US Futures Drop, Europe Gains Ahead Of Key CPI Data

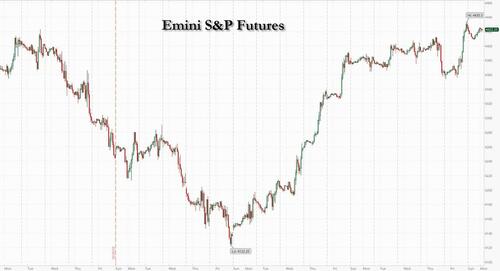

After last week’s torrid rally, and following gains on 9 out of the past 10 days, US stocks are set for a lower open as traders turn cautious ahead of key U.S. CPI data later this week which will give cues on what the Fed could do next, while investors also assessed the risk of a government shutdown on the 17th. As of 7:45am, S&P 500 futures are down 0.2% while Nasdaq 100 contracts lose 0.3% after the underlying indexes closed sharply higher on Friday. European stocks rose on Monday, with the Stoxx 600 index climbing 0.5%, well off the best levels however, with health firms were among the strongest performers as Novo Nordisk jumped almost 4% after a study backed the use of Wegovy to cut heart attacks and deaths in obesity patients. The news also benefited US-listed rival Eli Lilly & Co., which has its own weight-loss medications. Treasury yields slipped, while oil steadied and bitcoin traded around $37K.

In premarket trading, Boeing shares advanced almost 4%, thanks to a $52 billion deal with Emirates, as well as news that China is weighing an end to a freeze on purchases of Boeing aircraft. Plug Power shares fell another 4.2% following Friday’s plunge, after Morgan Stanley cuts its price target on the hydrogen fuel cell maker after the company’s going-concern warning last week. StoneCo shares gain 4.9% after the financial technology provider reported results late Friday that beat expectations thanks to strength in its financial services division.

Market attention is firmly focused on Tuesday’s US CPI data, which are expected to show inflation easing to a year-on-year rate of 3.3% in October, down from 3.7% in the prior month. While several Fed officials have rejected the likelihood of swift rate cuts, money markets and economists are sticking with policy-easing bets. Morgan Stanley forecast deep interest-rate cuts to start from June, while Goldman Sachs predicted the first cut around end-2024.

“If we get inflation in line with consensus, it will be good news but I don’t think the data will alter the tone we are hearing from Fed officials pushing back against markets’ excitement over rate cuts,” said Rabobank strategist Jane Foley. She predicted more “hawkish speak from central banks to control the degree to which markets price cuts.”

At the same time, there are more signs of thawing US-China ties with Joe Biden and Xi Jinping due to meet on Wednesday. The White House has cited a resumption of US-China military communications as a priority. Hong Kong-listed Chinese stocks gained 1.3%.

European stocks rose, with the Stoxx 600 up 0.6%. Health care stocks are among the best performers, with Novo Nordisk up as much as 4.3%, the most in a month, after the Danish pharmaceutical giant this weekend presented full data from a trial backed the use of Wegovy to cut heart attacks and deaths in people with obesity and a history of cardiac disease. Here are some other notable European movers:

- Evolution gains as much as 6.7%, the most since February, after the Swedish online gambling firm’s CEO bought almost 100,000 shares in the company for a total value of SEK100 million ($9.2 million)

- Banca Monte dei Paschi di Siena rises as much as 6.5% leading gains on the FTSE MIB index after Deutsche Bank upgraded the bank to buy from hold. Other lenders such as Banco BPM and BPER Banca also advance

- British Land rises as much as 6.5% to a three-month high after underlying earnings per share top estimates in first half of fiscal year. Morgan Stanley says rental growth was “impressive”

- Eramet rose as much as 4.2% after the French group announced new production and financial targets at its investor day

- Thyssenkrupp Nucera gains as much as 2.5% as Goldman sach initiates at neutral, saying it sees growth potential for the German green hydrogen electrolysis technology company; sets PT at €16

- Tullow Oil rises as much as 5.5%, the most since Oct. 9, after the exploration and production company entered into a $400 million five-year notes facility agreement with Glencore Energy UK, according to a statement

- Technip Energies drops as much as 3.8% after Barclays double-downgrades to underweight from overweight, saying its peers trade at significant discounts and offer better value

