Key Events This Quiet Week: SLOOS, Consumer Sentiment And Barrage Of Fed Speakers

Mercifully, the week after payrolls (not to mention a barrage of central bank announcements and peak earnings season) is usually very light on US data and this is indeed the case this week as DB’s Jim Reid writes in his weekly preview. The highlight for us will probably be today’s US Senior Loan Officers Opinion Survey (SLOOS) even if it’s unlikely to be an immediate market mover. Bank lending standards are in deep recessionary territory and the longer they stay there the more risk that refinancings won’t happen (or come at a much higher cost) which will slow the economy and potentially cause accidents. For now a combination of excess savings, private markets, and the lack of need for refis could have weakened the usual impact on the economy, even with the typical lag. So the trillion dollar question is can the economy get by long enough for bank lending standards to gradually improve to normal levels? We will see if any trends emerge today at 1pm ET when the SLOOS is published.

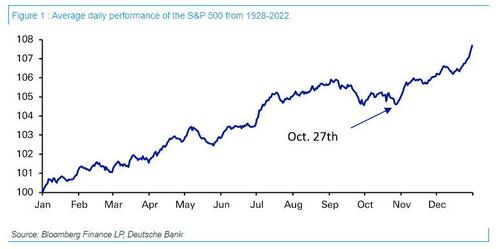

Before we continue, we take a brief detour to lay out Reid’s views on the big story of last week which, of course, was the epic rally in bonds and equities: As Reid notes, “It seems our seasonal chart we published on October 27th that basically said the bottom in US equity markets in H2 occurs on that day (using nearly 100 years of data), has picked the local lows perfectly.”

Some more observations from Reid:

The S&P 500 (+5.85%) had its best week in a year and 10 and 30yr US yields rallied -26.4bps and -24.8bps respectively and had their best week since March and January.

For Treasuries there was much talk about the QRA (quarterly refunding announcement) driving the rally. There’s no doubt that this was the initial catalyst but the rally had 4 stages. First the QRA, then the weak ISM, then the dovish Fed (all on the same day), and then finally a weak payrolls report on Friday which we’ll discuss at the end when we briefly recap the past week.

The one thing we’ll say here is that the Sahm Rule got a little closer to being triggered with US unemployment (3.9%) now 0.5pp above its lows in April. The trigger is the 3m moving average being 0.5pp above the 3m moving average lows of the last 12 months and when this happens the US economy has always been in, or about to be in, recession (using post WWII data). It is currently 0.33% above the lows. So one to watch.

The fascinating thing about markets is that the path to a hard landing is often via the appearance of a soft landing first. So we’re in this window where the data is softening but if it only ends up softens a bit, and then stabilising, then its great news. However if it’s the start of something bigger it’s not. The former scenario won out last week as you’ll see in more detail at the end in our review.

Moving onto this week, outside of the SLOOS, the week is full of Fed speak stored up from the Fed blackout period and with the FOMC being firmly behind us. Here is the line up:

- Monday begins with a speech by Governor Cook (dove) on financial stability.

- On Tuesday, NY Fed President Williams (dove) and Dallas Fed President Logan (hawk / voter) will moderate discussions, while Governor Waller (hawk) will speak about using economic data to understand the economy. In addition, Vice Chair of Supervision Barr (dove) will speak on financial technology, and we will hear for the first time from the new Kansas City Fed president Schmid (hawk) at an energy conference.

- The remainder of the week will feature repeat appearances by several of these officials (Cook, Barr, and Logan), as well as closing comments by Vice Chair Jefferson (dove) on Wednesday, a discussion by Atlanta’s Bostic (dove / non-voter) and Richmond’s Barkin (neutral / non-voter) on survey data on Thursday, as well as a speech on the economy and monetary policy by interim president of the St. Louis Fed Paese.

Of the above, the main one is Powell at the IMF conference on Thursday. Last Wednesday he talked about tighter financial conditions doing some of the Fed’s work for them. After the huge 60/40 rally since, will he still feel the same way by Thursday?

