Popping The AI Bubble: Companies That Drone On About AI In Earnings Calls See Their Shares Underperform

For much of the past year we have said (half jokingly, but not really) that countless companies would try to deflect attention from their sagging earnings by bloviating about “AI”, “chatGPT”, and how other topical buzzwords du jour, for the simple reason that merely mentioning said trigger phrases would spark rallies under their stock, something which clearly wasn’t lost on CEOs and CFOs (and especially Sundar Pichai). However, it now appears that the AI euphoria has finally peaked, and according to an analysis by Deutsche Bank (available to pro subs in the usual place), companies that “discuss” artificial intelligence the most in their corporate earnings calls this year have tended to underperform the wider market.

Starting at the top, it’s hardly a secret that many investors assume the buzz around generative AI since the launch of ChatGPT a year ago has driven the 2023 tech rally. After all, Nvidia has surged 141 per cent since ChatGPT was released, helping the Nasdaq 100 to a 20 per cent gain.

And yet, as DB’s Like Templeman has found, several factors suggest that AI optimism has not been the key driver of tech markets across asset classes. In fact, DB’s analysis shows that the companies that have discussed AI the most in their corporate transcripts this year have tended to underperform the wider market. Furthermore, when we look at abnormal returns for semiconductor stocks (initially deemed the big winners from AI), DB found that after an initial surge, the difference between their returns and those of software stocks, another directly impacted industry, has fallen to be relatively non-meaningful.

While there is a lot in the must-read DB report which looks at how AI has affected equity, credit, private and M&A markets, and analyzes corporate transcripts to see which companies have talked about AI the most and what that means for their market returns, in an “attempt to disentangle the signals from the noise to see where and how investors have priced in (or not) AI optimism”, for the purpose of this post we will focus on some of the highlights, starting the frequency of AI mentions in corporate transcripts.

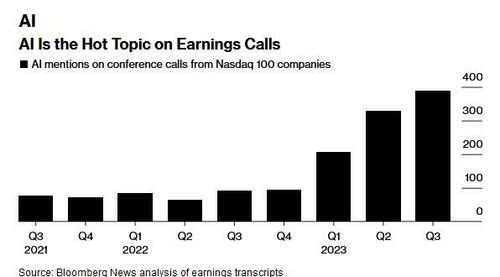

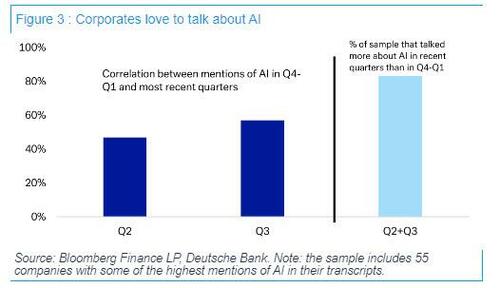

According to DB, and as shown in the chart above, the mentions of AI-related keywords in corporate transcripts have sharply accelerated this year as companies tried to pitch revenue and/or cost benefits from the technology to their investors. Indeed, The chart below shows that companies that began talking about AI when ChatGPT was released have continued to do so this year.

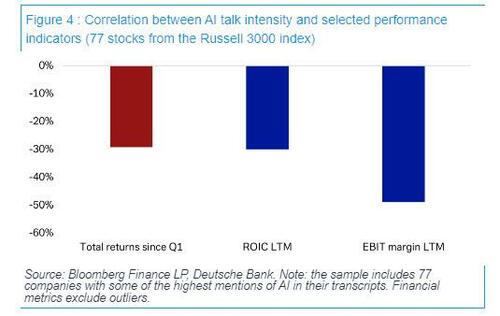

Yet while management teams may believe that merely throwing around buzzwords is enough to propel their stock to record highs (and for a while, it certainly seemed that way), we can now conclude that stock returns have been negatively correlated with the intensity of AI talk.

For a sample of 77 Russell 3000 stocks, the correlation between total returns since Q1 and the intensity of AI-talk in Q4’22-Q1’23 transcripts was -29%. In part, this is because AI was more in focus for smaller and less profitable firms. In other words, corporate AI enthusiasm is sticky, unlike investor attitudes which seem to be more discerning.

