Signs Of Impending Recession Required To Keep Pressure On Yields

Authored by Simon White, Bloomberg macro strategist,

Further declines in longer-term US yields will likely need signs of a near-term recession to trigger the pricing of more aggressive Federal Reserve rate cuts.

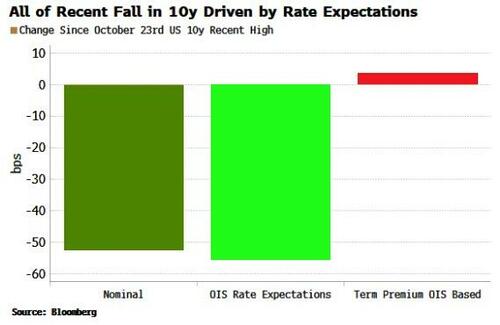

US 10-year yields have fallen over 50 bps since their recent high last month.

Almost all of this was driven by greater rate cuts being priced in.

The chart below shows the move in the 1-month OIS rate 10-years forward – an estimate of the market’s view of the long-run Fed rate – and the move in the nominal 10-year yield.

Both are almost the same, implying longer-term yields’ fall were driven by rising Fed rate-cut expectations.

It’s likely that will continue to be the case while Treasuries liquidity remains poor.

One of the worst 30-year Treasury auctions earlier this month was a stark example of how liquidity conditions have deteriorated.

Balance-sheet constraints, large fiscal deficits and elevated fixed-income vol are all contributing.

As long as liquidity is poor, USTs will face greater downside than upside risks.

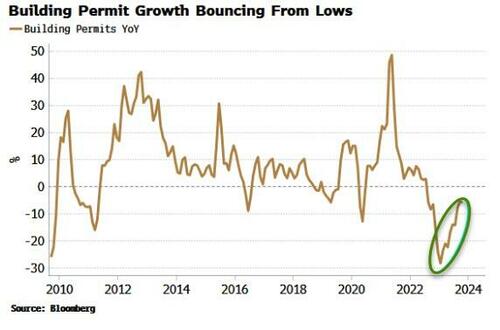

Thus to see further significant falls in US yields likely requires rising rate-cut expectations, which in turn requires evidence that a recession is fairly imminent.

That’s not the case at the moment, with several leading data points turning higher, such as building permits.

Tyler Durden

Tue, 11/21/2023 – 11:55

via ZeroHedge News https://ift.tt/SALlNMw Tyler Durden