Futures, Bonds Gain After Powell-Inspired Rout

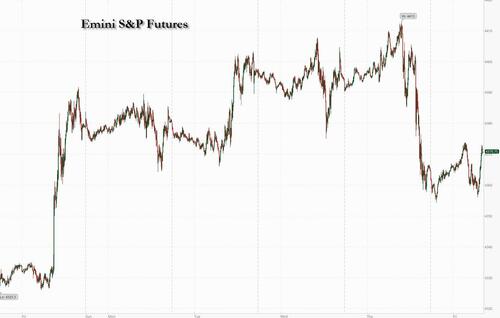

Just when it seemed that stocks were about to go on a 9-day winning streak, Fed chair Jerome Powell opened his mouth, said to shut the “fucking door“, and crashed stonks (the catastrophic 30Y auction just minutes earlier didn’t help) ending what would have been the longest streak since 2004.

And on to Friday morning, where after yesterday’s rout, stocks and bonds rebounded modestly even as investors speculated that more central bank speakers today will echo the hawkish message from Powell. As of 8:00am, S&P futures rose 0.25% to 4,373, rising off the worst levels of the day, while Nasdaq futures gained 0.1%; meanwhile in Europe the Stoxx 600 shed 1%, reinforced by poor earnings reports. The dollar is little changed while Treasury yields are marginally higher across the curve; energy outperforms with WTI futures up about 1% on the day

In premarket trading, energy shares rose along with oil, with West Texas Intermediate climbing back above $76 a barrel. Digital advertising firm Trade Desk slumped as much as 31% in out-of-hours trading in New York after issuing a weak sales guidance, which it blamed on broader economic pressures. And watch casino stocks after their shares had a terrible day in Hong Kong. Here are the other notable premarket movers:

- Blink Charging Co. shares rose 14% after the company revised FY 2023 sales higher. The company reported EPS below estimates and sales above estimates.

- Groupon shares slumped 32% after the firm reported adjusted loss per share for the third quarter that missed the average analyst estimate. Eric Lefkofsky, a co-founder of the company, informed the firm of his decision to resign as a member of the Board effective Nov. 9.

- Illumina shares slump 12% after the DNA-sequencing company cut its full-year revenue guidance. The company also reported third-quarter product revenue that missed estimates. Canaccord Genuity downgraded its recommendation on the stock to hold, saying the near-term outlook appeared “soft.”

- Plug Power shares fell 29% after the company, which makes machines that produce hydrogen and use it as a fuel, flagged going concern warnings after reporting a weak 3Q. RBC Capital Markets downgraded to sector perform from outperform, citing limited visibility and margin pressures.

- Toast shares edge higher, up 2.0%, as Baird raises its recommendation on the restaurant-software company’s stock to outperform from neutral. The broker says the upgrade comes after the stock has fallen nearly 50% from mid-year highs.

- Trade Desk shares plummet 27% after the advertising technology company gave a fourth-quarter forecast that was weaker than expected for both revenue and adjusted Ebitda. Analysts cut price targets noting that the weak guidance overshadowed an otherwise strong quarter.

- Unity Software shares fall 13% after the video-game tool maker reported third-quarter revenue that missed expectations. It also said it had started a “comprehensive assessment of our product portfolio,” and that as a result it would not be giving an outlook.

- Wynn Resorts shares dropped 5.2% after the casino operator reported third-quarter Macau adjusted property Ebitdar that missed estimates. While the company performed well in Las Vegas, analysts focused on Macau, with Barclays saying the margins and commentary were disappointing.

“Powell’s speech was a sort of a talk-tough moment as central banks have to convince the market there will be no pivot coming tomorrow morning,” said Erick Muller, head of product and investment strategy at Muzinich & Co. in London. “Each time they see markets pricing too many rate cuts, you will hear this kind of speech saying, ‘stop right there’.”

