Goldman’s “Last Mile” Of Disinflation Will Be Brutal

Authored by Simon White, Bloomberg macro strategist,

Inflation is starting to re-emerge, at odds with Goldman Sachs’ view that it is set to continue slowing through next year.

The signs are here already that price growth will revive in 2024, leaving the Federal Reserve’s next rate move more likely to be a hike after an extended pause.

“We don’t think the last mile of disinflation will be particularly hard”, according to Goldman’s 2024 Macro Outlook.

But that stands in contrast to a growing corpus of data showing that far from a smooth path back to core CPI of 2-2.5% next year for the G10 ex-Japan, inflation should start to reheat, eventually pulling the Fed and other central banks back to the fore with further hikes.

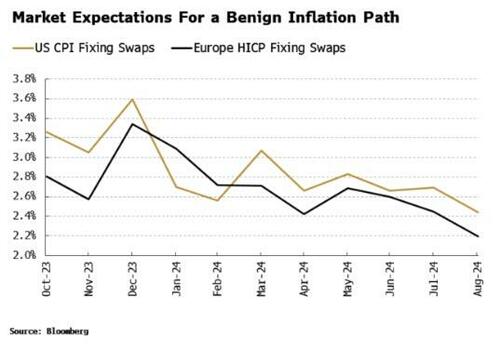

Getting inflation right remains the most important macro call. Markets are priced for a benign outcome, with CPI fixing swaps in the US and Europe expecting a steady decline in headline price growth to 2-2.5% over the next 12 months.

But the coming months are likely to see increasing volatility. Inflation lags growth, and before it shows unequivocal signs it is rising we are likely to see further signs of weaker growth, deepening expectations of rate cuts next year.

The US economy should avoid an NBER recession, while Europe and the UK may also manage to skirt full-blown economic contractions. But as it becomes clearer inflation is returning, a rate hike – not a cut – is likely to be next move of the Fed, ECB and perhaps even the BOE. Stocks and bonds will face downside risk from a realization that rates may have to remain persistently elevated.

There are at least three areas where data is already showing inflation will soon re-accelerate:

-

Persistently large fiscal deficits are fueling corporate profits, which since the pandemic are now the dominant driver of corporate prices

-

A re-acceleration in goods inflation reinforcing still-elevated services inflation

-

Rising price growth in China that will increasingly add to global inflation pressures

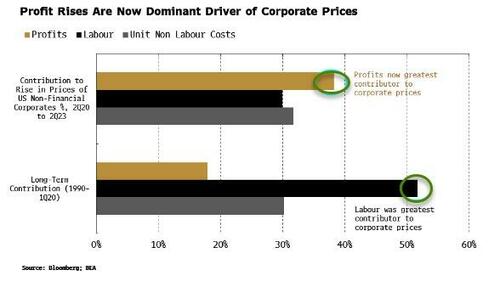

The pandemic saw a sea change in the largest drivers of corporate prices, with profits now the dominant influence. In the US, in the 30 years prior to Covid the cost of labor accounted for over 50% of the change in real corporate prices (i.e. the price per unit of real gross value added), with profits under 20% of the change.

But since 2020, that has been reversed: labor has only accounted for 30% of the change in corporate prices, while profits’ share has risen to 38%. Profits are now the single largest driver of corporate prices, and therefore are having a much greater impact on inflation.

Profits and margins have eased back recently, but that should not offer any solace to anyone with the view that their inflation potential has retreated.

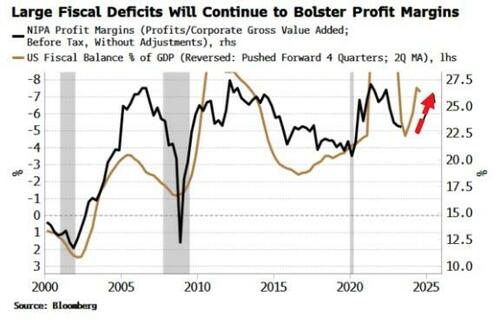

The US’s vast fiscal deficit is the elephant in the room when it comes to the rapid rise in profits seen in 2020 and 2021. Using the Kalecki-Levy profit equation it can be shown that the government deficit is currently the biggest driver of corporate profits – after all, one sector’s spending is another’s saving.

It was the fall in the fiscal impulse after its huge rise at the start of pandemic which led to a lull in profit margins. But as the chart below shows, the impulse has picked back up, and thus margins should soon do likewise. Furthermore, deficits are likely to remain large due to the emergence of a Treasury put. The Congressional Budget Office expects the same, with the deficit forecast to rise to 5.8% in 2024 from 5.4% in 2023, and to 6.1% in 2025.

Declining wage growth is part of Goldman’s disinflation argument. But wages may not be the primary vector of second-round inflation effects in this cycle as in the 1970s, and more oligopolistic corporates mean that profits take on that role, germinating a profit-price-wage spiral.

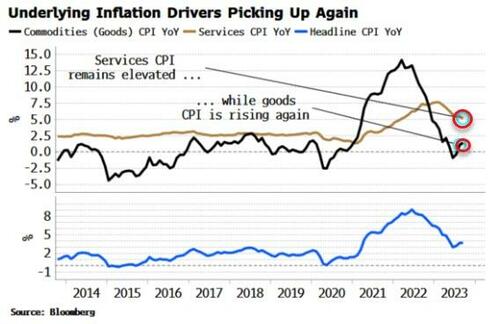

Further, the underlying dynamics of inflation are turning. Goods inflation has started rising again from a low level, and is starting to reinforce still-elevated services inflation, pushing headline CPI higher. A continued decline in core goods inflation is another of Goldman’s disinflation arguments, but goods inflation’s nascent rise is likely to be further underpinned by China.

China has been the ghost at the feast as far as the global post-pandemic recovery goes. But leading data is giving an incrementally clearer sign fiscal and monetary stimulus is having an impact.

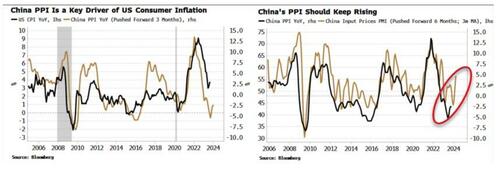

China’s PPI is one of the best gauges of global cyclical inflation. Its continued rise will mean burgeoning upward pressure on US and global CPI (left chart below). Moreover, leading data for PPI in China shows it should continue to increase (right-hand chart below).

China’s deflation has been an important component of the decline in inflation across the G10 ex-Japan, and thus its re-emergence would act as a boost to US and global price pressures.

It may look now as if we’re in the last mile of disinflation, but putting all of the above together suggests we’re getting close to this cycle’s inflation nadir, and the backdrop will soon look a lot less benign. As Stanley Druckenmiller advised, “Never invest in the present.”

Tyler Durden

Tue, 11/14/2023 – 12:15

via ZeroHedge News https://ift.tt/zk2Ecox Tyler Durden