- Aperam falls as much as 4% after AlphaValue/Baader cut the recommendation on the specialty steelmaker to add, from buy. The broker says 3Q was the “worst quarter ever” for the group and demand remains weak

- Dr. Martens shares fall as much as 5.2%, after the bootmaker is downgraded to equal-weight from overweight at Barclays, which expressed concern on the company’s focus on direct-to-consumer growth

- Asos falls as much -2.4% after Morgan Stanley said the growth outlook for online apparel retailers still looks challenging despite the progress made on margins in 2023

- FDM Group shares plummet as much as 18%, the steepest drop since March 2020, after the professional services provider signaled its 2024 performance would be hit by a decline in its workforce

Earlier in the session, Asian equities erased opening gains as US index futures drift lower. The Nikkei was little changed; Korea’s Kospi surrendered an early 1.1% jump to trade near flat; the ASX 200 is modestly softer. Greater China indexes are mixed; Hang Seng Tech index is 0.6% higher after increase in Singles’ Day sales. Shanghai Composite edges 0.2% weaker. Taiex outperforms regional peers on TSMC rally. Some more details:

- Hang Seng and Shanghai Comp traded cautiously as optimism from Alibaba and JD.com’s higher Singles Day sales was offset by cautiousness ahead of the approaching Chinese data and Biden-Xi summit.

- Japan’s Nikkei 225 initially gained after softer-than-expected PPI data which printed its slowest pace of annual growth since February 2021 although the index eventually reversed its gains amid rising yields and a slew of earnings.

- Australia’s ASX 200 was lacklustre amid weakness in the top-weighted financial sector after ANZ Bank earnings which posted a record FY cash profit but missed analysts’ forecasts and noted the external environment is likely to remain challenging.

- Indian stocks declined, underperforming most Asian peers, as investors dump technology and financial services shares. The S&P BSE Sensex Index fell 0.5% to 64,933.87 in Mumbai, while the NSE Nifty 50 Index declined 0.4%. Out of 30 shares in the Sensex index, seven rose and 20 fell, while three were unchanged. Of the 19 sectoral indexes tracked by BSE Ltd., 13 declined. An index tracking technology stocks was the biggest sectoral laggard.

In FX, the Bloomberg Dollar Spot Index steadied after Moody’s downgraded the US credit rating outlook, while Treasury yields fell 1-2bp across the curve; market focus rests on US CPI data out Tuesday and the outlook for Federal Reserve policy

- USD/JPY rose as much as 0.22% to 151.86 as Japan’s widening yield gap with Treasuries saw the yen slump to a fresh one-year low against the dollar

- GBP/USD climbed as much as 0.21% to 1.2253, the highest level since Thursday, as data indicated UK house prices fell the most in five years in November

- EUR/USD crept up as much as 0.14% to 1.0701 as the ECB’s de Guindos warned inflation may pick up again

Treasuries rise, with US 10-year yields falling 2bps to 4.63% as treasuries were slightly richer across the curve, recouping some of the late-Friday losses spurred by Moody’s shift to negative outlook on US credit rating. European bonds outperform slightly, with Italy debt leading gains after Fitch Ratings left the nation’s rating unchanged after Friday’s close. US session is light on economic data and Fed speakers, and coupon auction slate is blank until Nov. 20. US yields richer by 1bp-2bp with 10-year around 4.64%, underperforming comparable gilts and bunds by ~~1bp; 5s30s spread slightly steeper on the day at ~8bp after dropping below 6bp Friday. Dollar IG issuance slate empty so far, though Monday is expected to account for the bulk of the $30b in new bond sales anticipated this week.

In commodities, oil prices are little changed with WTI trading near $77.33. Spot gold falls 0.1%.

Bitcoin is under modest pressure and has lost the $37k handle, but action overall is limited in nature with overall newsflow fairly limited thus far in European hours and as such BTC remains well within familiar ranges.

