Lowe’s Shares Drop On Do-It-Yourself Weakness

Shares of Lowe’s Cos. Inc. fell 5% in premarket trading as the home improvement retailer lowered its annual revenue outlook once more, indicating growing challenges in discretionary spending for home renovations.

In a statement, CEO Marvin Ellison said, “In the third quarter, the company delivered strong operating performance and improved customer service despite a greater-than-expected pullback in DIY discretionary spending, particularly in bigger ticket categories.”

Ellison continued, “Given our 75% DIY mix, the DIY pressure disproportionately impacted our third quarter comp performance.”

For the third quarter, total sales fell to $20.5 billion from $23.5 billion, whereas Bloomberg Consensus data was around $20.91 billion. Comparable sales saw a 7.4% decline, exceeding the 5.4% drop forecasted by analysts.

Here are the key results from the third quarter:

-

Net sales $20.47 billion, -13% y/y, estimate $20.91 billion

-

Comparable sales -7.4%, estimate -4.9%

-

Gross profit $6.89 billion, -12% y/y, estimate $6.99 billion

-

Gross margin 33.7% vs. 33.3% y/y, estimate 33.3%

-

SG&A as a percentage of revenue 18.4% vs. 27.5% y/y, estimate 18.2%

-

Operating margin 13.2% vs. 3.93% y/y, estimate 13.2%

-

Total location count 1,746, -11% y/y, estimate 1,739

-

Retail space 194.90 million square feet, -6.3% y/y, estimate 194.46 million

Lowe’s expects $86 billion in total sales for the full year, whereas its previous forecast was $87 billion to $89 billion. It forecasts a 5% decline in comparable sales versus an earlier 2% to 4% forecast.

Here are the key results from the full-year forecast:

-

Sees comparable sales -5%, saw -2% to -4%, estimate -3.44% (Bloomberg Consensus)

-

Sees adjusted EPS $13.00, saw $13.20 to $13.60

-

Sees operating margin 13.3%, saw 13.4% to 13.6%, estimate 13.5%

-

Sees total sales about $86 billion, saw about $87 billion to $89 billion, estimate $87.59 billion

-

Still sees capital expenditure up to $2 billion, estimate $1.91 billion

The results were similar to rival Home Depot Inc.’s report last week that warned home-improvement demand was waning.

Lowe’s and Home Depot’s latest earnings results underscore the shift away from big home renovation projects after the Covid boom.

Also, Walmart CEO Doug McMillon warned last week, “In the US, we may be managing through a period of deflation in the months to come.”

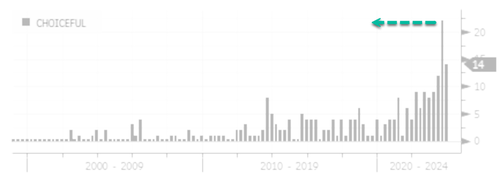

We noted Tuesday on the rising number of mentions CEOs are referring to consumers as “choiceful” in earnings calls.

This is just further proof that the average consumer is weak and burdened by credit card debt, student loans, drained personal savings, and inflation in the era of ‘Bidenomics.’

Tyler Durden

Tue, 11/21/2023 – 08:25

via ZeroHedge News https://ift.tt/vtYulhI Tyler Durden