Key Events This Week: CPI, PPI, Retail Sales, More Fed Speakers And Walmart Earnings

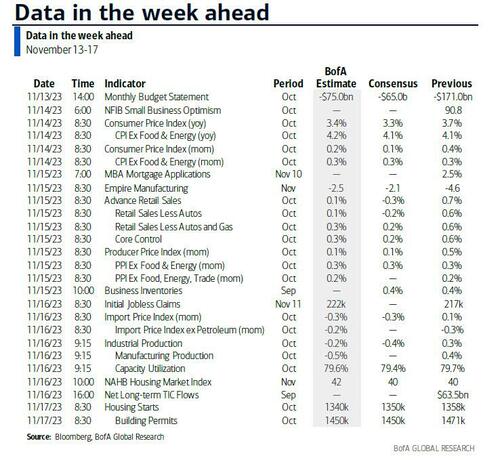

As DB’s Jim Reid writes in his weekly preview, this week will be the opposite of last week with not so much Fed speak but lots of important data and events, and the highlight will certainly be Tuesday’s US CPI but US retail sales (Wednesday) will also be a big driver of Q3 GDP forecasts. Additionally, PPI (Wednesday) and a raft of US housing data (NAHB – Thursday, starts/permits – Friday), will be other notable US releases alongside the NY Fed 1-yr inflation expectations today. Finally, something else that will sneak up on markets will be the potential US government shutdown on Friday.

There is also the APEC economic leaders’ summit week running in San Francisco until Friday having started on Saturday. A bilateral Xi and Biden meeting on Wednesday will be very important so watch out for headlines. Already Bloomberg are reporting overnight that China may end a 5-yr quasi-freeze in buying Boeing products by restarting 737 jetliner purchases. So the mood music is picking up ahead of the meeting.

Staying with China, it has its monthly big data dump also on Wednesday. In Europe we have the second print of the EA Q3 GDP (flash -0.1%), the ZEW survey and UK employment (tomorrow) and UK inflation and EA IP (Wednesday). Note that on Friday Moody’s will conclude its review of Italy’s rating. It’s on negative outlook and one notch from high yield territory but all three other main rating agencies have affirmed their rating in recent weeks (Fitch the latest after hours on Friday) and rate it higher than Moody’s so they would really be going out on a limb if they downgraded whatever the fundamental rationale. As a curveball look out for the state of emergency issued in Iceland after a series of powerful earthquakes have put them on high alert of a major volcanic eruption. The risk of an impact on airline travel seems to have been reduced by favorable wind patterns. This is good news as Jim Reminds his long-time readers that during the last major Icelandic eruption in 2010 I got stuck in Boston for 8 days, and I’m traveling this week.

Going through the main highlights in more detail now, let’s start with US CPI tomorrow. DB economists and consensus expect headline to come in at only +0.1% mom due to softer energy prices. DB think core edges up to +0.4% from +0.3% last month (consensus 0.3%). If DB is correct the YoY rate will be 3.3% and 4.2%, respectively, with the consensus 0.1pp lower on core. On DB’s estimates, the 3m and 6m annualised core reading would be 4.1% (up 1pp) and 3.6% (unch), respectively. So that will still be a headache for the Fed if realized.

DB also expects PPI on Wednesday to see headline at +0.2% (from +0.5%), due to softer energy prices, and core steady at +0.3% with all the attention on the components that directly feed into the Fed’s preferred core PCE, such as health care services and airfares.

On the same day US retail sales will be important to GDP forecasts. DB expect weak unit motor vehicle sales to encourage a -0.4% print on the headline (from +0.7%), with the same forecast for sales ex-auto (from +0.6%) due to lower gasoline prices. DB expect retail control, which goes into GDP, to be only +0.1% (from +0.6%). As our economists point out this grew at an annualised +6.8% in Q3. So potentially a big step down.

