The Fed Can’t, And Won’t, Nail The Dismount

Submitted by QTR’s Fringe Finance

There’s nothing more pathetic than being wrong in your prognostications and then Monday morning quarterbacking an excuse after the fact. It’s behavior that I don’t tolerate from people in my life and shouldn’t tolerate from myself either.

After all, if my brain droppings are going to be of any help other than just being cathartic for me, the goal should be correctly analyzing trends ahead of time. While my lengthy disclaimer at the bottom of all my posts makes it clear that I’m not a professional, generally shouldn’t be listened to, and write only my own personal thoughts and opinions, it would still be nice to get something right once in a while.

I’ll pause for obligatory pity laughs.

First, I’ll take to my mea culpa: I have been predicting that equity markets are going to move lower for the last two years, since rates have started to rise, and for the most part I’ve been wrong. This doesn’t mean I’ll be wrong in the future, but it’s important to know that thus far my timing has been poor, while I continue to believe that the fundamentals of my thesis – namely, that 5% rates on the largest outstanding bubble of debt in history – are still going to wreak havoc.

Next, let’s take a look at what happened on Tuesday, post-CPI, and why I think people are getting way too excited, way too quickly about inflation, the Fed, and rate cuts.

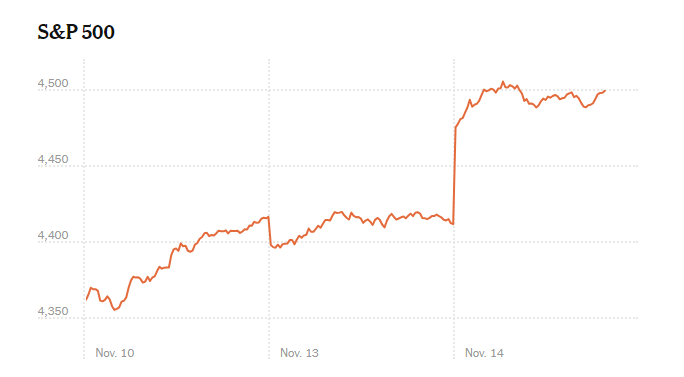

CPI, which is still elevated at 3.2%, came in under expectations (not under the Fed’s target), leading to a huge spike in markets, and a relief rally in bonds.

Chart: NYT

The move in bonds is less surprising for me than the move in markets.

Both assets have been pushed lower over the last couple of months, but bonds have especially been tormented.

Even if you’re a believer that yields need to continue to rise, which I think may be the case, I’m not completely surprised by the fact that bonds are using CPI as an excuse to take a breather. I continue to own and buy this one ETF on the regular, not only because I think yields are attractive with inflation where it is currently, but also because I believe these recurring buys will eventually capture higher yields if the bond market winds up continuing to crash in the mid-term.

One thing is still for certain: I really do believe something is going to have to break as a result of the last 18 months of elevated rates. We already saw the beginnings of this with regional banks needing to be bailed out by the Fed. But as I have stated innumerable times in past blog posts, I remain especially wary of entire sectors like commercial real estate, which has yet to mark its book across many investments, and housing, which I believe has already peaked and is in the midst of a significant pullback due to higher mortgage rates and a general need for deleveraging across the country.

I pointed out that the American consumer is stretched beyond their means in ways that they haven’t been for years in an article last week, when I noted these four charts showing everything you need to know to make the case for an economic downturn.

The trillion-dollar question that the stock market on Tuesday thinks it knows the answer to is whether or not the Fed is going to be able to break the back of inflation and declare success and a soft landing. Some people, like Jim Cramer, have already declared the soft landing a success.

When you see a move like Tuesday’s post-CPI move in the market, it isn’t just a relief rally, it’s also partly the market buying into the idea that the Fed both (1) knows what it’s doing and (2) is having success in its plan to quell inflation with higher rates. And to some degree, their plan is working: as can be seen in this chart, here’s the obvious reason CPI may be falling.

The routine has been good, in the sense that the market has held up and there’s been no real signs of panic despite the fact that there should be. I’ll admit it. But the broader question here is whether or not the Fed can stick the dismount.

