Housing, Credit Data Spotlight China’s Slump

By Ye Xie, Bloomberg Markets Live reporter and strategist

When President Xi Jinping meets his US counterpart Joe Biden this week, he will have relatively little evidence to cite while talking up the Chinese economy. In fact, the latest credit and housing data shows growth is again losing momentum.

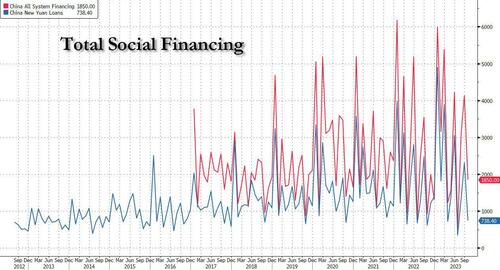

Data on Monday showed China’s credit growth remained steady in October, thanks to a jump in government bond sales, which helped mask the underlying weakness of the private sector. Even so, the flow of aggregate financing still fell short of economists’ forecasts. Those figures made clear that without the government stepping up borrowing, credit growth – the lubricant greasing the wheels of the economy — would have collapsed.

In addition, M1, a measure of money supply that includes corporate demand-deposit, grew only 1.9% from a year earlier, suggesting that nominal GDP is struggling. The weak M1 growth likely reflects the continued liquidity stress of property developers, according to Morgan Stanley.

Historically, the housing market, via borrowing from developers and home buyers, had been one of the main drivers of China’s credit growth. But despite various easing measures, the housing slump deepened.

Since the start of November, average new home sales volume in 21 major cities tumbled 44% from the pre-pandemic level in 2019, compared with a 31% decline in October, according to Nomura economist Lu Ting. That is similar to the pace of contraction in July, before Beijing started a new round of easing measures to stabilize the property sector.

The housing market isn’t the only place where consumers are reluctant to spend money. During Singles’ Day, the annual bargains extravaganza in days around Nov. 11, the total gross merchandise value (GMV) sold through the e-commerce platforms edged up 2% from the same shopping event last year, according to Nomura, citing data from Syntun, a third-party research firm. That marks a sharp slowdown from a growth pace of 14% in 2022.

All told, until housing market stabilize and consumer confidence rebounds, Beijing needs to do more to shore up the economy.

Tyler Durden

Mon, 11/13/2023 – 22:40

via ZeroHedge News https://ift.tt/La9R4N6 Tyler Durden