Traders Make Same Bet That’s Burned Them Before

By Tatiana Darie, Bloomberg Markets Live reporter and strategist

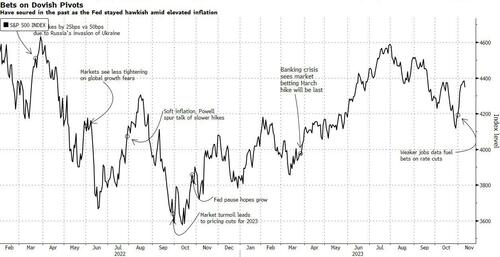

US stocks are at risk of a reckoning — that might already be underway — as Wall Street traders jump the gun to bet that the Federal Reserve will reverse course on its fastest rate hiking cycle on record. It’s a wager that’s burned them repeatedly in the past.

Stocks were making a bullish turn in November — posting their longest daily streak of gains in nearly two years — as traders grew more optimistic that a slowing jobs market will pave the way for interest-rate cuts sooner than anticipated next year, and deeper than officials projected.

But Thursday’s ugly bond auction spoiled the party and bets of a central bank pivot were scaled back after Fed Chair Powell said the central bank won’t hesitate to tighten more if needed. And there’s more losses coming if the recent trend is any guide.

It’s not the first time that traders have prematurely positioned for a dovish turn from the Fed that’s later proved to be nothing more than a figment of investors’ imagination. This time doesn’t look any different. Even as inflation has notably cooled, core inflation remains sticky and price growth is still running above target, policymakers have reiterated.

Let’s revisit the previous times when markets reacted in similar fashion. Deutsche Bank counted at least six other times in this hiking cycle that markets have positioned for a Fed pivot, only to see their hopes dashed later. The so-called ‘pivot’ has evolved from what was first described as a smaller amount of tightening, then slower hikes, later to betting on a pause and now outright cuts.

Of course, it’s hard to break out the individual drivers of the stock market, as fundamentals and sentiment play a big role. But if one just looks at the equity moves around the rallies resting on the hopes of the dovish pivot that Deutsche Bank described, the S&P 500 went on to fall about 9%, on average, in the weeks that followed (if you take highs and the lows around those rallies).

Rebounding stocks, which have been taking their cues from bonds recently, have also helped loosen financial conditions, which is self-defeating as the Fed might have to tighten again, as various policymakers have suggested.

Talk about rate cuts is premature, said a chorus of central bankers over the past week. Fed speakers acknowledged the softness in the labor market but as Chicago Fed President Austan Goolsbee noted that “is what you would want — is what you would expect.”

At 3.9%, the unemployment rate has already risen above the Fed’s projections for this year, which create some risks. However, leading indicators like unemployment claims and WARN data indicate the slowdown in the labor market may not be too concerning just yet, as MLIV’s Simon White argued.

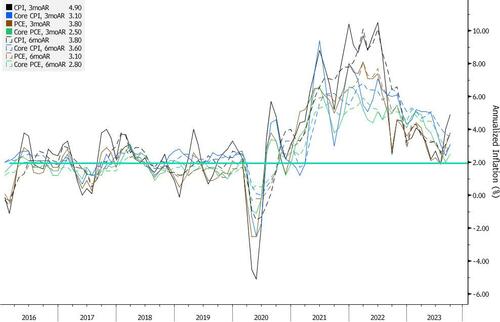

And while inflation is hovering not far from the Fed’s projections for this year, it’s still not at the central bank’s long-term 2% target. Looking at both six-month and three-month annualized rates for CPI, PCE and their core counterparts, one can see the deceleration in momentum has stalled.

There’s some evidence for investors to hang their hat on as the jobs market softens: “For the doves, they have all the ammunition they need to basically put the hawks in a casket,” Renaissance Macro’s Neil Dutta said on Bloomberg Television.

Nonetheless, the Fed’s own projections imply markets should prepare for more slack in the labor market as well as the economy — and for the Fed to take it in stride until their inflation goal is within reach.

Tyler Durden

Fri, 11/10/2023 – 12:25

via ZeroHedge News https://ift.tt/9xXiVvP Tyler Durden