Investors are now waiting to hear from ECB President Christine Lagarde, who will participate in a fireside chat later on Thursday. Comments are also due from from Dallas Fed President Lorie Logan, her Atlanta counterpart Raphael Bostic and San Francisco Fed’s Mary Daly. Markets were rattled yesterday after Powell said officials won’t hesitate to tighten if needed

European bonds and stocks are both in the red, tracking losses in their US counterparts on Thursday after hawkish comments by Fed Chair Powell and a soft 30-year bond auction. The Stoxx 600 is down 1% and set for its largest one-day drop in three weeks. Consumer product, food/beverage and mining shares are leading declines. Diageo plunged 16% after the UK distiller cut its profit outlook and Richemont lost 6.8% as revenue from luxury watches unexpectedly fell. There was a brief glitch in the updating of FTSE Russell indexes overnight in the UK, Italy and South Africa, which was fixed after about 38 minutes. Here are the most notable European movers:

- Allianz shares rise as much as 2.3% after the German insurer reported third quarter operating profit that beat the average analyst estimate, with Jefferies “pleasantly” surprised by the results

- GN Store Nord shares jump as much as 14%, the most since April 27, after the Danish hearing-aids maker reported results for the third quarter, narrowed its organic revenue forecast for the year and announced new cost savings

- OTP Bank shares climb as much as 2.3% after Budapest-based lender reported a third-quarter income beat thanks mainly to its profitable subsidiaries outside Hungary

- Mol shares climb as much as 1.2% after Hungary-based refiner raised its 2023 guidance for Clean CCS Ebitda after third-quarter beat estimates

- JCDecaux shares rise as much as 5.1% after the outdoor advertising company reported better-than-expected organic revenue growth in 3Q

- IMCD rises as much 5.1% after nine-month revenue came in lower than the prior year but KBC says the decline was a “modest” 1% in constant currency terms

- Bpost rises as much as 6.1% after the postal company reported third-quarter adjusted Ebit that beat estimates and reinstated its full-year earnings outlook after market hours on Thursday

- Valneva shares rise as much as 14% in Paris, the most since June 20, after the US FDA approved the French biotechnology firm’s chikungunya vaccine

- Diageo shares slide as much as 12%, the biggest intraday decline since 1997, after the alcoholic beverage company warned on profit, citing a “materially weaker” performance in Latin America and Caribbean

- Richemont dropped by as much as 5.3%, dragging European luxury stocks sharply lower, after the Swiss group reported an unexpected drop in earnings due to declining sales for its watches and faced adverse currency effects

- Shurgard falls as much as 6.4% after an offering of up to 8.16m new shares priced at €36.75 apiece, representing a 7% discount to last close

- Stabilus shares fall as much as 5.2%, the most since May. The German machinery manufacturer’s fresh guidance and Ebit margin for the full year looked “a bit conservative,” according to Oddo

Earlier in the session, Asian stocks declined as disappointing earnings hit Chinese and Japanese stocks along with a jump in Treasury yields after cautious comments by Federal Reserve Chair Jerome Powell. The MSCI Asia Pacific Index fell as much as 1.1%, erasing its gain for the week, with Chinese internet giants Alibaba and Tencent among the biggest drags. Japan’s SoftBank and Sony also weighed on the gauge after their results missed expectations. All major markets in the region were in the red Friday.

- Hong Kong benchmarks were the biggest decliners after after weak profit reports from chipmaker SMIC and casino operator Wynn Macau, while a cyberattack on China’s largest lender ICBC also weighed on sentiment. A report this week showed the Chinese economy has tipped back into deflation, exacerbating concerns over the fragility of the economic recovery.

- Australia’s ASX 200 initially saw the shallowest losses among the majors as the RBA’s SoMP suggested the economy had been a bit stronger than previously thought, while sectoral losses were led by Tech, Financials, and Energy although Metal and Mining bucked the trend.

- Japan’s Nikkei 225 was dragged lower by hefty post-earnings losses in Nissan, Sony, and Softbank, which were all lower by 3-6%, although the index later clambered off worst levels and rose back above 32,500.

- Indian stocks posted a late recovery to end higher, outperforming most Asian peers that fell on lackluster earnings from Chinese firms and hawkish comments from Fed Chair Powell.

