The Memo On Hard Landing Hasn’t Yet Reached The Stock Market

By Ven Ram, Bloomberg Markets Live reporter and strateigst

Stocks seem to be increasingly growing in conviction that inflation will slow sufficiently without the US economy rolling over. That is the dream-like scenario of a soft landing, but it’s also a dream. So, enjoy it while it lasts.

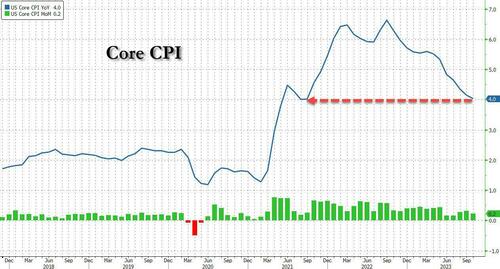

The S&P 500 has added to its already impressive gains for the year after the slower-than-forecast inflation numbers for October, but that stray swallow isn’t a reliable indicator of warmer weather. While we saw price pressure ease successively for 12 months through June, the trajectory has since been erratic. And it pays to not forget that core inflation is still running at twice the Federal Reserve’s target. Little wonder that Treasury yields resumed their upward journey Wednesday after Tuesday’s febrile declines.

The Fed estimates that the labor market won’t come into balance until the jobless rate climbs to at least 4.1%. While the unemployment rate nudged higher last month, the average this year has been 3.6% — far from levels that would bring the employment market into balance.

As Chair Jerome Powell cautioned recently, it may be a good idea to beware of head fakes in inflation, especially in the context of a still-resilient economy:

“We do expect growth to moderate in the coming quarters. Of course that remains to be seen. And we are attentive to the risk that stronger growth could undermine further progress in restoring balance in the labor market and in bringing inflation down, which could warrant a response from monetary policy.”

Given how strong demand is in the labor market and deeply embedded inflation in the aftermath of the pandemic, it’s unlikely that the Fed — despite its best efforts — will be able to land the economy with a gentle touchdown.

The idea that we go gently into the sunset is highly overwrought — the longer the economy stays resilient and the more prolonged the last mile of the inflation journey gets, the greater the risk of a hard landing will be. Right now, stocks don’t buy that story, but when they get the memo some day, it won’t make for great reading.

Tyler Durden

Fri, 11/17/2023 – 07:20

via ZeroHedge News https://ift.tt/ZyCSp3A Tyler Durden