US economic data scheduled for the session includes October NY Fed inflation expectations (11am) and monthly budget statement (2pm). Scheduled Fed speakers include Cook at 8:50am; Williams, Jefferson, Barkin, Barr, Goolsbee, Mester and Waller also due this week

Market Snapshot

- S&P 500 futures down 0.2% to 4,420.50

- STOXX Europe 600 up 0.8% to 446.65

- MXAP up 0.3% to 156.38

- MXAPJ up 0.6% to 489.47

- Nikkei little changed at 32,585.11

- Topix little changed at 2,336.62

- Hang Seng Index up 1.3% to 17,426.21

- Shanghai Composite up 0.2% to 3,046.53

- Sensex down 0.5% to 64,942.58

- Australia S&P/ASX 200 down 0.4% to 6,948.84

- Kospi down 0.2% to 2,403.76

- German 10Y yield little changed at 2.72%

- Euro up 0.1% to $1.0700

- Brent Futures down 0.2% to $81.27/bbl

- Gold spot down 0.0% to $1,939.32

- U.S. Dollar Index down 0.16% to 105.69

Top Overnight News

- Italy credit decision from Moody’s is being watched closely – Italy is rated Baa3 (the lowest rung of investment grade) w/a negative outlook and markets are on edge over whether the country will be moved into junk territory. BBG

- ECB Vice President Luis de Guindos warned that consumer-price growth may pick up again temporarily, though its prevailing direction is downwards. “We expect a temporary rebound in inflation in the coming months as the base effects from the sharp increase in energy and food prices in autumn 2022 drop out,” Guindos said. “But we see the general disinflationary process continuing over the medium term.” BBG

- Germany is set to double aid for Ukraine next year to EU8B and boost its total defense spending beyond the 2% of GDP threshold pledged by all NATO members. BBG

- Netanyahu said Israel would retain “overall security control” over Gaza and expressed opposition to a Palestinian Authority-led gov’t assuming control of the territory. The Hill

- US credit outlook downgraded from stable to negative by Moody’s after the Friday close (the AAA rating was affirmed), with the agency citing “downside risks to the country’s fiscal strength” as the primary reason for the change (along with continued political polarization). Moody’s

- Speaker Johnson unveiled a funding bill on Saturday that would extend spending authorization until 1/19 for some parts of the government and until 2/2 for others, but passage is far from guaranteed. BBG

- US launches a new round of airstrikes against Iranian-backed proxy facilities in Syria in retaliation for recent attacks in what is being called a “significant escalation” by the White House. WaPo

- FT-Michigan Ross poll underlines president’s struggle to overcome impact of inflation on voters’ economic outlook. Only 14% of Americans say they are better off financially since Biden took office while 70% feel the president’s economic policies either hurt the US economy or had no impact. FT

- A Boeing breakthrough in China may be unveiled when Joe Biden and Xi Jinping meet this week, people familiar said. Beijing may signal a commitment for 737 Max jetliners during the APEC summit, ending a long freeze on purchases as the leaders attempt to put a floor under their fraught relationship. BBG

A more detailed look at global markets courtesy of Newsquawk

European bourses are in the green, Euro Stoxx 50 +0.7%, despite a relatively tepid APAC handover with performance more in-fitting with that seen on Friday on Wall Street. Sectors are firmer across the board featuring outperformance in Travel & Leisure as Evolution’s CEO purchases shares, Health Care supported by Novo Nordisk obesity data while Banking names derive support from the likes of SocGen and BMPS. Stateside, futures trade on the back foot, ES -0.2%, despite firmer European trade with updates since Friday’s close unfavourable and include Moody’s altering its US rating and time running out for a resolution before a US shutdown; though, reporting on the shutdown has been mixed on Johnson’s bill. Emirates Airlines announced orders for 90 777-X Boeing (BA) jets worth USD 52bln; ordering General Electric (GE) 9X Engines and updating Dreamliner order for 35 units in total.

Top Asian News

- Chinese NDRC officials said the state planning agency will set up six platforms to facilitate private business, as well as monitor and solve problems, while the NDRC head said China’s private economy is expected to receive more favourable policies in the future, according to Global Times.

- Chinese officials met with US Treasury Secretary Yellen in the past week and raised concerns about investment restrictions, while China and the US agreed to avoid escalation of frictions.

- China is considering ending the freeze on Boeing (BA) with a 737 Max deal in the US, according to Bloomberg.

- US and Indonesia are to discuss the potential for a deal on electric vehicle minerals with Indonesia President Widodo to meet US President Biden at the White House on Monday, according to Reuters sources cited.

