Russell 2000 & Regional Banks Slammed As Yields & Crude Rebound

No US macro data today… and no World War 3 over the weekend… provided some early support for US equity futures but the cash open prompted growth over value purge (as small caps were clubbed like a baby seal and Nasdaq saw a modest bid)…

Source: Bloomberg

By the close, Russell 2000 was ugly while the rest of the majors found support around unch (with Nasdaq outperforming). There was a mini-melt-up in the last minute of the day….

One thing of note was that around 1300ET, a large sell program hit the market…

Source: Bloomberg

Small Caps reversed at their 50DMA (while the rest of the majors pushed above that level from Friday but couldn’t extend gains)…

Cyclicals underperformed Defensives today…

Source: Bloomberg

‘Most Shorted’ stocks were hammered all day as no squeeze was engineered…

Source: Bloomberg

Regional Banks gave back about half of ‘guru’ Gross’ gains from Friday…

But while stocks managed to cling to gains, bonds did not…

Source: Bloomberg

Yields were higher across the curve with the short-end underperforming (2Y +10bps, 30Y +6bps) BUT we note that the corporate bond calendar was relatively heavy today and likely drove the longer-end higher at least in some part…

Source: Bloomberg

The 10Y yield erased all of Friday’s post-payrolls plunge…

Source: Bloomberg

Notably, the 10Y Yield found support at its 50DMA on Friday and extended that today…

Source: Bloomberg

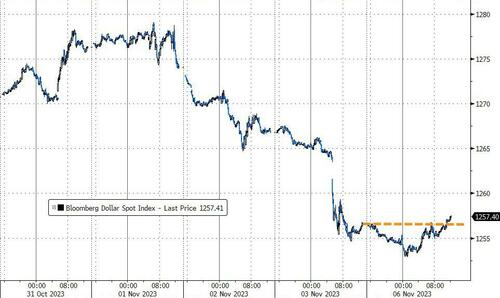

The dollar ended basically unchanged after weakness overnight was bid back during the US day session…

Source: Bloomberg

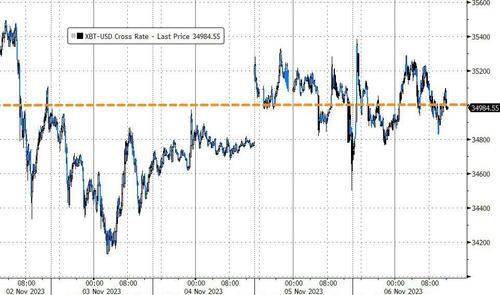

Bitcoin was marginally higher on the day, hovering around $35,000…

Source: Bloomberg

Gold leaked lower with futures unable to bounce back above $2000…

Oil managed to hold on to overnight gains, even as selling pressure pushed WTI back below $81 in the afternoon…

Finally, as we have detailed numerous times in the last week – be careful what you wish for when it comes to ‘tightening financial conditions’. As Bloomberg’s John Authers wrote this morning, monetary policy, Powell has reminded us, works through tightening financial conditions and deterring economic activity. That takes time to work its way through the system. Or, in the words of Milton Friedman, it has a lag. Of late, Powell has been emphasizing the work that tighter conditions – principally the higher 10-year yield – are doing for the Fed. That cheered many by suggesting that higher rates wouldn’t be necessary, and that’s probably been confirmed by the events of last week.

However, as we have highlighted, various problems remain as if it’s the market that has made conditions tighter, it follows that it can also make them looser. Buying things like credit because tight conditions mean there will be no more rate hikes is self-defeating, as it loosens conditions again.

As the Goldman Sachs financial conditions index (defined by its inventors as a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP), shows, conditions were as tight as they had been all year to start last week, and since then they’ve dropped more than half of the way toward neutral…

Source: Bloomberg

Authers echoes our views perfectly, this is a classic example of what the financier George Soros calls “reflexivity” – the capacity of markets to create their own reality, and not just reflect an external state of affairs.

In fact, the more dovish The Fed sounds (or not hawkish) and the more it mentions the market “doing its job for it via tightening financial conditions”, the more The Fed will be forced to step back into the hawkish mud and slow the market’s exuberance for fear of reigniting asset inflation (as well as ‘real’ inflation).

This is key now as, amid an avalanche of FedSpeak this week, the main speaker is Powell at the IMF conference on Thursday. Last Wednesday he talked about tighter financial conditions doing some of the Fed’s work for them. After the huge 60/40 rally since, will he still feel the same way by Thursday?

Tyler Durden

Mon, 11/06/2023 – 16:00

via ZeroHedge News https://ift.tt/oAdDHxj Tyler Durden