Key Events This Week: PCE, ISM, GDP And PMI

In what is shaping up as a quiet end to the month, this week has a few data points that according to DB’s Jim Reid will sharpen the forecasts further for economists especially in the US where the personal income and spending data (Thursday) will include the all important core PCE which is of course the Fed’s preferred measure of inflation. Elsewhere in the US the highlights are the second reading of Q3 GDP on Wednesday, the ISM manufacturing and Auto Sales (Friday), and Chicago PMI (Thursday).

There’s also a 2yr and 5yr auction today and a 7yr equivalent tomorrow. Supply has been a big mover in recent weeks in both directions so although this is relatively short duration it will give some idea of demand, something that will be consistently needed over the next few months and quarters.

In Europe, all eyes will be on the preliminary CPI reports for November on Wednesday and Thursday. There will also be labor market data across key economies in the region on Thursday, and a few sentiment gauges, including consumer confidence indices for Germany and France (tomorrow), as well as the final manufacturing PMIs on Friday.

In China, the most important releases will be the November PMIs on Thursday as well as the Caixin manufacturing gauge on Friday after the October prints disappointed. Consensus only expects a slight pick up. It’s a busy week in Japan with various labour market and economic activity gauges that you can see in the day-by-day calendar at the end as usual.

Central bank speakers include Fed Chair Powell (Friday), ECB President Lagarde (today) and BoE Governor Bailey (Wednesday). More are noted in the day-by-day calendar.

Elsewhere the delayed OPEC+ meeting that was expected yesterday is now planned for Thursday. That follows oil price volatility in recent weeks with Brent crude currently hovering near $80.5/bbl, down from nearly $97/bbl at the end of September. Also on Thursday, COP28 will kick off in Dubai, lasting a couple of weeks. So expect plenty of climate headlines.

Finally expect more reports of how Black Friday and Cyber Monday went in terms of US retail sales. So far for Black Friday, Mastercard have said sales (ex-autos) were ‘only’ up +2.5% YoY but split +1.1% for in-store and +8.5% for online. Adobe have confirmed the online sales momentum by suggesting they were up +7.5% and at a record. The only thing i would say is that I’ve been receiving so many pre-Black Friday emails alerting me to early -60% discounts here and -40% discounts there. So I suspect these sales are happening earlier than they use to so you probably have to look at sales across a longer period now.

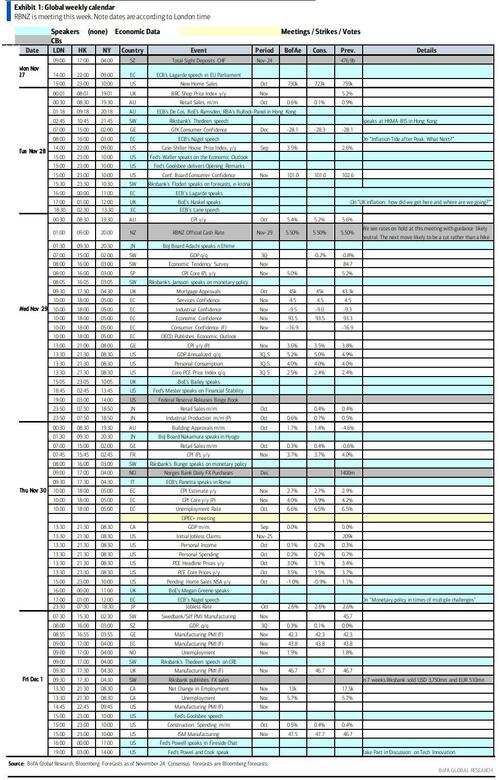

Courtesy of DB, here is a day-by-day calendar of events

Monday November 27

- Data: US October new home sales, November Dallas Fed manufacturing activity, China October industrial profits

- Central banks: ECB’s Lagarde speaks

- Auctions: US 2-yr ($54bn) and 5-yr ($55bn) Notes

Tuesday November 28

- Data: US November Conference Board consumer confidence, September FHFA house price index, Q3 house price purchase index, November Richmond Fed manufacturing index, business conditions, Dallas Fed services activity, Germany December GfK consumer confidence, France November consumer confidence, Eurozone October M3