Alternately, you can think of the Fed as somebody trying to pack at the end of a vacation. Somehow you’ve acquired more shit than you left with, and even though you can get it all into your luggage at first, flipping over your suitcase and trying to zip it up becomes an impossible task: there’s simply too much volume for it to hold.

This is the same type of stark, inevitable realization that we’re going to have about our economy: all this bullshit simply can’t fit into the confines of mathematics and reality.

We simply can’t keep rates where they are without something breaking, and the two-year lag that generally follows moves in monetary policy changes is all but behind us now: we are officially walking into the unknown and, ironically, it’s coming at the point when everybody is the closest to declaring victory.

A lot is going to depend on how inflation winds up going over the next year.

As a reminder, even though it “missed expectations” on Tuesday, inflation is still elevated at over 3%, and the Fed continues to say that it is committed to getting inflation back to its 2% target. If they hold to this, they are going to find out that they’re going to need to keep rates higher for longer than they thought, in my opinion.

But let’s say that current market predictions are accurate and the Fed starts to cut as soon as next summer without a market catastrophe. It is around these times when the effects of monetary policy from years past will finally start to catch up to the economy and the market and reality will set in.

As I have written in the past, market crashes usually don’t happen until the end of a rate hike cycle, or sometimes even not until the Fed starts cutting again. These two charts show that.

It’s difficult not to get swept up in the narrative that things may very well just be OK and the Fed may have nailed its job. It is everywhere, and when markets have a green day like they did on Tuesday, with the Dow rising over 2%, everybody on the street is eager to shove it in the faces of everybody else that all of the bears and pessimists were once again just cautious for no reason.

But it’s at this moment – the peak of hubris, the area when a soft landing is so close that everybody feels like they can reach out and touch it – that caution is the most warranted.

50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

Again, it’s important to admit that I understand how ridiculous some of this sounds, especially because I’ve been calling for lower equity markets over the last two years.

To me, it was inconceivable that with the market’s valuation we would need to wait two years for people to start to take caution, even ahead of something breaking economically. But I underestimated the resilience of the batshit crazy and outright pernicious mindset that has been cast over market participants as a result of decades of easy money. Why wouldn’t anybody think that a P/E of 25X is cheap? Am I even surprised that the market continues to rally?

All I can do is just shrug my shoulders and admit that so far I’ve been wrong. Hell, maybe it’ll turn out that I’ll just be wrong in general and the Fed will nail it without a catastrophe taking place.

One way or another, we’re getting rate cuts relatively soon. Most people think that it will be a result of natural easing by the Fed as inflation continues to cool, and I think that it’s going to be because of a catastrophic trainwreck somewhere that begets deleveraging and panic in markets (and on CNBC) that will scare the Fed shitless and force them to cut when it’s already too late and the damage has been done.

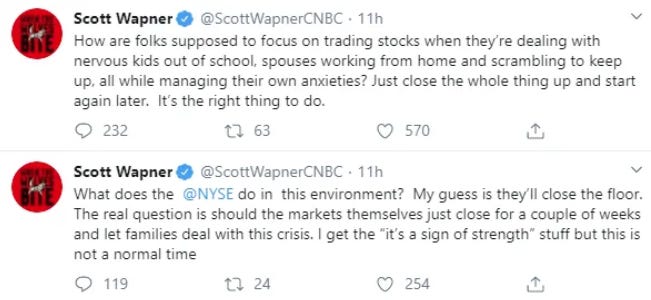

Don’t think it can happen? It’s only been 3 years since the last market meltdown had the cool, calm and collected CNBC lot begging for regulators to shut down the stock market because stocks were going down. Remember when Scott Wapner suggested we “just close the whole thing up and start again later”?

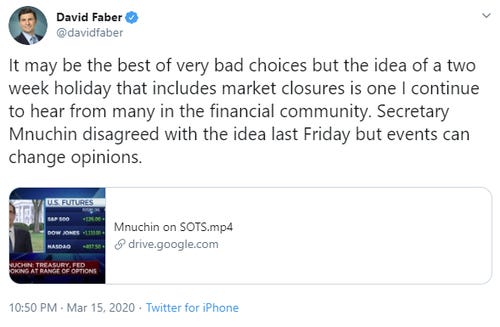

And when David Faber was floating the idea of a two week market holiday?