- RBA’s acting Assistant Governor Kohler said the decline in inflation is to be more gradual than previously thought and bringing inflation back to the target is likely to be more drawn out. Kohler also stated that domestically sourced inflation has been widespread and slow to decline, while she noted the key risk is that high inflation today feeds into inflation expectations.

- Japanese Finance Minister Suzuki says sudden FX moves are undesirable; does not comment on FX levels; will monitor markets and respond with a sense of urgency. Currency rates should be set by markets reflecting fundamentals.

- PBoC will step up monitoring and analysis of systemic risks, shadow banks and financial technological innovation, via Reuters citing sources. Will handle risks of small and medium-sized financial institutions in a timely manner.

APAC stocks were mostly subdued and failed to sustain the early momentum from last Friday’s rally on Wall St with the region cautious ahead of this week’s key risk events including US CPI and Chinese activity data, the Biden-Xi meeting on the sidelines of the APEC summit and the US government shutdown deadline. ASX 200 was lacklustre amid weakness in the top-weighted financial sector after ANZ Bank earnings which posted a record FY cash profit but missed analysts’ forecasts and noted the external environment is likely to remain challenging. Nikkei 225 initially gained after softer-than-expected PPI data which printed its slowest pace of annual growth since February 2021 although the index eventually reversed its gains amid rising yields and a slew of earnings. Hang Seng and Shanghai Comp traded cautiously as optimism from Alibaba and JD.com’s higher Singles Day sales was offset by cautiousness ahead of the approaching Chinese data and Biden-Xi summit.

Top European News

- ECB’s Centeno is facing an ethics review by an independent watchdog following a failed proposal by Portugal’s outgoing PM Costa for Centeno to replace him instead of holding new elections, according to FT.

- ECB’s de Guindos says he expects a temporary rebound in inflation in the coming months as the base effects from the sharp increase in energy and food prices in autumn 2022 drop out of the year-on-year calculation. At the December meeting, will be in a better position to reassess the inflation outlook and required policy action. Also seeing increasing signs of the impact of our policy decisions on the real economy

- German Ifo Survey (Oct): 18.2% of firms reported problems (prev. 24.0% M/M); material shortages in the manufacturing sector have eased significantly, supply situation near pre-COVID levels. Ifo says “firms should plan now for future shortages, diversify their supply chains, and increase inventory levels”. The auto sector remained the most affected by supply bottlenecks.

- Fitch affirmed Italy at BBB; Outlook Stable and affirmed Poland at A-; Outlook Stable on Friday.

- UK Home Secretary Braverman sacked, replaced by Cleverley. Former PM David Cameron appointed as UK Foreign Minister.

FX

- Dollar drifts ahead of NY Fed SCE and US CPI data on Tuesday, DXY slips into a slightly softer 105.85-68 range.

- Aussie outperforms as acting RBA Deputy Governor warns that battle to get inflation back to target will be drawn out, AUD/USD and AUD/NZD cross elevated between 0.6385-51 and 1.0835-1.0775 respective bands.

- Yen lags on yield dynamics and as Japanese corporate goods prices come in softer than expected, USD/JPY nudges closer to 152.00 from 151.40 where 1.3bln option expiries reside.

- Pound and Euro perky vs Buck as the former consolidates on 1.2200 handle and latter probes 1.0700.

- PBoC set USD/CNY mid-point at 7.1769 vs exp. 7.2889 (prev. 7.1771)

Fixed Income

- Some respite for debt ahead of key risk events including top-tier data.

- Bunds probe Fib resistance on the way up to 129.89 from 129.48.

- Gilts back on the 95.00 handle within 95.22-94.64 bounds and T-note nearer top of 107-15/07+ range.

- BTPs outpace peers after Fitch affirmed Italian BTP rating and speculation mounts about buyback or exchange auction.

Commodities

- Crude benchmarks rebounded from session lows and are just about in the green; though, initial price action was somewhat choppy and the move thus far keeps benchmarks well within recent ranges.

- WTI Dec’23 and Brent Jan’24 around USD 77.35/bbl and USD 81.60/bbl respectively; again, headlines have been numerous over the weekend and primarily on geopols (see the section below) while for crude specifically the OPEC MOMR is due at 12:00GMT/07:00EST.