In FX, the Bloomberg Dollar Spot Index is little changed. The pound falls 0.1% after showing little reaction to a slight beat for UK GDP. The Norwegian krone is the best performer, rising 0.7% versus the greenback after data showed inflation accelerated in October. A four-day rally in the Bloomberg Dollar Spot Index stalled as traders weighed the outlook for Fed policy and higher US yields. The gauge had gained 0.9% in the past four days as yield on policy-sensitive Treasury two-year notes rose 18 basis points. Traders now await the October US inflation data due on Tuesday. “The CPI next week will be the key driver for the dollar” following Powell’s comments, said Mingze Wu, a foreign-exchange trader at StoneX Group in Singapore. “The market is adjusting itself without any further inputs from Fed”

In rates, treasuries were narrowly mixed across the curve, broadly holding losses spurred Thursday by poor 30-year bond auction and hawkish Powell comments. Long-end underperforms, causing another bounce by 5s30s spread off 10bp level that’s been flagged as key support and a pain threshold for steepener positions. US yields are within 3bp of Thursday’s closing levels with long-end lagging slightly; 10-year TSYs dropped to 4.60% with bunds and gilts lagging by 7.5bp and 6bp in the sector, narrowing gaps that opened as Treasuries slumped toward the end of the US trading day. German 10-year yields rose 8bps while the UK equivalent adds 7bps. The dollar IG issuance slate empty so far; only one deal priced Thursday, taking weekly volumes above $43b; dealers’ forecast was for about $40b. US economic data scheduled for the session includes November preliminary University of Michigan sentiment at 10am

In commodities, crude prices advance, with WTI rising 1% to trade near $76.50. Spot gold falls 0.3%. Gold dropped 0.3%. The metal is set for a second weekly drop after fears eased that the Israel-Hamas conflict will broaden into a region-wide war.

Bitcoin extended recent gains, rising above $37,000 but it was Ethereum that stole the show suring above $2,100 after BlackRock’s Ethereum ETF plan was confirmed in a Nasdaq filing, according to CoinDesk.

Looking to the day ahead now, and data releases include UK GDP for Q3, Italian industrial production for September, and the University of Michigan’s preliminary consumer sentiment index for November. Otherwise, central bank speakers include ECB President Lagarde, Bundesbank President Nagel, and the Fed’s Logan and Bostic.

Market Snapshot

- S&P 500 futures up 0.3% at 4,374

- STOXX Europe 600 down 0.8% to 444.21

- MXAP down 0.9% to 155.80

- MXAPJ down 1.2% to 486.33

- Nikkei down 0.2% to 32,568.11

- Topix little changed at 2,336.72

- Hang Seng Index down 1.8% to 17,203.26

- Shanghai Composite down 0.5% to 3,038.97

- Sensex little changed at 64,886.09

- Australia S&P/ASX 200 down 0.5% to 6,976.49

- Kospi down 0.7% to 2,409.66

- German 10Y yield little changed at 2.72%

- Euro little changed at $1.0667

- Brent Futures up 0.8% to $80.65/bbl

- Gold spot down 0.2% to $1,954.02

- U.S. Dollar Index little changed at 105.94

Top Overnight News

- The UK economy flatlined in the third quarter, defying forecasts of a small contraction and ensuring a recession is avoided this year, as strong trade came to the rescue of poor domestic activity.

- On Thursday, trades handled by the world’s largest bank in the globe’s biggest market traversed Manhattan on a USB stick. Industrial & Commercial Bank of China Ltd.’s US unit had been hit by a cyberattack, rendering it unable to clear swathes of US Treasury trades after entities responsible for settling the transactions swiftly disconnected from the stricken systems.

- One of the most high-profile blockchain systems in traditional banking has added a new feature that lets companies shift cash automatically. JPMorgan Chase & Co’s JPM Coin now allows clients to program their accounts by plugging in a set of key conditions, enabling them to move funds to cover overdue payments and margin calls.

More detailed look at global markets courtesy of Newsquawk

APAC stocks traded lower across the board as the downbeat sentiment from Wall Street reverberated to the region following the poor 30-year US auction coupled with Powell’s hawkish lean, whilst the APAC region itself digested earnings and China’s ongoing woes. ASX 200 initially saw the shallowest losses among the majors as the RBA’s SoMP suggested the economy had been a bit stronger than previously thought, while sectoral losses were led by Tech, Financials, and Energy although Metal and Mining bucked the trend. Nikkei 225 was dragged lower by hefty post-earnings losses in Nissan, Sony, and Softbank, which were all lower by 3-6%, although the index later clambered off worst levels and rose back above 32,500. Hang Seng and Shanghai Comp conformed to the tone but Hong Kong was the regional underperformer with Tech and Financials, among the biggest losers.

