CPI Unexpected Misses Across The Board Due To Plunge In Gas Prices, Core Inflation Lowest In Over 2 Years

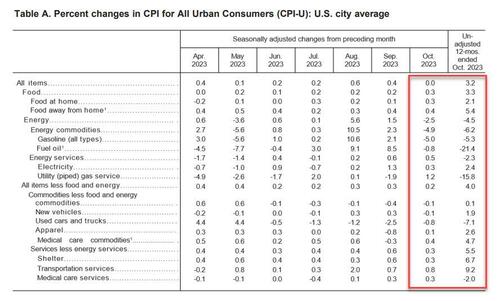

Following two months of hotter than expected prints (driven by surging energy prices and healthcare methodology changes), the October CPI print was expected slow materially from the previous month (from 3.7% to 3.3% on headline) even if core was expected to remain unchanged at 4.1%. What we got, however, was a miss in CPI across the board with both headline and core prints coming in below expectations on both a sequential and annual basis.

Starting with the headline CPI, it came in at 3.2%, below the 3.3% expected, while MoM CPI also missed expectations, printing unchanged (0.0%), below the consensus of a 0.1% print, and sharply below last month’s 0.4% print.

A similar picture emerged on core CPI, where the October MoM print was 0.2%, below the 0.3% consensus estimate and down from the 0.3% increase in Sept, while YoY managed to drop from 4.1% to 4.0% missing expectations of an unchanged print, and the lowest annual increase since Sept 2021.

According to the BLS, the index for shelter continued to rise in October (more below) offsetting a decline in the gasoline index and resulting in the seasonally adjusted index being unchanged over the month. The energy index fell 2.5 percent over the month as a 5.0-percent decline in the gasoline index more than offset increases in other energy component indexes. The food index increased 0.3 percent in October, after rising 0.2 percent in September. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.4 percent.

As noted above, the core CPI index rose 0.2% in October, after rising 0.3% in September, with the increase driven by rent, owners’ equivalent rent, motor vehicle insurance, medical care, recreation, and personal care. The indexes for lodging away from home, used cars and trucks, communication, and airline fares were among those that decreased over the month.

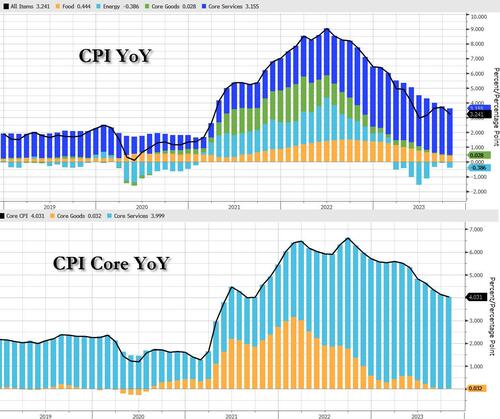

Looking at the contributions to annual CPI it’s clear that core goods inflation has all but disappeared (energy helped drag headline CPI lower in October), with the only sticky inflation left rooted deeply in services (mostly housing).

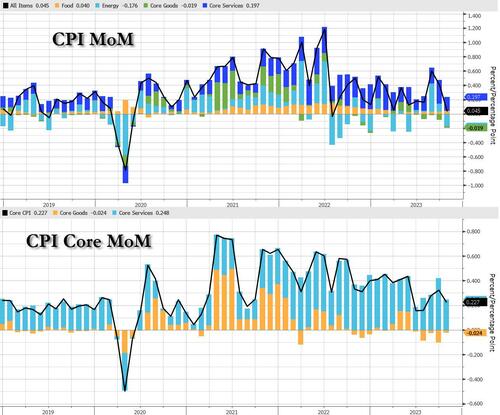

On a sequential basis, we also find that core goods inflation has been negative for the past 5 months, with energy helping drag down the headline print to unchnaged (energy detracted 0.176% from the bottom line number).

Developing

Tyler Durden

Tue, 11/14/2023 – 08:40

via ZeroHedge News https://ift.tt/yuXaIQS Tyler Durden