- Spot gold is little changed as the USD eases from best with XAU in a relatively narrow USD 10/bbl intraday range. However, spot silver has come under further pressure after losing the USD 22/oz mark in APAC trade.

- Base metals bolstered with marked gains in the likes of LME Copper and Dalian Iron Ore, attributed to property sector optimism within China by some and comes after a bout of upside in the regions equity bourses just prior to the European cash open.

- Iraq’s Oil Minister Abdel-Ghani said on Sunday that he expects to reach an agreement with the Kurdistan Regional Government and foreign oil companies to resume oil production from the Kurdish region’s oilfields within three days.

- Iraq and ExxonMobil (XOM) signed a settlement agreement allowing PetroChina (857 HK) to become a lead contractor at the West Qurna 1 oil field.

- Kuwait Integrated Petroleum Industries Company said there was a sudden interruption of fuel supplies at Kuwait’s Al Zour Refinery due to a defect in one of the main valves which almost halted production, according to state media.

Geopolitics: Middle East

- Staff at the Al-Shifa Hospital which is the largest in Gaza said patients and refugees were trapped in horrific conditions amid heavy fighting in nearby streets and it was also reported that the hospital had run out of water, food and electricity. Furthermore, WHO’s Tedros said they managed to get in contact with staff at the hospital and that it is no longer functioning as a hospital, according to BBC and Reuters.

- Israel PM Netanyahu said they offered Gaza’s Al-Shifa Hospital fuel but Hamas refused to receive it, according to an interview with NBC. It was also reported that Hamas suspended hostage negotiations over Israeli forces’ handling of Al-Shifa Hospital and denied refusing any amount of fuel from Israel, while it added that Israel’s offer to provide 300 litres belittles the sick and wounded and is enough to last for 30 minutes.

- Israel’s military said Hamas lost control of northern Gaza and residents have evacuated to the south despite Hamas instructions. Furthermore, the Israeli military said that civilians were wounded by an anti-tank missile near the Lebanon border and it retaliated with artillery fire, while Israel warned it was poised to impose quiet on the Lebanese front after hostilities increased on Sunday, according to Reuters.

- Palestinian President Abbas said that their people are facing a genocidal war and that they call on the US to stop the Israeli aggression against Gaza, while he added that they want international protection.

- US President Biden and Qatar’s Emir Al-Thani engaged in discussions to boost aid to Gaza. It was also reported that US Secretary of State Blinken and Qatar’s PM discussed efforts to evacuate the critically wounded and urgently increase the flow of humanitarian aid into Gaza, as well as discussed efforts to ensure the safe passage of foreign nationals out of Gaza and immediate return of hostages during a phone call on Saturday, according to Reuters citing a State Department spokesperson.

- White House National Security Adviser Sullivan said the US does not want to see firefights in hospitals and that the US is involved in negotiations between Israel and Qatar over hostages. Sullivan also stated that President Biden is determined to see a re-establishment of military-to-military ties with China and the question of Iran’s nuclear program and the threat it poses will be on the agenda meeting with Chinese President Xi.

- EU’s top diplomat Borrell called for immediate humanitarian pauses in Gaza and the establishment of humanitarian corridors. Borrell also stated that they call on Hamas to immediately and unconditionally release all hostages, while they condemn the use of hospitals and civilians as human shields by Hamas.

- Egyptian President Sisi called for an immediate sustainable ceasefire in Gaza without restrictions or conditions. It was separately reported that Egyptian security sources said the first group of Gaza evacuees crossed the Rafah border following the reopening of Sunday.

- Iranian President Raisi said the Gaza siege should end immediately and called on Islamic countries to impose oil and goods sanctions on Israel, while he added that there is no other way but to resist Israel and that they kiss the hands of Hamas for its resistance against Israel.

- Syrian President Assad urged a halt to any political process with Israel.

- US Air Force conducted two airstrikes against Iranian proxy targets in eastern Syria, according to Fox News.

- Iraq’s Harir Airbase hosting US and international forces was targeted by an armed drone which caused damage to infrastructure.

- “IRGC Air Force Commander: Israel’s war on Gaza has expanded and Lebanese Hezbollah is involved in it”, according to Al Jazeera.. “There is a possibility of Israel’s war on Gaza expanding and we are ready for all eventualities”

Geopolitics – Other

- German Chancellor Scholz’s government agreed to double military assistance to Ukraine for next year to EUR 8bln.

