Even Hot Inflation Readings Can’t Buy the Dollar a Bid

By Nour Al Ali, Bloomberg Markets Live reporter and strategist

Investors might expect the dollar to rally if US headline inflation comes in hot today. Problem is, that hasn’t worked well over the past year.

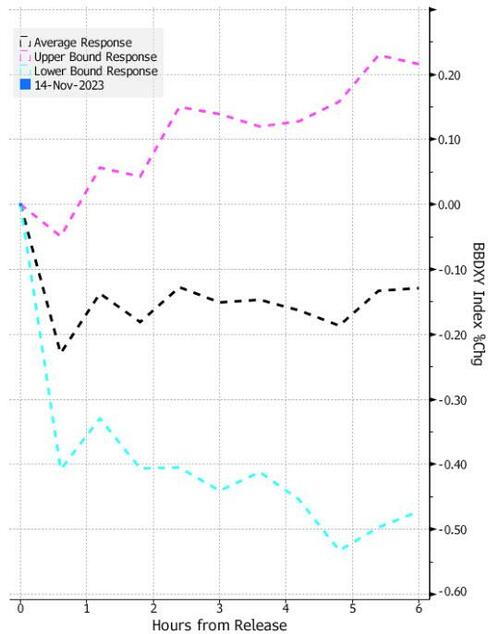

In the half hour after the past 11 US CPI data releases, the dollar fell almost without fail. And that included two instances where the reading came in hot. The only exception was last month, when headline beat and the dollar rose 0.1% in the time frame (the full Zerohedge preview is here).

Taking the average response over the period, the Bloomberg dollar index saw an immediate drop of approximately 0.2% post-release, coupled with an average decrease of ~0.3% half an hour after the release. In February, a higher-than-expected reading saw the greenback drop 0.3%.

An exception to this trend occurred in the previous month’s release, where the dollar rose within five minutes of the announcement, then rose about 0.6% over the following six hours. Over the past month, the US dollar’s upward momentum has waned, aligning with the Fed’s acknowledgment of the prevailing market consensus that the current hiking cycle is reaching its conclusion.

Tyler Durden

Tue, 11/14/2023 – 08:23

via ZeroHedge News https://ift.tt/ip2HmCc Tyler Durden