Michael Burry Liquidates “Big Short” After Suffering Big Loss; Doubles Down With Bet Against Semiconductors

Six months ago, when looking at Michael Burry’s Q1 13F which in turn followed just a few months after the famous permabear admitted he had been wrong to urge his followed to sell…

… we found that the Big Short had continued the trend of rapidly rotating his entire portfolio and in the first quarter, Burry liquidated the rest of his legacy 2022 holdings, dumping his entire stake in companies like Black Knight, Wolverine World Wide, MGM Resorts and Qurate, and also trimmed his formerly largest holding, private prison operator GEO group, and had reallocated the proceeds in three ways:

-

Adding to his Chinese exposure, making JD.com and Alibaba his top stocks (a move which appears to have been driven by the Q4 momentum and which has since fizzled, leading to substantial losses in Chinese names).

-

Launching a handful of new positions in energy names such as Coterra, NOV and Devon

-

Most notably, a third – or seven of the fund’s total 21 positions – were bank names, and with the exception of Wells, they were mostly distressed, regional, small banks and/or credit card companies, such as CapitalOne, Western Alliance, Pacwest, First Republic, and Huntington Bancshares, all of which had been hammered significantly during the March bank crisis.

In other words, as we put it then, “Burry appears to have enough of being called the “big short” and in this particular twist of the liquidity cycle is positioning himself to be the next “big long.”

Fast forward three months, when back in August we found that in Q2 Burry’s Scion Asset Management made even more dramatic changes to the investor’s personal portfolio.

First and foremost, we found that once again, Burry liquidated the bulk of his Q1 holdings, selling not only his previous top two positions, JD.com and Alibaba but also another 13 names of the 21 names that made up Burry’s Q1 holdings, among which were Zoom, Sibanye, Coherent, energy names such as Coterra, NOV and Devon, as well as all the banks he had acquired during the March crisis including Capital One, Wells Fargo, Western Alliance, Pacwest, and First Republic.

He also bought a bunch of things. Let’s start with Burry’s largest cash holdings which as of June 30, were Expedia ($10.9MM), Charter Communications ($9.2MM) and Generac ($8.2MM, which however is surely worth much less after the company’s catastrophic Q2 earnings which wiped out almost a third of its value). Other names Burry added were Cigna, CVS, MGM, Stellantis, Vital, all of which represented new mid-to-high single digit million positions (the full list is below).

But what was the most interesting new development, was not the single names Burry bought or sold, but his ETF and derivative trades.

Starting at the top, as of June, Burry owned two 2 million notional-equivalent blocks of SPY puts (for a notional-equivalent value of $887 million) and QQQ puts (a $739 million notional equivalent). In total, Burry owned puts on both the S&P and Nasdaq 100 for a notional-equivalent of $1.625 billion (which of course is not the capital at risk, and the actual premium Burry paid for those puts is orders of magnitude less), and which are both deeply underwater as of this moment since both the S&P and Nasdaq are trading high above where they were on June 30.

In other words, in the second quarter, Burry had made another giant (at least for his AUM) and very levered (using over $1.6 billion notional in put) “big short” bet on the broader market. Alas, unlike his infamous and original bearish bet against subprime, Burry’s latest attempt to time a market crash has crashed and burned, because according to the just released 13F from Burry’s Scion Capital, the $1.6 billion notional in puts on the SPY and QQQ have been liquidated. And since during the third quarter, when Burry unwound these positions (originally put on in Q2), the S&P did not drop below the June 30 highs, one can conclude that the puts either expired either worthless or were sold with very little value due to the brutal theta observed n Q3 when both calls and puts saw their value eviscerated.

Ok, so the “big short” liquidated his big market shorts; what else did he do in Q3?

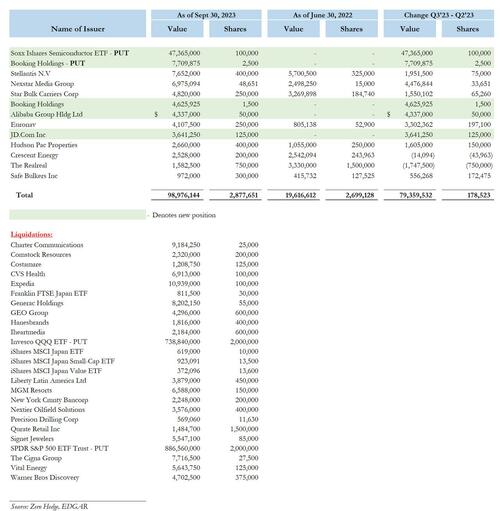

Well, as has been the case recently, Burry once again rotated almost all of his holdings, liquidating a total of 25 existing positions, including what were formerly his three biggest cash holdings including Expedia, Charter and Generac. At the same time he added to a handful of smaller positions including Stellantis, Nexstar, and Star Bulk carriers, none of which have done all that well in Q3 or Q4. Burry also appears to have taken a hedged position in Booking Holdings, where he bought both the stock and puts against the stock. Oh, and after liquidating his JD.com and Alibaba positions in Q1, the former doctor is back in the two names and is once again hoping that this time Chinese stocks will finally surge.

But the one most notable trade Burry did in Q3 was to put on a large bearish trade against semiconducors, by buying $47 million notional worth of SOXX puts, a trade which was likely prompted by Burry’s bearishness against NVDA and its peers, yet which may have been an even bigger flop than Burry’s ill-timed bet against the SPY and QQQ, especially if he held on to it until now when the SOXX is once again well above where it was on Sept 30 and is fast approaching 2023 highs largely thanks to Nvidia.

Burry’s full 13F summary is below.

Tyler Durden

Tue, 11/14/2023 – 15:13

via ZeroHedge News https://ift.tt/Ug8enj6 Tyler Durden