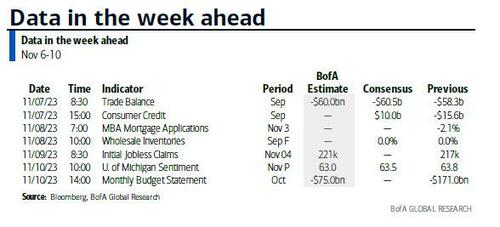

Elsewhere in the US, tomorrow’s trade numbers are of minor interest and then Friday’s University of Michigan’s consumer confidence is the other main highlight with focus on the 1yr and longer-term inflation expectations. The former spiking from 3.2% to 4.2% last month and more importantly, the latter picking back up a couple of tenths.

Moving back across the pond, markets will focus on German factory orders (today) and industrial production tomorrow. Other notable indicators due include Italian retail sales (Wednesday) and industrial production (Friday), the trade balance for France (Wednesday), the ECB Consumer Expectations Survey (Wednesday), and UK monthly GDP (Friday).

In China, all eyes will be on the inflation data (Thursday) following last week’s misses on the PMIs. Current median estimates on Bloomberg suggest the CPI is expected to fall back into negative territory (-0.1% YoY vs 0.0% in September) and the PPI is also seen falling (-2.7% vs -2.5%). Prior to the inflation prints, there will also be trade balance data tomorrow.

As well as Powell speaking this week, ECB President Lagarde (Thursday) and BoE Governor Bailey (Wednesday) will all make appearances. Staying with central banks, the RBA have their latest meeting tomorrow with our economists (more here) expecting a +25bps hike.

In corporate earnings, with more than 400 of the S&P 500 members having already reported, things will slow down a bit until Nvidia report on November 21st. The key names this week are in the day-by-day week ahead at the end. See our equity strategists’ global review of earnings season so far here.

Here is a day-by-day calendar of events:

Monday November 6

- Data: UK October construction PMI, new car registrations, Japan September labor cash earnings, household spending, Italy October services PMI, Germany September factory orders

- Central banks: BoJ’s Ueda speaks, ECB’s Holzmann and Nagel speak, BoE’s Pill speaks

- Earnings: Vertex Pharmaceuticals, NXP Semiconductors, Diamondback Energy, BioNTech, International Flavors & Fragrances, Ryanair

Tuesday November 7

- Data: US September trade balance, consumer credit, China October trade balance, Germany October construction PMI, September industrial production, Eurozone September PPI, Canada September international merchandise trade

- Central banks: Fed’s Schmid and Logan speak, ECB’s Nagel speak, RBA decision

- Earnings: Saudi Aramco, Gilead Sciences, Uber, UBS, Enel, Occidental, KKR, Engie, Coupang, Devon Energy, Klaviyo, Planet Fitness, Cava

Wednesday November 8

- Data: US September wholesale trade sales, Japan October bank lending, September trade balance, leading index, coincident index, current account balance, Italy September retail sales, France September trade balance, current account balance, Eurozone September retail sales, Canada September building permits

- Central banks: BoJ Summary of Opinions, ECB Consumer Expectations Survey, ECB’s Wunsch, Kazaks, Vujcic, Makhlouf, Lane and De Cos speak, BoE’s Bailey speaks, BoC Summary of Deliberations

- Earnings: Walt Disney, Airbus, ARM, Bayer, Biogen, Corteva, adidas, Warner Bros Discovery, Take-Two Interactive, Telefonica, Vestas, Roblox, MGM Resorts, Endeavor, Maplebear, Affirm, Viasat

Thursday November 9

- Data: US initial jobless claims, China October CPI, PPI, Japan October M2, M3, Economy Watchers Survey, France Q3 wages

- Central banks: Fed’s Powell, Barkin, Paese and Bostic speak, ECB’s Lagarde, Villeroy and Lane speak, BoE’s Pill speaks

- Earnings: AstraZeneca, Deutsche Telekom, Sony, Petroleo Brasileiro, Merck KGaA, Brookfield, ArcelorMittal, Illumina, Rheinmetall, Grab, Leonardo, Telecom Italia