On the earnings front, that 90% of the S&P 500 have reported now but with Nvidia next week breathing some life into the very late stages of the season. On deck this week we have retailers Home Depot, Target, and Walmart is traditionally the last retailer to report on Thursday.

See the rest of the week ahead in the day-by-day calendar of events at the end as usual.

Day-by-day calendar of events

Monday November 13

- Data: US October NY Fed 1-yr inflation expectations, monthly budget statement, Japan October machine tool orders, Germany September current account balance

- Central banks: ECB’s Guindos speaks, BoE’s Breeden and Mann speak

Tuesday November 14

- Data: US October CPI, NFIB small business optimism, UK September weekly earnings, October jobless claims change, Japan Q3 GDP, Germany November Zew survey, Eurozone Q3 GDP, employment, November Zew survey

- Central banks: Fed’s Goolsbee and Jefferson speak, ECB’s Lane and Villeroy speak, BoE’s Dhingra and Pill speak

- Earnings: Home Depot, RWE, Vodafone

Wednesday November 15

- Data: US October PPI, retail sales, November Empire manufacturing index, September business inventories, China October retail sales, industrial production, property investment, UK October CPI, RPI, PPI, September house price index, Japan October trade balance, September core machine orders, capacity utilization, Italy September general government debt, France Q3 ilo unemployment rate, Eurozone September trade balance, industrial production, Germany October wholesale price index, Canada October existing home sales, September wholesale sales, manufacturing sales

- Central banks: China 1-yr MLF rate, BoE’s Haskel speaks

- Earnings: Tencent, Target, Cisco Systems, Palo Alto Networks, JD.com, Infineon Technologies, Siemens Energy, Catalent, Alstom

Thursday November 16

- Data: US November NAHB housing market index, Philadelphia Fed business outlook, New York Fed services business activity, Kansas City Fed manufacturing activity, October industrial production, import and export price index, capacity utilization, September total net TIC flows, initial jobless claims, China October new home prices, Japan September Tertiary industry index, Italy September trade balance, Canada October housing starts

- Central banks: Fed’s Mester, Williams and Barr speak, ECB’s Lagarde, Knot, De Cos and Guindos speak, BoE’s Ramsden speaks

- Earnings: Walmart, Alibaba, Applied Materials, Macy’s, Siemens, Lenovo, SQM

Friday November 17

- Data: US October housing starts, building permits, November Kansas City Fed services activity, UK October retail sales, Italy September current account balance, ECB September current account, Canada September international securities transactions, October raw materials price, industrial product price

- Central banks: Fed’s Daly, Collins and Goolsbee speak, ECB’s Lagarde, Villeroy, Holzmann, Vujcic, Nagel and Wunsch speak, BoE’s Greene and Ramsden speak

Finally, turning to just the US, Goldman notes that the key economic data releases this week are the CPI report on Tuesday, the retail sales report on Wednesday, and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week, including public appearances by Vice Chair Jefferson on Tuesday and New York Fed President Williams on Tuesday and Thursday.

Monday, November 13

- 08:50 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver introductory remarks at the Fed’s 5th Conference on Nontraditional Data, Machine Learning, and Natural Language Processing in Macroeconomics. Text is expected.

Tuesday, November 14

- 03:00 AM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will moderate a panel discussion at a joint conference hosted by the Swiss National Bank. Q&A is expected. On October 18th, President Williams noted that the FOMC needed to “keep this restrictive stance of policy in place for some time” in order “to make sure that we really achieve that goal of 2% on a sustained basis.”

- 05:30 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will deliver a virtual speech on uncertainty at a conference hosted by the Swiss National Bank. Text and audience Q&A are expected. On October 9th, Vice Chair Jefferson said he would “remain cognizant of the tightening in financial conditions through higher bond yields” in assessing the appropriate “future path of policy.”