- Central banks: Fed’s Goolsbee and Waller speak, ECB’s de Cos speaks, BoE’s Ramsden and Haskel speak

- Earnings: PDD, Workday, Crowdstrike, Intuit

- Auctions: US 7-yr ($39bn) Notes

Wednesday November 29

- Data: US October wholesale inventories, advance goods trade balance, UK October net consumer credit, mortgage approvals, M4, Japan October retail sales, industrial production, Italy October PPI, September industrial sales, November manufacturing confidence, economic sentiment, consumer confidence index, Germany November CPI, October import price index, France Q3 total payrolls, Eurozone November services industrial and economic confidence, Canada Q3 current account balance

- Central banks: Fed’s Beige Book, Mester speaks, BoE’s Bailey and Hauser speak

- Earnings: Prosus, Dollar Tree, Okta, Snowflake, Salesforce

Thursday November 30

- Data: US October personal income and spending, pending home sales, PCE deflator, November Chicago PMI, initial jobless claims, China November PMIs, UK November Lloyds business barometer, Japan Q3 company sales, profits, capital spending, November consumer confidence index, October job-to-applicant ratio, jobless rate, housing starts, Italy November CPI, October unemployment rate, Germany November unemployment claims rate, October retail sales, France November CPI, October PPI, consumer spending, Eurozone November CPI, October unemployment rate, Canada September GDP

- Central banks: BoJ’s Nakamura speaks, ECB’s Panetta speaks, BoE’s Greene speaks

- Earnings: Marvell, Dell

Friday December 1

- Data: US November ISM, total vehicle sales, October construction spending, China November Caixin manufacturing PMI, Italy November manufacturing PMI, new car registrations, budget balance, France October budget balance, Canada November jobs report, manufacturing PMI

- Central banks: Fed’s Powell, Cook and Goolsbee speak

* * *

Finally, here is Goldman’s weekly preview focusing on the US, where the key economic data releases this week are the core PCE inflation report on Thursday and ISM manufacturing on Friday. There are several speaking engagements from Fed officials this week, including Chair Powell on Friday, Fed Governor Waller and Chicago Fed President Goolsbee on Tuesday, and Cleveland Fed President Mester on Wednesday.

Monday, November 27

- 10:00 AM New home sales, October (GS -6.0%, consensus -4.7%, last +12.3%)

Tuesday, November 28

- 09:00 AM FHFA house price index, September (consensus +0.4%, last +0.6%)

- 09:00 AM S&P Case-Shiller 20-city home price index, September (GS +1.0%, consensus +0.8%, last +1.0%)

- 10:00 AM Conference Board consumer confidence, November (GS 101.3, consensus 100.8, last 102.6)

- 10:00 AM Richmond Fed manufacturing index, November (consensus +1, last +3)

- 10:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will deliver welcoming remarks at the Chicago Fed’s Midwest Agriculture Conference. On November 17, Goolsbee said “if we hit the targets that we expect to hit, then we would be on path to get to 2%, and that’s what I call the golden path – no recession, and [inflation] gets down – but that housing inflation is the thing we should really keep an eye on.”

- 10:00 AM Fed Governor Waller speaks: Fed Governor Chris Waller will speak on the economic outlook in a moderated discussion at the American Enterprise Institute. A moderated Q&A is expected. On November 7, Waller said “[the] blowout [performance of third-quarter US economic growth] warrants a very close eye when we think about policy going forward.”

Wednesday, November 29

- 08:30 AM Wholesale inventories, October preliminary (last +0.2%)

- 08:30 AM Advance goods trade balance, October (GS -$86.5bn, consensus -$86.2bn, last -$86.8bn)

- 08:30 AM GDP, Q3 second release (GS +5.1%, consensus +5.0%, last +4.9%); Personal consumption, Q3 second release (GS +4.0%, consensus +4.0%, last +4.0%): We estimate a 0.2pp upward revision to Q3 GDP growth to +5.1% (qoq ar), reflecting upward revisions to residential and business fixed investment and to government spending.