Top Asian News

- A ransomware attack on the Industrial and Commercial Bank of China has disrupted the US Treasury market by stopping China’s largest bank from settling Treasury trades, according to market participants cited by FT. SIFMA told members on Thursday that ICBC had been hit by ransomware software. The attack prevented ICBC from settling Treasury trades on behalf of other market participants. ICBC (1398 HK) Financial Services confirmed they experienced a ransomware attack that resulted in disruption to certain FS systems, according to Reuters.

- PBoC Governor said they are closely watching financial risks in some sectors; some provinces are facing a certain degree of debt risks and the central government is paying high attention to the matter, via state media

- PBoC policy adviser said China is able to achieve slightly above 5% GDP growth this year; consumption recovery still remains weak; fiscal deficit ratio can be raised next year. China’s exports are still expected to face relatively big pressure next year. Weak external demand and inadequate domestic demand increase overcapacity pressure in China, according to Reuters.

- China Vice Premier He Lifeng said the important task for the meeting with US Treasury Secretary Yellen is to implement tasks from US President Biden and Chinese President Xi. He added talks with Yellen have been constructive, and will communicate China’s concerns about their economic and investment relationship with the US. Looking for effective measures to put US-China economic and trade relations back on track, according to Reuters.

- Country Garden Holdings (2007 HK) reportedly aims to inform key bondholders of its cash flow projections by year-end, according to Reuters sources; aims for a tentative plan to restructure offshore debt by year-end, and aims to start formal negotiations with offshore bondholders by February or March next year, sources added.

- PBoC injected CNY 203bln via 7-day reverse repos with the rate at 1.80% for a CNY 160bln net daily injection.

- Japanese government to top up fiscal loan and investment program with additional JYP 886bln in a second extra budget to beef up supply chain, according to a draft cited by Reuters.

- Japan mulls a 5%+ wage hike as a condition for tax breaks, via Sankei.

- BoJ is to conduct broad-based survey of companies behaviour since mid-90’s; to be conducted between Nov’23-Feb’24 as part of its long term monetary policy review.

- RBA SoMP: considered the option to continue to hold policy rates steady but decided a hike would provide more assurance on inflation; Whether further tightening of monetary policy will depend on data. Click here for the full headline.

- New Zealand PM Hipkins said the Governor General will be advised to extend current caretaker government arrangements until a new government is formed, according to Reuters.

European bourses reside in the red, Euro Stoxx 50 -0.8%, though the region is on track to end the week around the unchanged mark overall. Action which comes as a continuation of the post-Powell/auction hit to sentiment experienced in Thursday’s US session. Sectors are primarily softer with Food, Beverage & Tobacco hit as Diageo cuts guidance, Consumer Products/Services sold post-Richemont while Real Estate slips on SBB and Redrow. Energy bucks the trend and is modestly firmer as benchmarks attempt to once again recoup from recent pressure. Stateside, futures are near the unchanged mark within -0.2% to +0.2% parameters with the ES flat and the NQ lagging a touch as US yields inch higher. Ahead, a handful of Fed speakers will be scrutinised for any deviation from the Powell line.

Top European News

- SNB’s Schlegel says a temporary increase in inflation via rent is possible.

- China’s Vice Premier says they are willing to work with the EU to deepen practical cooperation in promoting industrial transformation and upgrades, via State Media; to jointly safeguard supply chain stability.

- Portugal’s president dissolves parliament and calls snap elections, according to dpa. Portugal is to hold an election on March 10, 2024 according to AFR.

- Peru Central Bank cuts reference rate by 25bps to 7.00%, as expected.

FX

- Buck back on a recovery track as Fed Chair Powell underscores lack of confidence about current policy being restrictive enough, DXY edges closer to 106.00 from sub-105.00 w-t-d low.

- Euro and Yen defend semi-psychological 1.0650 and 151.50 marks vs Dollar, Pound keeps afloat of 1.2200 against Greenback post-better than forecast UK GDP metrics.

- Franc pares losses towards 0.9000 as SNB Schlegel highlights the prospect of a blip in inflation on rents, Norwegian Krona rejuvenated by hotter than consensus CPI, core especially.

- PBoC sets USD/CNY mid-point at 7.1771 vs exp. 7. 2963 (prev. 7.1772)

Fixed Income

- Bonds on the brink of a complete round trip from weekly peak to trough after hawkish-leaning Fed soundbites and poor US 30 year auction.