- 06:00 AM NFIB small business optimism, October (consensus 90.5, last 90.8)

- 08:30 AM CPI (mom), October (GS +0.09%, consensus +0.1%, last +0.4%); Core CPI (mom), October (GS +0.32%, consensus +0.3%, last +0.3%); CPI (yoy), October (GS +3.29%, consensus +3.3%, last +3.7%); Core CPI (yoy), October (GS +4.13%, consensus +4.1%, last +4.1%): We estimate a 0.32% increase in October core CPI (mom sa), which would leave the year-on-year rate unchanged at 4.1%. Our forecast reflects a 7bp boost from residual seasonality across the apparel, lodging, pets, and household furnishings and operations categories (mom sa). We also expect a positive swing in the health insurance CPI starting this month that should drive a roughly 5bp increase in the monthly run rate of the core. We assume a further rise in new car prices (+0.2%) reflecting the temporary production drag from the UAW strike and a related pullback in dealer incentives. On the negative side, we estimate a 1.3% drop in used car prices on lower auction prices and a 3% pullback in airfares on softer demand. We also look for deceleration in car insurance rates (we assume +0.8%), as premiums have nearly caught up to repair and replacement costs. We expect a somewhat slower pace of shelter inflation (we estimate +0.45% for rent and +0.44% for OER) reflecting slowing rent growth and a more normal rent-OER gap, following recent volatility. We estimate a 0.09% rise in headline CPI, reflecting lower energy (-3.0%) and higher food (+0.3%) prices.

- 10:00 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will testify at a Senate Banking Committee hearing on financial regulation. Text is expected. On October 2nd, Vice Chair Barr noted that the FOMC was likely “at or very near to the level that is sufficiently restrictive to bringing inflation back to 2% over time.” He also said that the FOMC would increasingly focus on “the path of interest rates over time,” noting that “it is likely that we’ll need to keep rates up for some time in order to get inflation down to 2%.”

- 12:45 PM Chicago Fed Governor Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver a speech at the Detroit Economic Club on the economy and monetary policy. Q&A is expected. On November 7th, President Goolsbee noted that “over the next couple of months, [the decline in inflation] might equal the fastest drop … in the last century.” President Goolsbee stressed that “as long as we’re making progress [on inflation], as I’ve been saying for a while, the moment of arguing how high … the [fed funds] rate [should] go is going to fade to how long should we keep rates at this level as inflation is coming down.”

Wednesday, November 15

- 08:30 AM Retail sales, October (GS -0.7%, consensus -0.3%, last +0.7%); Retail sales ex-auto, October (GS -0.5%, consensus flat, last +0.6%) ;Retail sales ex-auto & gas, October (GS -0.3%, consensus +0.2%, last +0.6%); Core retail sales, October (GS -0.3%, consensus +0.2%, last +0.6%): We estimate core retail sales declined 0.3% in October (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects the resumption of student loan payments and a late-month slowdown in credit card spending. We also view seasonality as a negative factor. We estimate a 0.7% drop in headline retail sales, reflecting lower auto, gasoline, and restaurant sales.

- 08:30 AM PPI final demand, October (GS +0.1%, consensus +0.1%, last +0.5%); PPI ex-food and energy, October (GS +0.3%, consensus +0.3%, last +0.3%); PPI ex-food, energy, and trade, October (GS +0.2%, consensus +0.2%, last +0.2%)

- 08:30 AM Empire State manufacturing survey, November (consensus -3.0, last -4.6)

- 09:30 AM Fed Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will testify at a House Financial Services Committee hearing on financial regulation. Text is expected.

- 10:00 AM Business inventories, September (consensus +0.4%, last +0.4%)

Thursday, November 16

- 06:10 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will take part in an event at the San Francisco Fed’s Asia Economic Policy Conference, entitled “Global Linkages in a Post-Pandemic World.”

- 07:10 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will participate in a discussion on bank supervision and regulation at the 7th annual conference of the European Systemic Risk Board. Moderated and audience Q&A are expected.