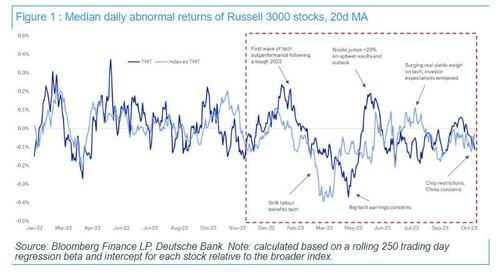

The flipside is that contrary to conventional wisdom, AI has not been the key driver of tech markets across different asset classes this year. While it is certainly true that tech has decoupled from the broader market this year, it is less clear that AI had a major role in this. The chart below shows a measure of abnormal returns for the tech sector compared with the rest of the market:

While there was a visible outperformance wave in the first months of the year when tech benefited from a risk-on mood as well as in the aftermath of large drawdowns in 2022, later on, big tech rallied on the back of perceived haven status amid the SVB selloff, followed by another advance around an upbeat forecast from Nvidia in late May.

Non-AI factors have since driven the performance of tech stocks. In particular, rising real yields has been the narrative since the summer. Moves across tech stocks became more synchronized as well. While, early on, ChatGPT propelled semiconductor stocks and left the software industry firms behind, now, various industries across the TMT sector seem to be converging. That points to a waning effect on markets of generative AI and indicates investors are refocusing on non-AI factors in their stock decisions.

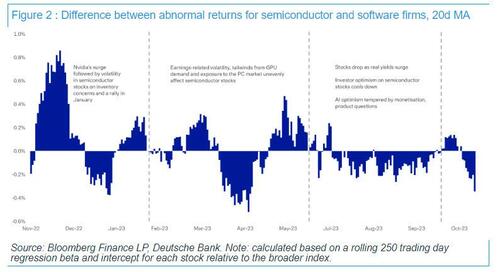

Another way to see AI’s waning influence on the market is to split out semiconductor stocks from ‘software & services’ firms. The next chart shows an initial surge in semi stocks after ChatGPT was rolled out in November 2022, mainly driven by Nvidia as the first-order beneficiary of the uptick in generative AI. This was followed by a number of smaller market waves tied to earnings of semiconductor firms (and the selloff in software stocks that were deemed to be negatively affected by ChatGPT).

Nevertheless, the wedge between the two industry groups has stabilized over the last few months, showing few new AI-driven shocks. Moreover, semiconductor stocks came under pressure as investors tempered expectations.

Templeman concludes that with the impact of AI now fading on public capital markets, the big gains in AI (in the near term) are likely to remain in private markets. Indeed, “beyond a handful of stocks, there have been few clear winners or losers from the buzz around generative AI.” At present, some of the major non-semiconductor players are still figuring out the product and there are several risks that cannot be ignored. For other technologies including machine learning that are frequently touted for their applications in areas such as medicine and cybersecurity, the reality is that few of those emerged overnight and they have been evolving for years.

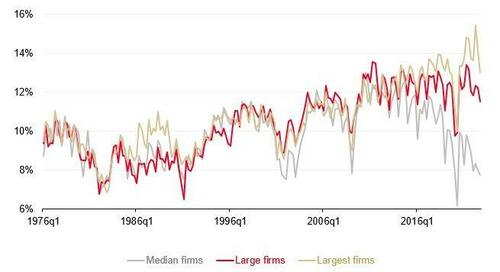

Regardless, until AI benefits become widespread enough to significantly move economic data, company-level effects may remain highly skewed and concentrated, with a limited sustained pass-through to broader indices, and mostly benefiting the largest and most diverse companies as we observed on Friday.

Finally, while there is no doubt that some venture capital funds may hit the jackpot when they find the next FAANG of AI, DB does not expect those winners to hit the IPO markets in the next couple of quarters.

For much more, including the changing impact of AI on credit markets, venture capital, IPOs, M&A, see the full note available to pro subs.

Tyler Durden

Mon, 11/13/2023 – 07:45

via ZeroHedge News https://ift.tt/egGFyKO Tyler Durden