Friday November 10

- Data: US November University of Michigan consumer survey, October monthly budget statement, UK Q3 GDP, September monthly GDP, trade balance, industrial production, index of services, construction output, Italy September industrial production

- Central banks: Fed’s Logan and Bostic speak, ECB’s Nagel speaks

- Earnings: Allianz, Tokyo Electron

* * *

Finally, here is Goldman preview of the key US events, noting that the key economic data release this week is the University of Michigan’s preliminary consumer sentiment report on Friday. There are several speaking engagements from Fed officials this week, including Chair Powell; governors Cook, Barr, Waller, and Jefferson; and presidents Schmid, Williams, Logan, Bostic, and Barkin.

Monday, November 6

- 11:00 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will discuss financial stability at Duke University. Speech text and a moderated Q&A are expected. On September 22, when discussing the potential impact of AI on the economy and monetary policy, Cook said, “Empirical evidence is still patchy, but there is work showing that generative AI improves productivity in a variety of settings…Any large change in the labor force will generate disruptions and challenges that will need to be addressed to help workers adapt and thrive.”

Tuesday, November 7

- 08:30 AM Trade balance, September (GS -$59.2bn, consensus -$60.0bn, last -$58.3bn)

- 09:15 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will discuss financial technology at the Annual DC Fintech Week hosted at the Fannie Mae headquarters. A moderated Q&A is expected. On October 2, Barr said, “I think it is likely that we are at or very near to the level that is sufficiently restrictive to bringing inflation back to 2% over time…I think we are going to be increasingly focusing on thinking about the path of interest rates over time. I think it is likely that we’ll need to keep rates up for some time in order to get inflation down to 2%. I’m confident that we’ll get there…I strongly agree with what Chair Powell has said about where we are in the tightening cycle. Given how far we have come, we are now at a point where we can proceed carefully.”

- 09:50 AM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeffrey Schmid will deliver opening remarks at an energy conference hosted by the Dallas and Kansas City Fed. A Q&A is not expected. Schmid began his term as president on August 21, 2023.

- 10:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak about using economic data to understand the economy at a St. Louis Fed conference. Speech text and a moderated Q&A are expected. On October 18, Waller said, “I believe we can wait, watch, and see how the economy evolves before making definitive moves on the path of the policy rate…I will be watching how these interest rates evolve in coming months to evaluate their impact on financial conditions and economic activity.” He added, “While there is some basis for expecting that inflation will continue to fall, let me remind you, as I have done repeatedly, that we have seen a string of good inflation reports evaporate multiple times in the recent past. So I will be watching the next several reports for clearer indications that inflation is on a trajectory to 2%…Although the labor market is showing signs of loosening by various metrics, it is still unusually tight. While I anticipate that it will continue to loosen, I will be watching closely to see that this remains true.”

- 12:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion at an event hosted by the Economic Club of New York with the dean of the Wharton School. On October 18, Williams said, “Right now, we need to keep this restrictive stance of policy in place for some time to get inflation down.” Discussing recent inflation data, he added, “We have seen big improvements but we still have a ways to go… I’m not going to declare victory.”

- 01:25 PM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will participate in a fireside chat at an energy conference hosted by the Dallas and Kansas City Feds. A moderated Q&A is expected. On October 9, Logan said, “If term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening to achieve the FOMC’s objectives…If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate. However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more. So, I will be carefully evaluating both economic and financial developments to assess the extent of additional policy firming that may be appropriate to deliver on the FOMC’s mandate.”

Wednesday, November 8

- 05:15 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will discuss financial stability at the Central Bank of Ireland Financial System Conference. Speech text and a moderated Q&A with the audience are expected.

