Industrial Production Plunges In October As Auto-Maker Strikes Hit

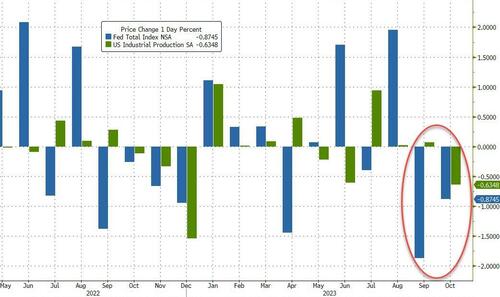

After its surprising bounce last month (on a seasonally-adjusted basis, because it crashed NSA), US Industrial Production was expected to decline 0.3% MoM in October. It was worse – down 0.6% MoM from a downwardly revised September print (from +0.3% to +0.1%). October’s decline is the worst since Dec 2022 and the YoY drop of 0.8% is the worst since the COVID lockdowns…

Source: Bloomberg

Notably, once again, the non-seasonally-adjusted industrial production tumbled more than then seasonally-adjusted data…

Source: Bloomberg

On the manufacturing specific sector, consensus was for a 0.4% drop MoM but it was considerably worse, dropping 0.7% MoM (and September’s print was revised down from +0.4% to +0.2% MoM). That is the biggest MoM drop since March and biggest YoY drop since the COVID lockdowns.

That is also the 8th straight month of YoY declines for Manufacturing production.

Source: Bloomberg

Output was weighed down by a 10% plunge in motor-vehicle production as the annualized rate of car assemblies dropped to 9.22 million units, the least since February 2022. Excluding parts production, autos and trucks production fell 16.5% MoM – the biggest drop since the COVID lockdowns…

Source: Bloomberg

Starting in September, the United Auto Workers union authorized targeted strikes against the Big Three Detroit automakers, disrupting production at the companies and at their suppliers. The UAW reached tentative agreements with management in late October, laying the groundwork for a rebound in factory output in November.

So theorteically, we should see bounce back next month. Unless demand – as WMT hinted at – has fallen off a cliff.

Tyler Durden

Thu, 11/16/2023 – 09:25

via ZeroHedge News https://ift.tt/NTrbG5l Tyler Durden