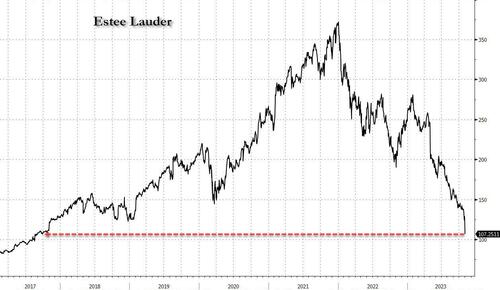

Estee Slaughter: Beauty Giant Implodes To 6 Year Low As Consumers Hit Brick Wall

When we looked at the performance of consumer stocks last quarter, we found a not unexpected divergence between companies catering to lower income consumers, which have been hammered for much of 2023, and those targeting rich buyers, which – especially in the case of a handful of European luxury giants such as LVMH, Kering and Hermes – had done tremendously well for much of the past year, making Bernard Arnault the richest man in the world, if not for long.

Fast forwarding to today, while we have yet to hit rock bottom when it comes to lower income cohorts, it is becoming increasingly clear that the answer to our question from May, namely “did the luxury bubble just burst” is now a resounding yes as the following boom-to-bust chart of European luxury giants LVMH, Hermes and Kering shows.

Today, the bursting of the luxury bubble took its latest casualty, Estée Lauder, whose already-battered shares plummeted even more, tumbling as much as 21%, their biggest one-day drop in history, after the beauty giant slashed its full-year outlook on troubles in China and the Middle East. The stock has lost almost half of its value in 2023 alone.

As BBG notes, the owner of the MAC and Tom Ford brands has been “floundering in its crucial travel retail business in Asia due to weaker-than-expected demand.” The continued weakness in that channel, as well as an added drag from the Israel-Hamas war, show the beauty company has failed once again to get its footing, meaning it is likely to keep ceding market share to archrival L’Oréal.

For the current fiscal year, Estée Lauder expects net sales in a range of negative 2% to positive 1% versus the prior year, while earnings are seen at $2.08 to $2.35 a share. In August, it had forecast net sales to increase between 5% to 7% and saw earnings of $3.43 to $3.70 a share.

Estée Lauder said net sales in the most recent quarter fell 10%, in line with the downbeat outlook the company forecast in August (the only positive was that the company did a +6% in the Americas vs a Consensus -2%, although that too is about to reverse now that Americans are finally paying down their student loans, credit cards are maxed out and any “excess savings” are long gone).

For the current quarter, the company now expects net sales to decrease between 9% to 11% versus a year ago and sees diluted net earnings between 47 cents and 57 cents a share. The potential risks from disruption in Israel and the Middle East are expected to have a dilutive impact of 8 cents. The company doesn’t break out what portion of revenue it generates in the region.

“The big question, like last quarter, and the one before it, will be: ‘Is this the final cut?’” Bernstein analysts led by Callum Elliott wrote in a research note.

Chief Executive Officer Fabrizio Freda said in a statement that the New York-based company lowered its fiscal 2024 outlook due to slower growth in prestige beauty in Asia travel retail and mainland China, as well as the risk of disruption to its business in Israel and elsewhere in the Middle East.

Remarkably, even though Estée Lauder had already lowered expectations in the previous quarter – after already cutting its outlook several times in the past year leading to another near record price drop back in April – the market was still caught off-guard, sending the stock down the most on record. That’s raised concerns among investors that executives don’t have a good grip on what’s happening in their business.

“We thought that this quarter could be the trough and did not expect another guidance cut,” RBC Capital Markets analyst Nik Modi wrote in a research note. “All the read thrus suggested China was weak, but we thought EL’s guidance last quarter accounted for the weakness. Clearly we were wrong.”

On a call with analysts, CEO Freda said: “We expect calendar year 2023 to be the final and, frankly, painful post-Covid reset period for the company.”

Good luck with that.

Curiously, the cosmetic industry may be the one place where lower-income consumers are holding out better then their higher-income peers. Estée Lauder’s quarterly results are in contrast to competitor L’Oréal, which said late last month that sales were up 4.5% in the three months that ended on Sept. 30. While the French beauty giant – which sells more mass-market items under brands such as Maybelline New York and L’Oréal Paris – has also been hit by the slowdown in duty-free sales in China and South Korea, the business represents a much smaller portion of its revenue versus Estée Lauder.

L’Oreal’s cheaper products have sold more briskly than items from its more expensive brands as inflation-weary consumers have become pickier. Estée Lauder, meanwhile, sells more higher-end products and on Wednesday cited the “slower-than-expected recovery of overall prestige beauty.”

Which brings us to a key question: has the consumer finally hit a brick wall? While we are confident that recent results indeed confirm that consumers are virtually tapped out, a slightly more cheerful take comes from Goldman consumer trader Scott Feiler who tries to present today’s dismal results in a slightly better light.

Here is his take on today’s earnings onslaught:

- Bottom-Line Intact for 3Q: The magnitude of top-line upside has begun to slow, but companies have pretty continued to beat across the board on the EPS/EBITDA line for 3Q. Even the names with the biggest downward reactions this morning so far in the pre (Wayfair, EL, CCEP, GOOS) largely all beat EPS for this quarter.

- Top-Line Upside is slowing though: While bottom-line remains intact (for 3Q at least), the top-line upside does appear to be harder to come by. See YUM, EAT, EL, GOOS etc for prints that largely saw in-line sales, even as EPS handily beat.

- Restaurants remain a relatively bright spot in the US: YUM (+1.5% comp beat), FWRG (40 bps comp beat) and EAT (20 bps comp beat at Chili’s) are all “fine” still with still constructive commentary, even as traffic has slowed some.

- China Unsurprisingly called out as weak: 2 of the biggest stock disappointments this morning are EL (called out incremental headwinds from a slower-than-expected recovery of overall prestige beauty in mainland China) and YUMC (said they observed softening consumer demand emerged in late September through October).

- The 2 biggest single names in focus in our IB chats – EL and Wayfair.

- For EL, the guidance cut only 1 quarter in is well below any of the worst estimates we had heard. The only “positive” is the bulk of it was blamed on China (somewhat known) and the Middle East. They did a +6% in the Americas vs a Consensus -2%, and so we think a focus on the 930AM call will be whether there were shipment benefits that helped that figure. Despite the better Americas and Jason’s note titled ““bottom perhaps finally found,” the overwhelming feedback continued to be negative this morning on lack of conviction in an EPS bottom.

- For Wayfair, the stock dropped hard as soon as the release hit. A ton of inbounds from most asking why. Yes, revenues missed for 3Q but it was only a 1% miss vs consensus and the bogey, while margins beat by about 150 bps. The big concern here seems to be less about margins (most understand a beat was likely) and more about top-line, especially fears around 4Q. On the call, they spoke to QTD gross revenues running around flat. We think expectations were well below the consensus +5% for the full 4Q, so agree that the -10% move lower in the pre is a bit surprising. This is a shoot first, ask questions later type tape though.

Needless to say, that is hardly the kind of tape one sees at the start of bull markets.

Tyler Durden

Wed, 11/01/2023 – 12:45

via ZeroHedge News https://ift.tt/9cWuLgy Tyler Durden