- Bunds, Gilts and T-note all nearer bases of 129.45-130.13, 94.70-95.32 and 107-10+/23 respective ranges.

- BTPs sub-112.00 and digesting Italy’s multi tranche mid-month issuance

Commodities

- A very similar story to Thursday for the crude benchmarks, which are attempting to reclaim the modest ground they gained in the first half of that session before broader sentiment was hit by a poor US auction and Chair Powell.

- WTI Dec’23 and Brent Jan’23 are at the upper-end of USD 75.31-76.49/bbl and USD 79.79-80.86/bbl respectively; however, this leaves the benchmarks around USD 5/bbl shy of their WTD bests and almost USD 20/bbl off the early-October YTD peaks.

- Metals feature contained performance for spot gold, but with a slight negative bias as it eases back towards the WTD trough while base metals are pressured alongside the broader risk tone; XAU is back within relative proximity to the 200- and 100-DMAs of USD 1934/oz and USD 1927/oz respectively.

- Over 60 countries are reportedly backing a deal to triple renewable energy and shift away from coal, according to Reuters citing officials.

Geopolitics

- “The Israeli army announces the cessation of its airstrikes in the Gaza Strip to mitigate civilian casualties”, according to Sky News Arabia.

- Israeli military said it struck a position in Syria in response to Thursday’s drone attack in Eilat, according to Reuters.

- Iranian Foreign Minister said expanding the scope of war has become inevitable with the increase in escalation in Gaza, according to Sky News Arabia.

- China’s Ambassador to the US Feng says US-China relations are still facing severe challenges, and there is still a long way to go to stabilise and improve relations, according to Reuters.

- China Coast Guard, on the Philippines’ resupply mission on Nov 10th, urged the Philippines to immediately stop infringing on China’s sovereignty; Followed the Philippines’ resupply vessels and took control measures, according to Reuters.

- Hungarian PM Orban says the EU must not begin membership discussions with Ukraine, via State Radio.

Market Snapshot

- 10:00: Nov. U. of Mich. Current Conditions, est. 70.3, prior 70.6

- Nov. U. of Mich. Sentiment, est. 63.8, prior 63.8

- Nov. U. of Mich. Expectations, est. 61.0, prior 59.3

- Nov. U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

- Nov. U. of Mich. 1 Yr Inflation, est. 4.0%, prior 4.2%

DB’s Jim Reid concludes the overnight wrap

As we hit the end of another week my 6-yr old twin boys have been asked to play in an under 8s tennis tournament tomorrow. They play a lot on our patio and the longest rally I’ve ever seen (with their bikes as a net) is 3 shots. So unless they go for immediate winners down the line I’m not optimistic of success. Their current football record is one draw and eight losses against other teams so I feel I’m preparing them for life.

Generally this week it’s been a series of winners for a 60/40 portfolio but that came to a shuddering halt last night. Indeed on Tuesday we paraphrased the famous “just as you thought it was safe to buy bonds” line from the Jaws movie. That was a false alarm as longer bonds rallied back again through last week’s yield lows in Asia yesterday morning. However, the sharks have fought back with a vengeance via a bond sell-off that was made worse by a very poor 30yr auction and what was interpreted to be a hawkish Powell speech an hour later at 7pm London time. In short, both 10yr (+13.2bps) and 30yr yields (+15.1bps) saw their largest increases in four weeks, which in turn dragged the S&P 500 (-0.81%) to its first decline in 9 sessions .

While the 3yr and 10yr auctions the previous two days were well digested, the $24bn 30yr auction last night priced at 4.769%, 5.3bps above the indicated pre-sale level. Only one other 30yr auction in the last decade has had a tail around these levels. The bid-cover ratio (at 2.24) and the size of end-investor take up (at 75% vs 82% last month) were at their weakest since late 2021. 10yr and 30yr Treasury yields had already been trading c. 7bps and 11bps higher on the day but roughly doubled that move immediately after the auction (spiking by 9bps and 11bps, respectively). The 30yr yield saw a decent reversal later on but still closed +15.1bps higher on the day. On the other hand, the 10yr largely maintained its move, up +13.2bps to 4.63%, helped by some relatively hawkish comments from Powell an hour later. In Asia this morning, 10 and 30yr yields are around -1.5bps lower.

