Bonds & Stocks Shrug At Moody’s USA Credit Rating Downgrade, Oil & Gold Bounce

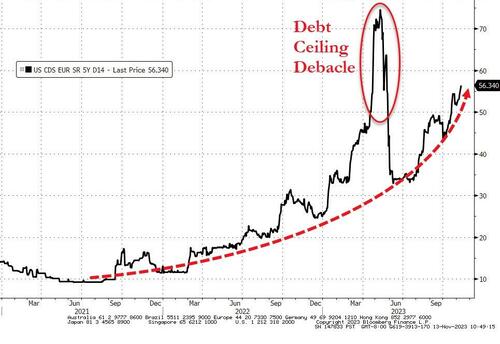

Quiet on the macro side (inflation survey lower), snoozy on the geopolitical chaos (no WW3 over the weekend), and markets were in holiday mode with quiet volumes leaving bonds and stocks unch to slightly lower after Moody’s joined the rest of its ratings-imagineers and cut USA’s outlook to negative. Perhaps they just needed to look at the market’s perception of the sovereign risk ‘Murica….

Source: Bloomberg

The equity and bond market’s reaction to this warning so simple – “America, Fuck yeah!”

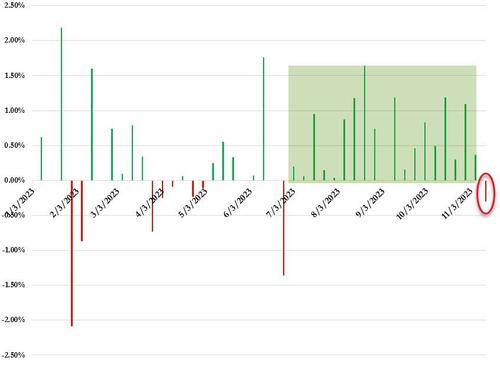

Futures were weak out of the fate after Sunday night’s open. Late in Asia a bid emerged, but that faded into the US cash open. The algos immediately stepped in and ramped all the majors to the highs of the day and that’s where they oscillated for the rest with some late-day selling pressure dragging the S&P red along with Nasdaq. By the close, only The Dow ended higher.

This ended the Nasdaq’s Monday win-streak at 19-straight weeks…

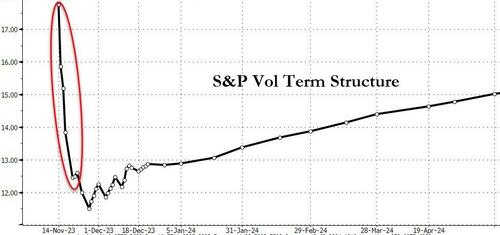

VIX was higher on the day, but we note the term structure of S&P vol shows significant event risk priced in for the next few days (CPI, Retail sales, etc)…

Source: Bloomberg

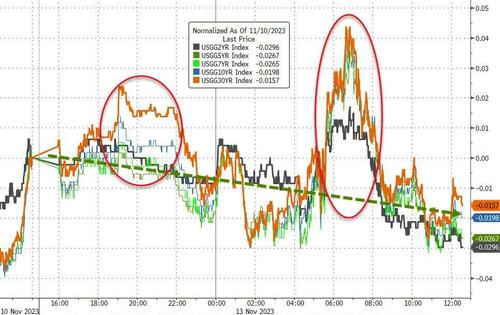

Treasuries the same, ending the day marginally better (down 2-3bps across the curve) after some chop higher in yields intraday with the short-end outperforming by a smidge…

Source: Bloomberg

The dollar was lower on the day with the bulk of the selling from 1000-12000ET…

Source: Bloomberg

Bitcoin leaked lower on the day, ending just below $37,000…

Source: Bloomberg

On the other hand, Ethereum rallied back above $2100…

Source: Bloomberg

Gold jumped higher…

Source: Bloomberg

…bouncing off its 200DMA once again…

Source: Bloomberg

Oil prices crept back higher for the second day in a row, with WTI back above $78…

Source: Bloomberg

Crucially, WTI rallied back above its 200DMA…

Source: Bloomberg

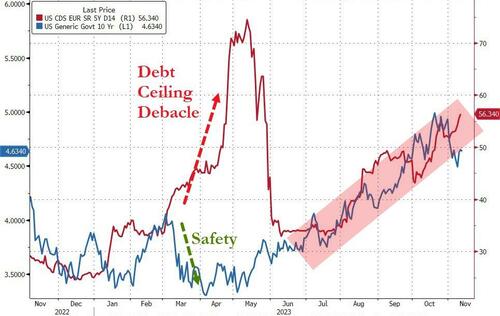

Finally, circling back to the start of this note, in a regime-shift from historical norms, the US Treasury yields are broadly trending higher with USA Sovereign credit risk…

Source: Bloomberg

Are the bond vigilantes back?

Tyler Durden

Mon, 11/13/2023 – 16:00

via ZeroHedge News https://ift.tt/uYR3NJr Tyler Durden