EU Could Ban Russian Diamonds As Soon As Next Week

Although Russia’s economy has not collapsed under Western sanctions, the European Union is preparing to unveil another round of sanctions, focusing on Moscow’s diamond exports, potentially as early as next week.

At the G7 foreign ministers’ meeting in Japan, EU’s top diplomat, Josep Borrell, told the Financial Times that the EU has secured enough backing from G7 countries on the new ban, as well as support from Belgium – one of the world’s leading diamond traders.

“In order for [EU] member states to be unanimous for the ban on diamond trade, some were requesting that the G7 were giving, let’s say, political coverage,” said Borrell.

He added: “Well, this has been done and the co-ordination has worked and we will be able to put the package of sanctions in front of [foreign ministers on Monday. “

Borrell said the foreign ministers of Canada, France, Germany, Italy, Japan, the UK, and the US have agreed to “reduce the revenues Russia extracts from exports” and cited “non-industrial diamonds, including those mined.”

There was chatter among G7 leaders in May about restricting the Russian diamond trade, as well as in September when Belgian officials told reporters the new trade restriction would go into effect on Jan. 1.

Last year, Russian mining giant Alrosa PJSC’s diamonds were still flowing onto global markets despite the US Department of the Treasury’s Office of Foreign Assets Control hitting the company with sanctions.

Before the Russian invasion of Ukraine, Anglo American Plc’s De Beers and Alrosa PJSC accounted for nearly 60% of all rough diamond sales worldwide, with De Beers accounting for 33% and Alrosa for 24%.

De Beers recently said the diamond industry supports the West’s efforts against Russia:

“The question is how we can do this collectively and effectively so that all parts of the industry – large and small – are represented.”

The challenging part will be getting India, the mecca of diamond cutting and polishing, on board with trade restrictions.

According to trade data, Russia is the largest producer of rough diamonds, exporting more than $4 billion.

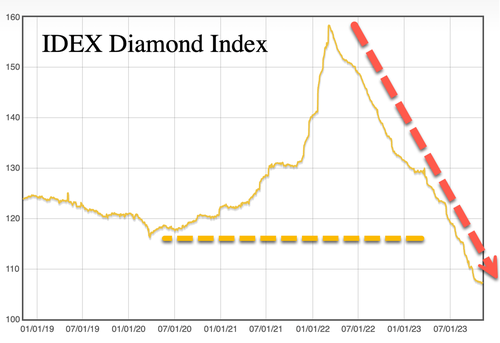

This comes when lab-grown diamonds are flooding the market, and consumer luxury demand is waning, resulting in a crash in diamond prices.

De Beers reported today that October’s diamond sale was only $80 million – compared with the same month last year of $454 million. Last month’s sale was the worst since the early days of the pandemic.

Should the EU proceed with sanctions on Russian diamonds, they could transform rough diamond supply chains worldwide overnight.

Tyler Durden

Thu, 11/09/2023 – 05:45

via ZeroHedge News https://ift.tt/81fBWHA Tyler Durden