +1.56% on Friday) also helping. In Europe, the STOXX 600 gained +0.38% on Friday but fell back -0.67% in weekly terms to its lowest level since mid-August.

Over in commodities, the oil rally took a breather on Friday but remained elevated against a backdrop of tight supply. Oil product supply is also getting tighter as Russia plans near zero diesel exports next month following its temporary ban on gasoline exports. Accordingly, Brent crude traded flat on Friday (-0.07%) but was up +2.19% week-on-week to reach $95.31/bbl, its highest weekly level since last November. WTI crude slipped back more significantly on Friday (-1.00%) but was still up +0.84% on the week.

In other commodity news, gold fell back -3.98% last week (and -0.80% on Friday) to $1,849/ounce, hitting its lowest level since February after its largest weekly decline since 2021. The downward momentum comes after Fed policymakers indicated they intended to keep policy tight for a longer period, pushing gold prices below the $1,900/ounce support level that had largely held since March.