‘Hawkish’ FOMC Minutes: Warn On Fading Consumer, Financial System Stability Risks

Since the last FOMC meeting, on November 1st, the dollar has tumbled over 3% sending stocks, bonds, and bitcoin all higher (and gold, though only marginally)…

Source: Bloomberg

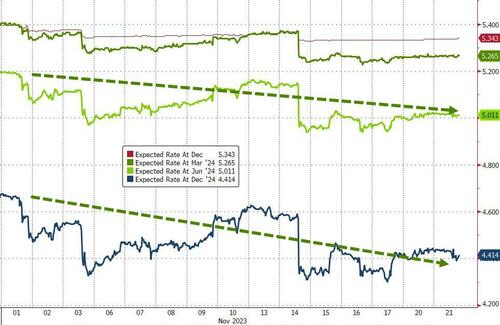

Rate-change expectations have shifted significantly more dovish with more rate-cuts priced-in sooner in 2024 (with nearly 100bps of cuts priced-in for next year)…

Source: Bloomberg

The yield curve (2s30s) has flattened (re-inverted) dramatically too…

Source: Bloomberg

Perhaps most notably, since The Fed highlighted the fact that the market “was doing its job” (by tightening financial conditions), US macro data has serially disappointed and financial conditions have loosened dramatically…

Source: Bloomberg

The point of all that is to suggest the market is now convinced The Fed is done hiking (and just as convinced they will start cutting soon) and so today’s Minutes will be analyzed for any insights into that narrative.

The problem – of course – is that the Minutes are stale and have missed significant events from the macro side (soft payrolls and CPI data for example); and as a reminder, Powell, speaking around a week after the FOMC meeting, struck a more hawkish tone, and said that although progress had been made on inflation, there was still a “long way to go”.

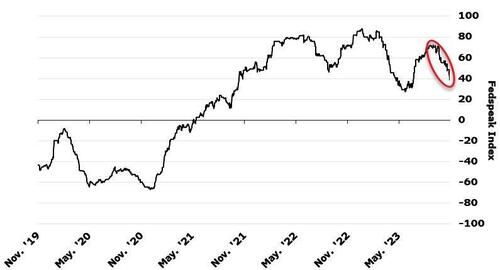

Additionally, FedSpeak has been hawkish since The Minutes: Applying Bloomberg Economics’ natural language processing model to Fedspeak, recent committee statements still indicate a hawkish tilt — though moving toward neutral.

This primarily reflects members seeking to transmit caution and convey a higher-for-longer stance.

So, what do The Minutes show?

These are the key takeaways from minutes of the Fed’s latest meeting:

“All” officials supported the decision to hold the benchmark rate in a 5.25%-5.5% target range, indicating the broader 19-member Federal Open Market Committee was also united, in addition to the 12-0 decision among voting members.

The minutes also make it clear that even if the Fed isn’t hiking, policymakers want to keep rates high until they are convinced inflation is under control.

Policymakers agreed that the Fed “was in a position to proceed carefully” on whether to hike again and should condition further tightening on whether sufficient progress has been made in bringing down inflation

All participants agreed that the Committee was in a position to proceed carefully and that policy decisions at every meeting would continue to be based on the totality of incoming information and its implications for the economic outlook as well as the balance of risks.

All officials judged it would be appropriate to keep rates at a level restricting the economy “for some time until inflation is clearly moving down sustainably” toward the Fed’s 2% inflation goal

In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time.

A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted.

Most policymakers saw the risks to inflation as weighted to the upside.

“The staff continued to view the uncertainty around the baseline projection as considerable. Risks around the inflation forecast were seen as skewed to the upside, given the possibility that inflation could prove to be more persistent than expected or that further adverse shocks to supply conditions might occur.

Should these upside inflation risks materialize, the response of monetary policy could, if coupled with an adverse reaction in financial markets, tilt the risks around the forecast for economic activity to the downside.”

Fed staff expected below-potential growth over next two years with a slowing business sector:

A few participants commented that their business contacts had reported that cost increases could not be easily passed on to customers.

Several participants noted that an increasing number of District businesses were reporting that higher interest rates were affecting their businesses or that firms were increasingly cutting or delaying their investment plans because of higher borrowing costs and tighter bank lending conditions.

A few participants noted that the tighter financial and credit conditions could be particularly challenging for small businesses.

A few participants observed that higher interest rates were also affecting the agricultural sector, with their contacts noting that high financing costs were likely weighing on purchases of heavy agricultural equipment.

Regarding the energy sector, a few participants observed that energy markets had calmed after significant volatility at the start of the current armed conflict between Israel and Hamas.

…and warns on the fading consumer:

Some participants remarked that the finances of some households—especially those in the low- and moderate-income categories—were increasingly coming under pressure amid high prices for food and other essentials as well as tight credit conditions.

Several participants added that delinquencies on auto loans and credit cards had risen for these households

Some participants commented that their District contacts reported a somewhat weaker picture of consumer demand than indicated by the incoming aggregate data.

A few participants observed that activity in the housing sector had flattened out in recent months, likely reflecting the effects of further increases in mortgage rates from already elevated levels.

Reiterating comments from the press conference, the minutes also discussed the tightening of financial conditions (although, of course, as we detailed above, conditions have loosened dramatically since).

Credit continued to be generally available to businesses, households, and municipalities. Total core loans on banks’ books continued to increase in the third quarter, although at a slower pace than earlier in the year.

However, smaller firms were finding it harder to obtain credit, with the share of small firms reporting in September that it was more difficult to obtain credit compared with three months earlier rising from an already elevated level.

Capital market financing continued to be available, although issuance in most markets was below typical levels.

Finally, Fed staff continue to see notable risks to the stability of the financial system, noting that “valuations in equities, housing, and CRE were high.”

But of course, as we noted above, this was before the soft jobs and CPI data.

Read the full Minutes below:

Tyler Durden

Tue, 11/21/2023 – 14:05

via ZeroHedge News https://ift.tt/e3JPrVN Tyler Durden