Bullion & Black Gold Breakdown As Loosening Financial Conditions Foil Fed’s Plan

As earnings season winds down and macro catalysts are scarce (Fed Chair Powell said nothing at all today on monetary policy… but speaks again tomorrow), so Treasury yields drifted lower and stocks struggled (led by banks and energy).

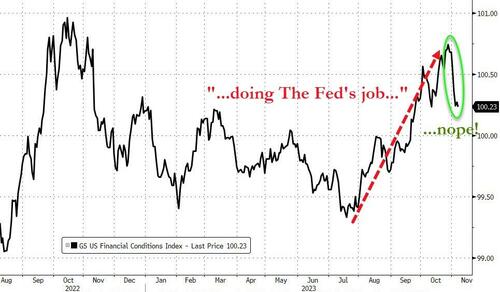

The reflexive (loosening) reversal in financial conditions, since The Fed bragged about the market doing its (tightening) job for them has been significant to say the least – erasing, according to Goldman, around 50bps of the 100bps implied rate-hikes that the Q3 tightening created…

Interesting, ‘hard’ data has fallen along with the tighter financial conditions…

Source: Bloomberg

…but ‘soft’ survey data has ignore the tightening financial conditions…

Source: Bloomberg

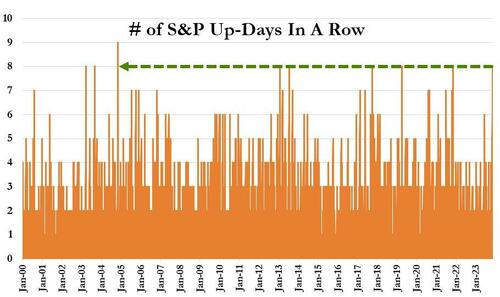

Small Caps were clubbed like a baby seal again. The Dow ended red as The S&P and Nasdaq battled it out for a green close and their 8th and 9th up-day in a row respectively…

The Nasdaq rose 10 days in a row in Nov 2021, but the S&P hasn’t risen for 9 days in a row (which it would do if green tomorrow) since 2004…

Eli Lilly’s FDA approval for its Tirzepatide GLP-1 analog drug for obesity treatment sent Obesity-based stocks higher at the expense of restaurants and gyms etc…

Source: Bloomberg

Regional banks were battered once again (after yesterday’s FHLB news)…

Treasuries were mixed today with the long-end outperforming once again (30Y -9bps, 2Y +2bps). On the week, the long-end is the big winner (-13bps) while the short-end is the only segment of the curve higher in yield (2Y +10bps, 5Y +1bps)…

Source: Bloomberg

Having dis-inverted, the yield curve (2s30s) tumbled back to one-month lows…

Source: Bloomberg

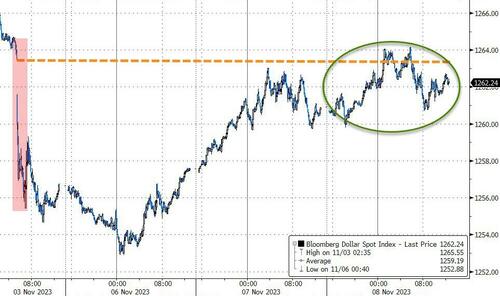

The dollar went nowhere today, hovering at those pre-payrolls-plunge highs…

Source: Bloomberg

For the second day in a row, Bitcoin jumped higher around 1130ET, but couldn’t hold the gains…

Source: Bloomberg

Gold prices continued to drift lower, but remain well off their pre-Israel lows…

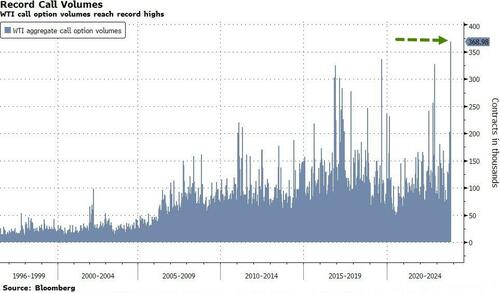

Crude prices crashed to near 4-month-lows with WTI tagging a $74 handle intraday…

Is crude following tightening financial conditions with a two-month lag?

Source: Bloomberg

Or was yesterday’s record call option volume a sign of the bottom getting close?

Source: Bloomberg

Finally, liquidity in the crucially-important US Treasury market remains very poor – at its worst since 2010…

Source: Bloomberg

The last time liquidity was this bad – in March 2020 – The Fed unleashed its largest money-drop ever.

And in light of that liquidity crisis, is it any wonder that Warren Buffett is holding his drypowder.

Since the pandemic first struck, the conglomerate’s holdings of cash have declined, but its holdings of T-bills have soared past $126 billion to a record. Wondering why he is not snapping up those ‘cheap’ stocks you keep hearing about on TV?

Simple – according to his favorite indicator, stocks are only back to the same level of ‘expensive’ as they were at the peak of the dotcom bubble…

Source: Bloomberg

As Buffett once remarked, “Our stay-put behavior reflects our view that the stock market serves as a relocation center at which money is moved from the active to the patient.”

Tyler Durden

Wed, 11/08/2023 – 16:00

via ZeroHedge News https://ift.tt/8bHBj9X Tyler Durden