- 08:30 AM Import price index, October (consensus -0.3%, last +0.1%)

- 08:30 AM Initial jobless claims, week ended November 11 (GS 220k, consensus 220k, last 217k); Continuing jobless claims, week ended November 4 (GS 1,860k, consensus 1,853k, last 1,834k): We estimate that initial jobless claims were roughly unchanged at 220k. We estimate that continuing claims increased to 1,860k, reflecting continued upward pressure from seasonal distortions.

- 08:30 AM Philadelphia Fed manufacturing index, November (GS -8.5, consensus -10.3, last -9.0): We estimate that the Philadelphia Fed manufacturing index rebounded 0.5pt to -8.5 in November, reflecting the rebound in East Asian industrial activity and a possible boost from the end of the auto strikes.

- 08:30 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will deliver opening remarks at the 2023 Financial Stability Conference hosted by the Cleveland Fed and the Office of Financial Research. On October 20th, President Mester noted that, “regardless of the decision made at our next meeting, if the economy evolves as anticipated, in my view, we are likely near or at a holding point on the funds rate.”

- 09:15 AM Industrial production, October (GS -0.4%, consensus -0.3%, last +0.3%); Manufacturing production, October (GS flat, consensus -0.3%, last +0.4%); Capacity utilization, October (GS 79.3%, consensus 79.4%, last 79.7%): We estimate industrial production decreased 0.4%, as weak oil and gas production and mining outweigh a modest decline in motor vehicle production. We estimate capacity utilization declined to 79.3%.

- 09:25 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President Williams will deliver remarks at the New York Fed’s 2023 Treasury Market Conference.

- 10:00 AM NAHB housing market index, November (consensus 40, last 40)

- 10:30 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will participate in a discussion on central bank digital currencies at a conference hosted by the Bank of Canada and Sweden’s Riksbank. Moderated Q&A is expected. On November 7th, Governor Waller noted that the labor market was “slowing down” and getting into “better balance between supply and demand.” On October 18th, Governor Waller said that he believed the FOMC could “wait, watch and see how the economy evolves before making definitive moves on the path of the policy rate.” He stressed he would be “looking carefully at the data to see whether the real side of the economy begins to cool off or whether prices, the nominal side of the economy, heat up,” noting that “as of today, it is too soon to tell.”

- 10:35 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will speak about financial stability at the New York Fed’s Treasury Market Conference.

- 11:45 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will deliver remarks at the 2023 Financial Stability Conference hosted by the Cleveland Fed and the Office of Financial Research.

Friday, November 17

- 08:30 AM Housing starts, October (GS +0.2%, consensus -0.7%, last +7.0%): Building permits, October (consensus -1.4%, last -4.5%)

- 08:45 AM Boston Fed President Collins (FOMC non-voter) speaks: Boston Fed President Susan Collins will deliver introductory remarks at a Boston Fed conference titled “Rethinking Full Employment.” On October 11th, President Collins noted that the FOMC can take more time to evaluate incoming data because “we are likely close to, and possibly at, the peak of this tightening cycle.” Still, President Collins noted that “further tightening could be warranted depending on incoming information.”

- 08:45 AM Fed Vice Chair for Supervision Barr speaks: Fed Vice Chair for Supervision Michael Barr will deliver remarks on the payment system at the Clearing House’s annual conference. Moderated Q&A is expected.

- 09:45 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver remarks at the Chicago Fed’s Annual Community Bankers Symposium. Text is expected.

- 10:00 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will deliver closing remarks at the 33rd Frankfurt European Banking Congress. Text and audience Q&A are expected. On November 10th, President Daly noted that if inflation “continues to move sideways, and the labor market and GDP growth remain solid or strong,” the FOMC would “probably have to raise [the fed funds rate] again.” However, President Daly noted that “if those things … come down and inflation comes and continues to come down to 2%, … then that’s a different decision.”

Source: DB, Goldman, BofA,

Tyler Durden

Mon, 11/13/2023 – 09:50

via ZeroHedge News https://ift.tt/JaF9wpx Tyler Durden