VIX Hits Cycle Lows In Defiance Of Weak Fundamentals

Authored by Simon White, Bloomberg macro strategist,

The VIX made its cycle lows last week, despite elevated cross-asset volatility and poor fundamentals in credit markets that would normally be consistent with a higher VIX.

The index made a new pandemic-era low last Friday, steepening the VIX futures curve.

The VXV (made up of options with an average expiry of three months) and the VIX1D (made of zero-day options) also both made new lows.

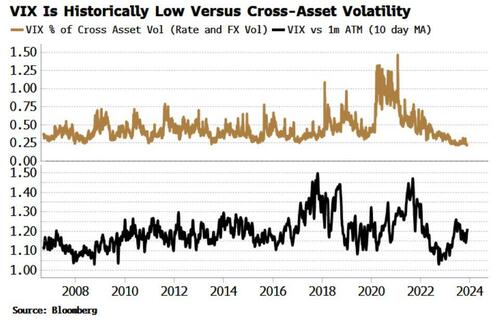

Moreover, the VIX is low versus realized volatility and, shown in the top panel of the chart below, historically low versus cross-asset volatility (i.e. fixed-income and FX volatility).

The VIX has been rising versus at-the-money volatility since 2022 (bottom panel in chart above).

Put skew has been rising as downside protection becomes more expensive. But call skew has also risen, mainly due to investors’ speculative trading, keeping the absolute value of the VIX low.

Given that stocks have spent the better part of two years in a bear market, intuitively one might expect implied vol to be higher. But dealer hedging of positive-gamma positions, which represses realized and thus implied volatility, and low implied index correlation due to the largest stocks driving the majority of the S&P’s returns have conspired to keep the VIX low.

Nonetheless, underlying fundamentals suggest the VIX should be higher. The equity of a firm is a thin sliver of capital between its assets and liabilities. When a company’s credit situation worsens, the equity must bear the burden of the adjustment, stoking its volatility.

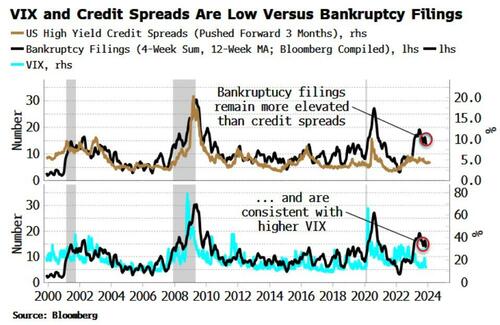

This is one of the reasons why there is such a close relationship between high-yield credit spreads and the VIX.

Bankruptcy filings in the US (which lead formal Chapter 11 bankruptcies) are elevated and consistent with wider credit spreads. Thus they are also consistent with a higher VIX.

Bank credit has tightened, loan charge-off rates are rising, and more companies are defaulting on the their debt.

Underlying credit conditions are not being reflected in credit spreads or implied equity volatility. Both are subject to an abrupt repricing higher when they are.

Tyler Durden

Mon, 11/27/2023 – 10:20

via ZeroHedge News https://ift.tt/XnP7hLb Tyler Durden