- Russian Foreign Minister Lavrov said the EU isn’t hiding its intentions to push Russia out of Central Asia and that these attempts are futile, while he added that Russia has been historically present there and is not going to disappear from there, according to AFP.

- US, Japan and South Korean defence officials assessed growing nuclear and missile threats from North Korea at a meeting on Sunday, while the US and South Korea revised their tailored deterrence strategy in the face of North Korean nuclear advancements, according to Yonhap. It was separately reported that North Korea criticised the UN Command meeting scheduled in South Korea as confrontational for the region and it called for the UN Command to be dissolved which it said was an illegal war organisation, according to KCNA.

- Russia’s Kremlin says Polish plans to deploy tanks closer to the Belarus border would escalate tensions.

US Event Calendar

- 11:00: Oct. NY Fed 1-Yr Inflation Expectat, prior 3.67%

- 14:00: Oct. Monthly Budget Statement, est. -$65b, prior -$171b

Central Bank Speakers

- 08:50: Fed’s Cook Gives Introductory Remarks

DB’s Jim Reid concludes the overnight wrap

This week will be the opposite of last week with not so much Fed speak but lots of important data and events. It’s hard to look much beyond Tuesday’s US CPI as the key highlight of the week butUS retail sales (Wednesday) will a big driver of GDP forecasts. PPI (Wednesday) and a raft of US housing data (NAHB – Thursday, starts/permits – Friday), will be other notable US releases alongside the NY Fed 1-yr inflation expectations today. Something that will sneak up on markets will be the potential US government shutdown on Friday.

We also have an APEC economic leaders’ summit week running in San Francisco until Friday having started on Saturday. A bilateral Xi and Biden meeting on Wednesday will be very important so watch out for headlines. Already Bloomberg are reporting overnight that China may end a 5-yr quasi-freeze in buying Boeing products by restarting 737 jetliner purchases. So the mood music is picking up ahead of the meeting.

Staying with China, it has its monthly big data dump also on Wednesday. In Europe we have the second print of the EA Q3 GDP (flash -0.1%), the ZEW survey and UK employment (tomorrow) and UK inflation (DB preview here) and EA IP (Wednesday). Note that on Friday Moody’s will conclude its review of Italy’s rating. It’s on negative outlook and one notch from high yield territory but all three other main rating agencies have affirmed their rating in recent weeks (Fitch the latest after hours on Friday) and rate it higher than Moody’s so they would really be going out on a limb if they downgraded whatever the fundamental rationale. As a curveball look out for the state of emergency issued in Iceland after a series of powerful earthquakes have put them on high alert of a major volcanic eruption. The risk of an impact on airline travel seems to have been reduced by favourable wind patterns. This is good news as long-time readers will remember that during the last major Icelandic eruption in 2010 I got stuck in Boston for 8 days, and I’m travelling this week.

Going through the main highlights in more detail now, let’s start with US CPI tomorrow. Our economists and consensus expect headline to come in at only +0.1% mom due to softer energy prices.DB think core edges up to +0.4% from +0.3% last month (consensus unchanged). If DB is correct the YoY rate will be 3.3% and 4.2%, respectively, with the consensus 0.1pp lower on core. On DB’s estimates, the 3m and 6m annualised core reading would be 4.1% (up 1pp) and 3.6% (unch), respectively. So that will still be a headache for the Fed if realised.

DB expect PPI on Wednesday to see headline at +0.2% (from +0.5%), due to softer energy prices, and core steady at +0.3% with all the attention on the components that directly feed into the Fed’s preferred core PCE, such as health care services and airfares.

On the same day US retail sales will be important to GDP forecasts. DB expect weak unit motor vehicle sales to encourage a -0.4% print on the headline (from +0.7%), with the same forecast for sales ex-auto (from +0.6%) due to lower gasoline prices. DB expect retail control, which goes into GDP, to be only +0.1% (from +0.6%). As our economists point out this grew at an annualised +6.8% in Q3. So potentially a big step down.

See the rest of the week ahead in the day-by-day calendar of events at the end as usual. Note that 90% of the S&P 500 have reported now but with Nvidia next week breathing some life into the very late stages of the season.

