Quarterly Refunding Preview: How Much Of An Increase In Coupon Issuance

On Monday we got the what: the Treasury’s schedule of new debt issuance for the current and coming quarters, which as we discussed was modestly below what was previously expected, at $776BN down from $852BN in the previous forecast, and down from $1 trillion in Q2 (nonetheless rising again to $816BN in the first calendar quarter of 2024).

Today, at 8:30am we get the how, how will the Treasury funding this new debt; here, as Newsquawk notes, analysts are split on whether Treasury will increase coupons at same pace as prior or less.

In the quarterly financing estimates released on Monday, the Treasury announced it expects to borrow $776bln in net marketable debt for the October-December period, which is down $76BN from its July 2023 estimate; today’s refunding announcement will delve into how much of that decrease is driven by bills/coupons.

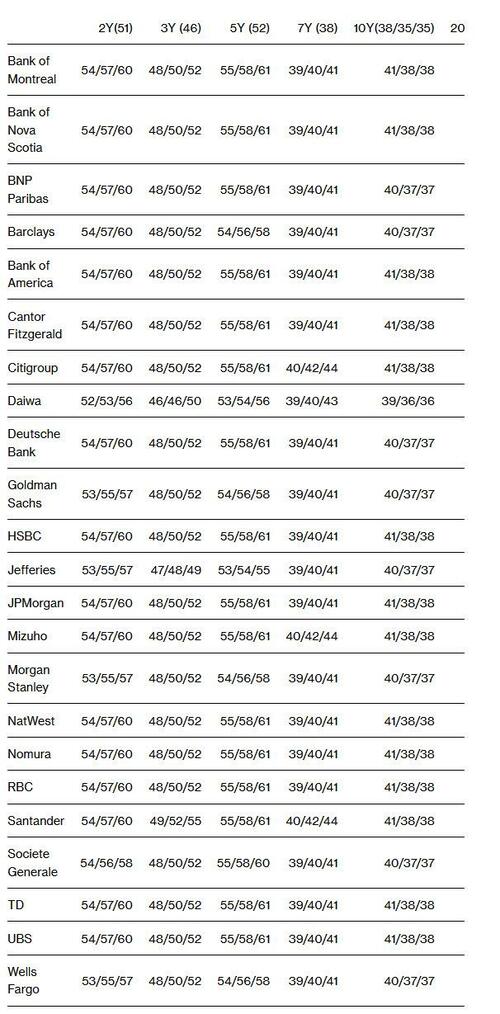

As the Treasury guided in the last refunding, it is expected to increase its coupon auction sizes again. However, there is a great split amongst analysts on whether the Treasury will increase the auction sizes again at the same pace as the August refunding where 2yr, 3yr. 5yr, 7yr, 10yr, 20yr. and 30yr tenors (both new issues and reopenings) were increased per month by USD 3bln, 2bln, 3bln, 1 bln. 3bln. 3bln. 1 bln, and 2bln. respectively, or whether the Treasury will opt for a smaller increase amid the heavy sell-off in bonds and the increase in term premia.

For instance. Goldman Sachs sees a smaller total amount of increases with 2yr. 3yr, 5yr, 7yr. 10yr, 20yr. and 30yr tenors increased by USD 2bln, 2bln. 2bln, 1 bln. 2bln, 1bln, and 1bln. respectively.

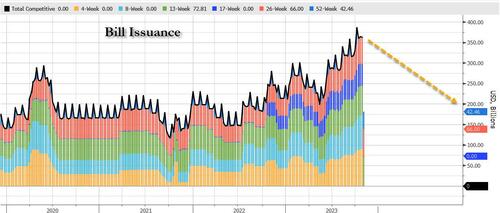

As Bloomberg notes, the consensus view is that letting up on note- and bond-auction growth would expose the Treasury to risks associated with relying too heavily on bills. Bills already comprise about 20% of the Treasury’s debt, the upper end of the range recommended by the department’s industry advisers. This is the concern voices by Stanley Druckenmiller, namely that the Treasury should have issued more coupons when rates were lower instead of relying too much on Bills.

Firms including Barclays Plc, Jefferies, Morgan Stanley and Wells Fargo are among those predicting a slowdown in Treasury’s auction ramp-up. At Jefferies, economist Thomas Simons is among those citing the strong appetite for bills as a reason to slow the growth of bond and note issuance. He forecasts a refunding total of $112 billion next week.

In the case of the 10-year note, of the 23 primary dealers that provided forecasts — ASL Capital Markets didn’t — the majority expects the new-issue and reopening sizes to increase by $3 billion. That would be the same pattern as last quarter. However, nine dealers predict increases of no more than $2 billion, and one sees $1 billion.

The following are predictions for auctions of fixed-rate coupon-bearing notes and bonds in November, December and January, in billions of dollars, with most recent sizes in parentheses. Two- to seven-year auctions are monthly new issues, while 10-, 20- and 30-year entries are a new issue with two reopenings.

We will also get the details on the auction size increases for the rest of the other tenors.

Tyler Durden

Wed, 11/01/2023 – 08:29

via ZeroHedge News https://ift.tt/jaYVLWs Tyler Durden