In the words of Niles Crane, “Was I ever that young?”

Anyway, if the former situation happens (natural rate cuts without a trainwreck), there’s still a good chance we could run into a major economic catastrophe in the process. After all, rates at 4% instead of 5% won’t make too significant of a difference on the giant debt balloon that we have blown up over the last two decades. There are too many sectors in crisis and rates were simply at 0% for too long. Even rates at 2% or 3% would eventually cause significant chaos with the amount of very cheap debt that we have outstanding.

And then of course there’s the pesky looming question of whether or not we’re going to have an inflationary crack-up boom and the nominal price of stocks will rise – with Larry Lepard making the best case for this on my last podcast – or if we’re going to have a deflationary depression, where the prices of everything crash, and the economy grinds to a halt. Even though both of those situations are polar opposites, they would both be catastrophic for the consumer and the economy. And if you’re long gold and short the market, like I am, there’s a bunch of different ways to win in both situations. And the only situation I see where the market would rise and gold wouldn’t, would be one where the general public believes that the economy is growing on its own without the help of Fed easing or inflation. I’ll pause for laughter.

And so, while we likely have another week where stocks rallied mightily, and the data looked as though it’s moving in the market’s favor, one needs to step back, zoom out, and come to several unpleasant realizations that I don’t think are being discounted anywhere right now.

-

First, valuations are still extremely elevated, with the S&P multiple still around 25x earnings.

-

Second, we are at a point of unprecedented geopolitical volatility compared to the last several decades, with war breaking out in the Middle East and Russia still at war with Ukraine. The West and its foes continue to diverge from one another and it looks as though prospects for progress globally are no more promising today than they were a week or a month ago.

-

Third, people need to understand that inflation still isn’t dead yet. Inflation coming in at over 3% is a far cry from the Fed’s 2% target. I’ve stated in the past and continue to believe that the Fed is going to have to raise their inflation target eventually, and that something over 2% will be the new normal. If this happens, expect precious metals and other commodities to skyrocket. But for now, remember that a step towards a perceived success does not equal winning the war on inflation. And if we win the war, we may overshoot into deflationary depression territory quickly as M2 continues to evaporate.

-

Fourth, it’s important that people understand that entire market indices are being led by just a couple of stocks. Market breadth is at rock-bottom levels while indices continue to somehow move higher. This is the result of what’s being called the magnificent 7 stocks. This means that if these 7 stocks start to pull back, you can expect the entire market to collapse with them.

-

Finally, in the midst of all this chaos, it is important to remember that there is a significant amount of investment across the board that has still not been reined in. Last week I wrote about how WeWork and FTX – both companies worth tens of billions of dollars at one point – fell from grace and have seen their founders publicly ridiculed, despite once being labeled as visionaries. I expect this to continue to happen, not only to high-flying VC unicorns like these names, but also across other sectors, like commercial real estate, that are due for a major comeuppance.

With rates where they are, this is simply unavoidable. There are games of “pass the hot potato” being played right now as your read this behind the scenes, with major companies undoubtedly looking to offload toxic assets that we have no clue even exist.

We only find out about these travesties after literally every last possible Band-Aid or avenue for rectification has been tried and then fails. In other words, there is a large lag from monetary policy to economic impact, but there is an even larger lag behind companies going bust and actually admitting it publicly, voluntarily or involuntarily.

I’m not incapable of changing my mind, and today’s piece will either go down as part of a volume of work that makes it very easy to ridicule me in the future, or it will be found to be prescient at a time when it was most needed. The only thing I know for sure is that I come by it honestly when I try to remind myself that it is now, at a time when everybody thinks are perfect and the Fed is on its way to a “10” routine, that it seems like a good reminder that in my opinion they can’t, and won’t, nail the dismount.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Thu, 11/16/2023 – 11:25

via ZeroHedge News https://ift.tt/Lnz1oMf Tyler Durden