Bitcoin ‘Supply’ Tightens As ‘Tsunami’ Of Institutional-Demand Looms

Enthusiasm towards spot ETF approvals (and what that means for wider adoption) has prompted a resurgence in demand for cryptocurrencies with Bitcoin and Ethereum soaring this week.

Bitcoin has erased all the losses from the Terra stablecoin crisis…

Source: Bloomberg

And Ethereum is back above $2,000, outperforming bitcoin this week…

Source: Bloomberg

…after the ETH/BTC cross found critical support…

Source: Bloomberg

Financial institutions have been relatively slow to get into digital asset markets. But, as regulatory clarity improves, that’s about to change according to many industry participants.

“2024 literally is going to be a year of institutional adoption, primarily first through the Bitcoin ETF, which will be followed by an Ethereum ETF,” Galaxy Digital founder Mike Novogratz said during the Q3 earnings call.

“As institutions get more comfortable, if the government gives its seal of approval that Bitcoin is a thing, you are going to see the rest of allocators starting to look at things outside of that. And so, money will flow into the space.”

According to Novogratz, a Bitcoin ETF will bring a measure of institutional confidence and a significant amount of funding to the cryptocurrency space.

“This ETF is giving us all breathing space, putting life in the system. That brings in capital that allows the rest of the stuff to flourish. But I think if you look at the crypto long-term plan, it’s on target,” he added.

Interestingly, as CoinTelegraph reports, the potential influence of an Ether spot ETF was also brought up during the investor call. Galaxy Digital’s CEO said its possible approval might not be as well received as a Bitcoin ETF, given that Ethereum’s validating model is based on a staking model and staking yields.

“Unless they can figure out an ETF that actually passes through the staking rewards, it will be kind of a subpar product from just owning Ethereum with someone like us and having it staked,” Novogratz explained.

Novogratz is already seeing confirmation of his views on adoption as institutional buying appears to have started as we highlighted Goldman Sachs Crypto team’s recent comments yesterday: initial market data suggests that market activity was heavily institutional with four main indicators:

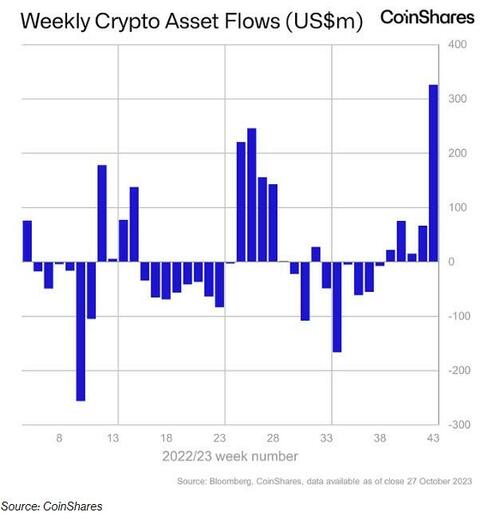

1. In October, we saw approximately $437m of inflows into BTC exchange – traded products (Bloomberg). On a weekly basis, BTC-based digital asset investment products led the largest single-week inflows into crypto funds since July 2022, for the week ending 27 Oct 2023. BTC-based funds accounted for 90% of the total crypto fund inflows, totaling $296m ( Bloomberg ).

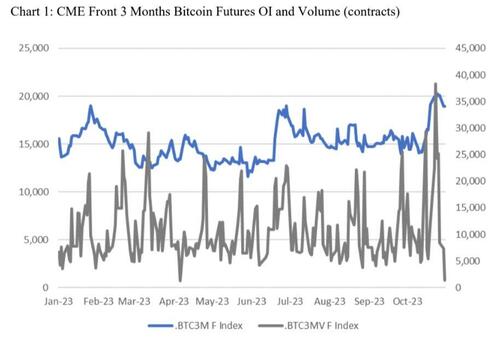

2. Most noticeable change was on CME, where Bitcoin futures open interest notched to an all-time high of 20,369 contracts on 25 Oct 2023 ( CME Group ), and 6 of the top 10 open interest days for bitcoin futures occurred between 20 and 27 Oct 2023. Total open interest on CME hit $3.58b on 30 Oct 2023. In October, CME surpassed the 100k BTC mark for the first time, overtaking Bybit and OKX to rank second behind only Binance ( CoinDesk ) among exchanges offering standard Bitcoin futures and perpetual futures. The daily traded volume for the front 3 – month expiries on CME also notched a YTD high of 25,185 contracts on 25 Oct 2023.

