Wall Street Reacts To Today’s CPI Shocker Which Was The Biggest “Market Surprise” Of 2023

After several months of upside surprises, markets were expecting more of the same. Instead, they got the biggest across the board CPI miss in a year, and indeed if one looks at the market reaction to the print it is shaping up as the biggest “positive surprise” response this year.

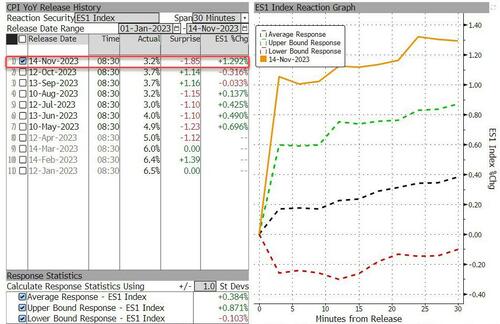

As shown in the chart below, the spike in stock futures in the first 30 minutes after the release was the largest reaction to a CPI print in 2023 based on data compiled using the Bloomberg’s Market Impact Monitor. For the dollar, this is the largest drop and absolute move since January while gold saw its biggest gain post CPI since July.

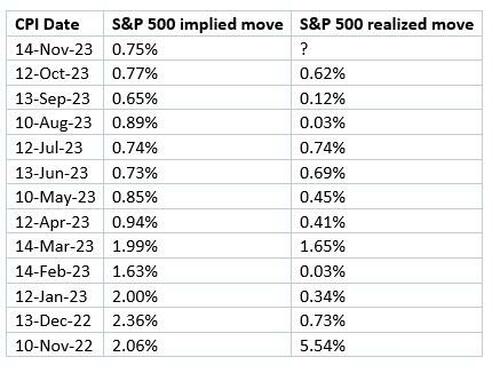

Considering options were pricing in just a 0.75% move today, there will be a lot of very unhedged, and hurt, traders.

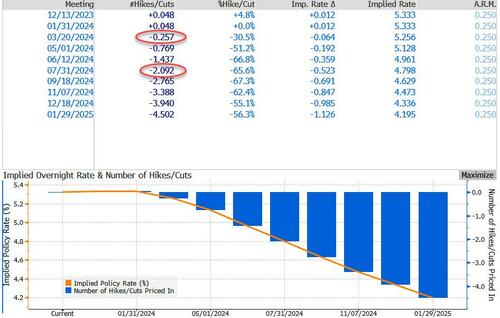

And while even the WSJ’s Nikileaks hinted that the Fed is now done with hikes, and the market pricing in some rate cuts as soon as March and around 2 cuts by July…

… Bloomberg’s Chris Antsey made a good point: “if the Fed does stay on hold in December, then by the January meeting, it will have been on hold for half a year. At that point, you would have to assume any move to raise rates again would be effectively a new cycle. Hard to see how they would think one 25 basis point increase would do the trick. We’d be in another cycle of tightening.”

And we will be, just as soon as China panics and injects trillions into the economy to avoid a full-blown revolt, some time in late 2024 just in time to send commodities soaring to record levels ahead of the US election. Until then, however, it’s time to enjoy the end of the current hiking cycle as the bulk of Wall Street reactions to today’s CPI print suggest.

Below we excerpt the reactions to today’s CPI from several traders, analysts and strategists.

Win Thin, global head of currency strategy at BBH:

“I’m not hanging up the ‘Mission Accomplished’ banner just yet. Transportation was a big downside factor (-0.9% m/m). However, food and beverages (0.3%), housing (0.3%), and services (0.3%) are still showing solid gains. 4 cuts by end-2024? Again, ain’t happening. The market sees what it wants to see. It’s been wrong on the Fed this entire cycle.”

Ian Lyngen of BMO Capital Markets:

“This print was good news for the Fed and offers evidence that monetary policy is still effective and impacts the real economy with a lag — the fundamental things apparently still apply. This takes a rate hike off the table in December and reinforces our call that July was the last hike of the cycle and the process will now shift to the Fed attempting to delay cuts as long as possible.”

Anna Wong of Bloomberg Economics:

“October’s surprisingly soft core CPI reading will increase Fed officials’ confidence that rates are sufficiently restrictive. Still, core CPI readings will need to continue on this path for several more months for the FOMC to declare a definitive end to the rate-hike cycle. Looking at the 12-month change in core inflation, it’s still running at twice the pace of the Fed’s 2% target. Overall, inflation is still a long way from the target — and the road there is sure to be bumpy.”

Greg McBride, Chief Financial Analyst at Bankrate

“The slower pace of inflation is little comfort to households still dealing with the cumulative effect of rising prices. The strain on household budgets is real with the Consumer Price Index up more than 18% in the past 3 years.”

Jay Bryson, Wells Fargo chief economist:

“You would need to see a few more months of 0.2 before saying mission accomplished. I think the Fed is going to delay easing at this point.”

Bryce Doty, of Sit Investment Associates:

“The Fed looks smart for effectively ending their tightening cycle as inflation continues to slow. Yields are down significantly as the last of investors not convinced the Fed is done are likely throwing in the towel.”

Kathy Jones of Charles Schwab:

“Things are going their way and they probably don’t want to change policy until there is more confidence in the inflation outlook. I think the Fed sticks with it’s on-hold policy until they get a series of low month to month readings over a period of 3 to 6 months and/or the labor market shows a lot more weakness.”

Oscar Munoz, macro strategist at TD Securities

“Core goods still in deflation, that was a surprise for us. We were looking for strength there. New vehicles prices and apparel were surprises to the downside for us. The OER decline was expected, though rents continue to move sideways (some concern there). Lodging away from home was a driver of inflation in Sep, it mean-reverted today. All told, good report for the Fed. They will continue to maintain the odds of another hike on the table, but the market won’t buy it. Higher for longer will be the message Fed officials will try to convey.”

Stuart Paul, of Bloomberg Economics

“Lodging away from home again served as a critical swing factor. Whereas a surge in lodging prices boosted shelter costs in the September report, the 2.5% month-on-month decline in October created approximately 3 bps of drag and explains much of the downside surprise in inflation. Measures of homeowners’ equivalent of rent moderated to 0.4% in October from 0.6% in September, creating additional disinflation in reported shelter costs.”

Spencer Hakimian, CEO of Tolou Capital Management:

“The cumulative effect of 525 basis points of tightening, along with QT, are evidently working. The FOMC must exercise patience and allow last year’s tightening fully flow through the economy. Two-year Treasuries are poised for significantly attractive risk-adjusted returns, due to market pricing for rate cuts as well as a nearly 5.00% yield.”

Victor Masotti, Director at Clear Street:

“Softer than expected CPI data has traders repricing probabilities for the FOMC’s next move as today’s inflation reading supports the view that rates have peaked and the FOMC will need to begin easing sooner rather than later. At close of business yesterday, December FOMC rate hike probabilities were at 15%, while we are now at 0% chance of a hike after CPI YoY came in at 3.2% versus expectations of 3.3% and last month’s print at 3.7%. The narrative has now shifted towards 2024 as to when the first rate cut will come with the market pricing in a 75% chance of a cut in May 2024 and pricing in more than one 25bp rate cut in June 2024. In repo pricing, we have seen 2 and 3mo term repo tighten 2-3bps from last week’s prints. As for year-end funding, general collateral year-end turn (12/29/23 – 01/02/24) has been printing in the 5.60 range.”

Source: BBG, primary sources

Tyler Durden

Tue, 11/14/2023 – 11:00

via ZeroHedge News https://ift.tt/WaXH6jG Tyler Durden