Overnight in Asia, Japanese October producer prices came in below expectations, rising +0.8% month-on-month (vs +0.9% expected). In terms of markets the Nikkei is fairly flat as I type. Elsewhere, the Hong Kong Hang Seng is +0.10%, the Shanghai Comp +0.11%, the Kospi -0.10%, whilst the Chinese CSI 300 is underperforming, down -0.27%. S&P 500 (-0.46%) and NASDAQ (-0.51%) futures are notably lower for this time of day after the US outlook change late on Friday (see below). 10yr yields are currently up +0.4bps with 30yrs +1.7bps higher.

Now turning back to last week, on Friday we had the preliminary results for November’s University of Michigan consumer sentiment survey, which posted below expectations at 60.4 (vs 63.7 expected). Aside from the headline result, inflation expectations for both 1yr ahead and 5 to 10yrs came in above forecasts at 4.4% (vs 4.0% expected) and 3.2% (vs 3.0% expected). Breaking down the details, much of the raised expectations for inflation derived from concerns about higher oil prices in the context of the conflict in Israel. The first print is often revised down and energy prices have fallen back again of late so while these are not good prints, they may not stick. Indeed, markets didn’t react much, especially with US retail gasoline prices falling for a seventh consecutive week (-2.22%).

Late in Friday’s US session (after the equity bell) Moody’s shifted its Aaa credit rating of the US from stable to negative outlook, citing increased downside fiscal risks. S&P and Fitch ratings are already a notch lower at AA+, so the Moody’s move may be seen as a step towards catching up to the other rating agencies but if it did lose its last AAA rating that would be highly symbolic. It did weigh modestly on Treasuries. 10yr yields were virtually flat on the day prior to the news, but then moved higher in the final half an hour to close up +2.7bp. In week-on-week terms, they were up +8.0bps. The 30yr yield (-0.3bps) stabilised after Thursday’s losses and was flat on the week (-0.4bps) after a volatile few days that included the disappointing 30yr auction. The short-end sold off on Friday, as 2yr yields rose +4.2bps, and gained +22.2bps week-on-week, the largest weekly rise since May and back to pre-“dovish”-FOMC level. So also a big flattening last week .

The 10yr German bund yield continued to rise on Friday (+7.1bps), in part catching up to US sell-off on Thursday. In weekly terms, yields were up +7.3bps.

After stumbling on Thursday following the poor 30yr Treasury auction, US equities recovered strongly on Friday. The S&P 500 gained +1.56%, finishing the week up +1.31%, to its highest level in nearly two months. Much of Friday’s momentum was driven by the tech giants, with the NASDAQ up +2.05%, and the FANG+ index gaining +2.71% to its highest level since late July. In weekly terms, the indices were up +2.37% and +4.63% respectively. By contrast, the Russell 2000 small cap index fell -3.15% last week (despite a +1.07% rise Friday) .

Over in Europe, risk-off tones dominated on Friday, with all major European equity indices in the red (albeit before at least half of the US rally on Friday). The STOXX 600 fell -1.00% on Friday, after poor earnings outlooks from beverage firm Diageo (-12.17% on Friday) and luxury firm Richemont (-5.20%). Overall, STOXX 600 was near flat on the week (-0.21%). Elsewhere in Europe, the FTSE 100 fell -0.77% week-on-week (and -1.28% on Friday), the French CAC traded flat (-0.03%, and -0.96% on Friday), whereas the German DAX rose +0.30% (but fell -0.77% on Friday).

Lastly, turning to commodities, oil fell for the third consecutive week amid rising demand fears and easing concerns over supply risks from the Middle East, as well as news crude production reached a record high of 13.2 million barrels per day. Brent Crude fell -4.08% to $81.43/bbl, and WTI crude by -4.15% to $77.17/bbl. Oil did pare back losses on Friday, as Brent gained +1.77% and WTI by +1.89%. With perceptions of geopolitical tensions on the decline, gold dropped -2.63% week-on-week (and -1.11% on Friday) to $1,940/ounce, its largest weekly decline since the end of September.

Tyler Durden

Mon, 11/13/2023 – 08:14

via ZeroHedge News https://ift.tt/6KkhBLV Tyler Durden