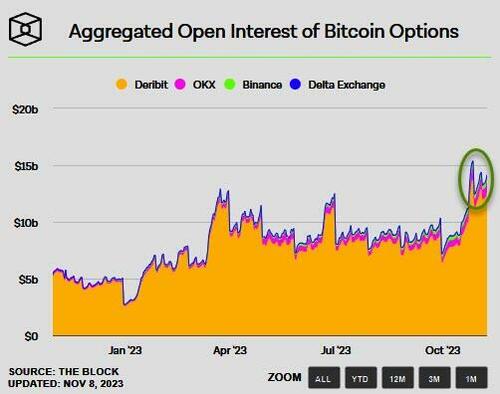

3. In addition, the open interest across BTC options also reached an all – time high of $15.4b on 27 Oct 2023 ( The Block Data )

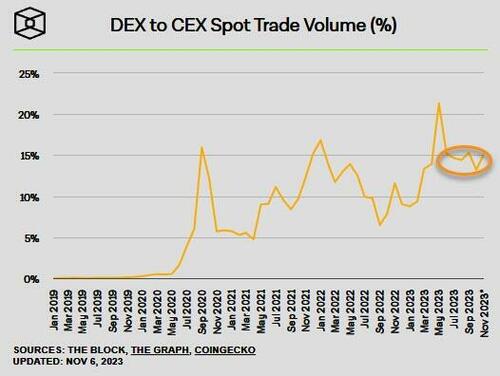

4. On – chain activity remains muted relative to rest of the year, with daily active address count of 1.1m (vs 950k addresses (annual average in 2023) ( Coinmetrics ) and DEX to CEX spot trade volume at 13% (vs May’23 21%) ( The Block Data ).

Novogratz and Goldman are not alone.

Dan Tapiero, founder and CEO of 10T Holdings, expects a “torrent” of institutional inflows in the run-up to a US ETF approval.

“Now begins the renewed drumbeat of ‘institutional adoption’ of Bitcoin,” he announced on Nov. 10.

“Real facts driving idea now rather than hope. As CME btc futures open interest surpasses Binance in the #1 spot. Torrent of capital from the traditional world about to hit.”

At the same as the demand-side of the crypto space looks to be accelerating, the supply-side is tightening.

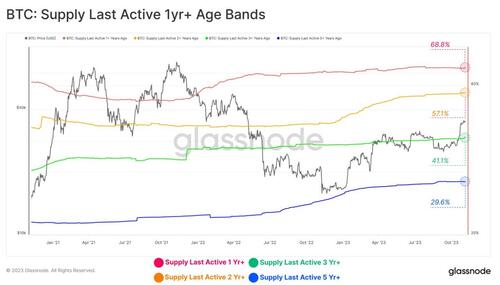

As The Block reports, the circulating supply of bitcoin is historically tight, with coins held by long-term investors at an all-time high, according to Glassnode data.

The data found that existing bitcoin investors are becoming increasingly unwilling to part with their holdings, with analysts at Glassnode observing “impressive rates of accumulation taking place.”

“The bitcoin supply is quite tight with several measures of supply such as illiquid supply, coins HODLed, and long-term holder supply at historical highs,” Glassnode analysts said in a note shared with The Block.

Additionally, Glasnode analysts highlighted the that “The illiquid supply metric, which measures the amount of supply held in wallets with minimal history of spending is also at an all-time high of 15.4 million bitcoin”…

The analysts added that the spending behavior of short-term bitcoin holders has changed following BTC’s rally above the key $30,000 level.

“The recent rally suggests that a shift in market character has taken place now that the market has rallied above the key $30,000 level. Analysis of investor cost basis for various cohorts suggests that this $30,000 level is an important zone of interest for the bulls,” the Glassnode analysis said.

Finally, circling back to demand, Erik Anderson, Global X’s Senior Digital Assets Research Analyst, concludes in a recent op-ed at CoinDesk: While institutional allocations to crypto have faced myriad roadblocks through the years, the foundation being laid today signals a shift in the winds. Incremental gains on the regulatory front, maturing market infrastructure, a growing number of institutionally viable investment vehicles, and a deeper understanding of the value of crypto-assets are all leading institutional investors to take a fresh look, promising a potentially transformative crypto landscape ahead.

Tyler Durden

Fri, 11/10/2023 – 12:05

via ZeroHedge News https://ift.tt/BMfvLlW Tyler Durden