- 09:15 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will deliver opening remarks at the Fed’s Division of Research and Statistics Centennial Conference. Speech text is expected, but a Q&A is not. We saw the November FOMC statement and Powell’s press conference as slightly dovish overall, for three reasons. First, the FOMC statement acknowledged the recent tightening in financial conditions, and Chair Powell laid out conditions that seem likely to be met under which the tightening would displace the need to hike. Second, Powell clarified that above-potential growth on its own would not be enough to warrant another rate hike and added that potential growth is currently higher than usual because labor force growth is elevated. Third, Powell downplayed the 1pp jump in one-year Michigan inflation expectations, a somewhat concerning recent data point, and said, “it’s just clear that inflation expectations are in a good place.” In response to a question about the plan for balance sheet normalization, Powell said that the FOMC is not talking about or considering changing the pace of runoff and that “it’s hard to make a case that reserves are even close to scarce at this point.”

- 10:00 AM Wholesale inventories, September final (consensus flat, last flat)

- 02:00 PM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will discuss the Community Reinvestment Act at the National Association of Affordable Housing Lenders annual conference. A moderated Q&A is expected.

- 04:45 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will deliver closing remarks at the Fed’s Division of Research and Statistics Centennial Conference. Speech text is expected. On October 9, Jefferson said, “My view is that the FOMC is in a position to proceed carefully in assessing the extent of any additional policy firming that may be necessary.” He added, “I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy.”

Thursday, November 9

- 08:30 AM Initial jobless claims, week ended November 4 (GS 215k, consensus 220k, last 217k); Continuing jobless claims, week ended October 28 (GS 1,835k, consensus 1,830k, last 1,818k): We expect continuing claims to trend up because of residual seasonality, as we estimate seasonal distortions will exert a cumulative boost of 375k to the level of continuing claims by March.

- 09:30 AM Atlanta Fed President Bostic (FOMC non-voter) and Richmond Fed President Barkin (FOMC non-voter) speak: Atlanta Fed President Raphael Bostic and Richmond Fed President Tom Barkin will participate in a fireside chat at the Atlanta Fed’s New Orleans branch about the importance of surveys and how survey data inform their economic outlook and policy views. A moderated Q&A with audience participation is expected. On November 3, Bostic said, “Today, my outlook is that we’re going to stay on that slow and steady and if we continue to do that then I think where we are now will be sufficiently restrictive to get us to the 2% level for inflation.” He added, “We’re going to be in sort of slow, steady growth that is methodical” in 2024. Asked when the FOMC might cut the fed funds rate, he said, “That’s down the road…We can’t wait until we are exactly at 2% to start reducing rates. It has got to be before that.” Finally, asked how long it would take to get inflation down to target: “I would say it’s going to be in the second half of next year.” Barkin said, speaking to the payrolls report on November 3, “What we saw today was data that showed a gradual lessening of the job market. I think that’s what those who would like to not see another rate hike would want to see. We’ll see what inflation comes in.” He added, “What I’ve been hearing is normalizing” and that the labor market is coming into “better balance…Supply has been getting better, demand’s coming off, particularly in places like professionals. It’s still hot in skilled trades…the gradual lessening that we’ve been expecting is continuing.” Asked about future fed funds rate moves, he said, “I don’t prejudge…We just got out of the last meeting.”

- 12:00 PM St. Louis Fed Interim President Paese (FOMC non-voter) speaks: St. Louis Fed Interim President Kathleen O’Neill Paese will discuss the economy and monetary policy. Speech text and a moderated Q&A are expected.

- 02:00 PM Fed Chair Powell speaks: Fed Chair Jerome Powell will participate in a panel discussion on monetary policy challenges in a global economy at the IMF’s annual research conference. A moderated Q&A is expected.

Friday, November 10

- 07:30 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will speak at the European Central Bank’s conference on money markets. Speech text and a Q&A with audience are expected.

- 09:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak to the Mobile Chamber of Commerce about economic mobility and challenges in the community. A Q&A with audience participation is expected.

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 63.5, consensus 63.5, last 63.8): University of Michigan 5-10-year inflation expectations, November preliminary (GS 2.9%, last 3.0%)

Source: DB, BofA, Goldman,

Tyler Durden

Mon, 11/06/2023 – 09:51

via ZeroHedge News https://ift.tt/OakEhI5 Tyler Durden