- 01:45 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak on financial stability at the George G. Kaufman Center for Financial Policy Studies Policy Conference 2023 at Loyola University. Text and audience Q&A are expected. On November 16, Mester said “we’re going to have to see much more evidence that inflation is on that timely path back to 2%. But we do have really good evidence that it has made progress and now it’s just, is it continuing?”

- 02:00 PM Beige Book, December FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the November FOMC meeting period noted that there had been little to no change in economic activity since the September report. Consumer spending was mixed, especially among general retailers and auto dealers, and tourism activity continued to improve following strong tourism spending reported in the September Beige Book. Banking contacts reported slight to modest declines in loan demand, and consumer credit quality was described as stable or healthy. Manufacturing activity was mixed, though multiple Districts reported an improving outlook for the sector. In this month’s Beige Book, we look for anecdotes related to growth, sentiment, and the evolution of labor market tightness and inflationary pressures.

Thursday, November 30

- 08:30 AM Personal income, October (GS +0.3%, consensus +0.2%, last +0.3%); Personal spending, October (GS +0.2%, consensus +0.2%, last +0.7%); PCE price index, October (GS +0.05%, consensus +0.3%, last +0.4%); Core PCE price index, October (GS +0.16%, consensus +0.2%, last +0.1%): Based on the details of the PPI, CPI, and import price reports, we estimate that the core PCE price index rose 0.16% in October, corresponding to a year-over-year rate of +3.48%. Additionally, we expect that the headline PCE price index increased 0.05% in October or increased 3.02% from a year earlier. Our forecast is consistent with core services ex housing inflation of 0.24% and with a 0.18% increase in our trimmed core PCE measure (vs. 0.28% in September and 0.17% in August).

- 08:30 AM Initial jobless claims, week ended November 25 (GS 220k, consensus 218k, last 209k); Continuing jobless claims, week ended November 18 (GS 1,890k, consensus 1,868k, last 1,840k): We estimate that initial jobless claims rebounded by 11k to 220k after falling by 24k in the prior week. We would note initial claims tend to be more volatile in November and December—likely reflecting difficulties with seasonally adjustment around the holidays—and that this week’s period coincides with Thanksgiving, which could contribute to additional volatility. We estimate that continuing claims increased to 1,890k, reflecting continued upward pressure from seasonal distortions.

- 09:45 AM Chicago PMI, November (GS 46.0, consensus 46.0, last 44.0): We estimate that the Chicago PMI rebounded by 2.0pt to 46.0 in November, reflecting upward convergence towards other business surveys. Our GS manufacturing tracker rebounded 1.4pt to 50.2.

- 10:00 AM Pending home sales, October (GS -2.0%, consensus -0.9%, last +1.1%)

Friday, December 1

- 10:00 AM Construction spending, October (GS +0.8%, consensus +0.4%, last +0.4%)

- 10:00 AM ISM manufacturing index, November (GS 48.0, consensus 47.7, last 46.7): We estimate the ISM manufacturing index rebounded by 1.3pt to 48.0 in November, reflecting the rebound in East Asian industrial activity and upward convergence towards other business surveys. Our GS manufacturing tracker rebounded 1.4pt to 50.2.

- 10:00 AM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will speak in a moderated Q&A at the Chicago Fed’s Economic Policy Symposium.

- 11:00 AM Fed Chair Powell speaks: Fed Chair Powell will visit Spelman College in Atlanta, Georgia to participate in a fireside chat with Spelman College President Helene D. Gayle. A livestream of the event is expected.

- 02:00 PM Fed Chair Powell and Fed Governor Cook speak: Fed Chair Powell and Fed Governor Lisa Cook will participate in a roundtable discussion to hear from local leaders in the tech innovation and entrepreneurship community.

- 05:00 PM Lightweight motor vehicle sales, November (GS 15.3mn, consensus 15.5mn, last 15.5mn)

Source: DB, Goldman, BofA

Tyler Durden

Mon, 11/27/2023 – 10:40

via ZeroHedge News https://ift.tt/UoeQ5r3 Tyler Durden