In remarks at an IMF conference, Fed Chair Powell said that “if it becomes appropriate to tighten policy further, we will not hesitate to do so” and echoed an earlier line that ”we are not confident that we have achieved such a stance” that would ensure inflation returns to 2%. There was some balance within his comments — alluding to two-sided risks and the role that improved supply has played in bringing down inflation – but adding that “going forward, it may be that a greater share of the progress in reducing inflation will have to come from tight monetary policy”. So hawkish comments overall, especially when other Fed speakers had struck a more dovish note earlier in the day. For instance, Atlanta Fed President Bostic said that “I think our policy is restrictive, and likely sufficiently restrictive”. Meanwhile, Richmond Fed President Barkin said that “we are still not seeing the full effects of policy”, and that “I believe there’s a slowdown coming”.

Powell’s comments had a larger impact on the front-end. The likelihood of another rate hike priced by Fed funds futures went up from 17% to 24% on the day, with end-24 pricing up +10.3bps to 4.56%. The 2yr yield was trading +2 to 3bps higher on the day prior to Powell’s speech, but was up +8.7bps to 5.02% at the end, the first time since the end of October that it has closed above 5%.

The moves in yields were also interesting given that there were fresh signs of the labour market softening. That came from the weekly jobless claims data, where continuing claims rose to their highest level since April over the week ending October 28, at 1.834m (vs. 1.820m expected). The initial claims were broadly as expected at 217k over the week ending November 4 (vs. 218k expected) but this still pushed the 4-week average up for a third week running. Our US economists did note in a recent report (here) that the current rise in continuing claims may be exaggerated due to excess seasonality. But even keeping this caveat in mind, their rise in the past 5 weeks (+162k) has outpaced that seen in the same period last year (+137k). So adding to the evidence from last week’s jobs report that several labour market indicators are now steadily weakening.

The spike in yields in the latter part of the US session weighed on what had been a mixed day for equities. The S&P 500 had been on course to narrowly eke out a historic 9th consecutive gain before the 30yr auction, but then fell sharply to close -0.81% lower. The losses were broad-based with the NASDAQ (-0.94%) and Dow Jones (-0.65%) seeing similar declines. The small cap Russell 2000 underperformed (-1.57%), falling for the 4th day in a row. Its -4.17% decline so far this week puts it on course for the worst weekly performance since March.

One of the outperforming assets on the day was cryptocurrencies. Bitcoin (+3.74% to $36,638) rallied to its highest level since 5 May 2022 – just before the collapse of the Terra stablecoin which then prompted a chain of stresses in the crypto space.

Back in Europe, equities outperformed their US counterparts but closed before the late slump, with the STOXX 600 advancing +0.84% on the day, with similar gains for the DAX (+0.81%) and the CAC 40 (+1.13%). Meanwhile, European bonds had seen a more modest rise in yields for the day prior to the US 30yr auction, as those on 10yr bunds (+3.1bps), OATs (+2.8bps) and BTPs (+3.3bps) all moved higher .

In Asia, the Hang Seng (-1.59%) is the biggest underperformer so far while the CSI and the Shanghai Composite are easing -0.69% and -0.45%, respectively, as concerns about the health of the world’s second-biggest economy resurfaced as China’s deflationary pressures worsened in October. Elsewhere, the KOSPI (-0.96%) and the Nikkei (-0.72%) are also losing ground in early trade. S&P 500 (+0.08%) and NASDAQ 100 (-0.02%) futures are fairly flat.

Early morning data showed that New Zealand’s manufacturing sector activity remained in contraction for the eight consecutive month as the NZ manufacturing index dropped to 42.5 in October from 45.1, notching its biggest contraction since August 2021.

Looking back at yesterday’s other data, it was a quiet day in Europe, with the one release of note being Q3 wage growth in France. This came in at +0.5% quarter-on-quarter (+1.0% prev.), marking the slowest quarterly wage growth in two years. While this data can be noisy for an individual quarter, it adds to other evidence of a slowing labour market in the euro area.

To the day ahead now, and data releases include UK GDP for Q3, Italian industrial production for September, and the University of Michigan’s preliminary consumer sentiment index for November. Otherwise, central bank speakers include ECB President Lagarde, Bundesbank President Nagel, and the Fed’s Logan and Bostic.

Tyler Durden

Fri, 11/10/2023 – 08:23

via ZeroHedge News https://ift.tt/tPW7D43 Tyler Durden