Waller Whacks The Dollar: Dovish Fed-Hawk Sparks Bid For Bullion, Bonds, & Bitcoin

Another day, another set of weaker data with Case-Shiller home-prices rising at their slowest rate since March, ugly downward revisions in the Conference Board consumer confidence data (and labor market weakness), and Richmond Fed Manufacturing and Dallas Fed Services showing anything but resilience as the temporary highs of Bidenomics’ spending spree come crashing back to earth…

Source: Bloomberg

But it was FedSpeak that prompted initial movement today.

Historically one of the more hawkish Fed members, Governor Christopher Waller said he’s encouraged by a recent slowing of economic activity, which may indicate the central bank’s policy is tight enough to contain inflation that still remains too high.

“I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%,” Waller said Tuesday in prepared remarks for an event at the American Enterprise Institute in Washington.

“I am encouraged by what we have learned in the past few weeks – something appears to be giving, and it’s the pace of the economy.”

Waller added that the recent slowdown in CPI was positive:

“This is encouraging, but it is not enough evidence to be sure it will continue,” Waller said.

“Just a couple of months ago, inflation and economic activity bounced back up, and the future was looking less certain.”

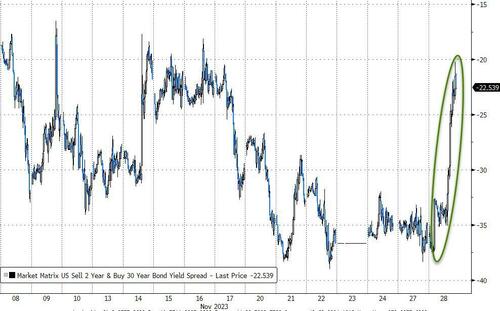

But Waller’s comments essentially endorsing the Taylor Rule were the market mover – implying that when inflation cools, real interest rates should decrease – prompted a major bull curve steepening in TSY yields…

Source: Bloomberg

If inflation continues to cool for several more months, maybe three to five months, and US central bankers feel confident it’s headed in the right direction, the Fed could lower the policy rate just because inflation is low, Waller told the audience in a question-and-answer session at the American Enterprise Institute.

Rate-cut expectations surged on the headlines (now pricing in 110bps of cuts in 2024)…

Source: Bloomberg

Of course, CPI’s next print will drop on Thursday morning.

“The Fed is providing parameters for the potential of looser policy,” said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities.

However, Waller did note (somewhat hawkishly) that “the recent loosening of financial conditions is a reminder that many factors can affect these conditions and that policymakers must be careful about relying on such tightening to do our job.”

Source: Bloomberg

But, Fed Governor Michelle Bowman (another traditional hawk) is less sure about the progress being sustainable:

“We should keep in mind the historical lessons and risks associated with prematurely declaring victory in the fight against inflation, including the risk that inflation may settle at a level above our 2 percent target without further policy tightening,” she said.

The US equity majors chopped around but a late-day short squeeze lifted The Dow, Nasdaq, and S&P into the green while Small Caps ended red…

“Most Shorted” stocks had a double-squeezey day today – first from the initial dip after the down-open and then after the 7Y auction…

Source: Bloomberg

VIX pushed down to a new cycle low around 12.60 before the 7Y auction triggered a massive spike above 14 (and back down)…

…not a fat finger.

Treasuries were aggressively bid from around 8amET with the short-end outperforming (2Y -12bps, 30Y -2bps). Since the close before Thanksgiving, the short-end is down 17bps (and 25bps from Monday’s highs)…

Source: Bloomberg

10Y yields are down to almost 4-month lows (was 5.00% the top?)…

Source: Bloomberg

And the 2Y Yield hit 4-month lows…

Source: Bloomberg

The dollar was clubbed like a baby seal back to 4-month lows on the dovish narrative…

Source: Bloomberg

And as the dollar sank, gold jumped back above $2040, back up near record highs…

Source: Bloomberg

Bitcoin surged back above $38,000…

Source: Bloomberg

Oil prices ripped back higher after dropping on OPEC headlines with WTI back up to $77, erasing losses from last week…

Finally, given the decoupling between real-yields (surging higher) and gold prices, it would appear the precious metal is very much in play…

Source: Bloomberg

…and no, Sara Eisen, you don’t need a weaker dollar for gold strength…

Source: Bloomberg

…but, of course, in the limit, that’s where it ends.

Tyler Durden

Tue, 11/28/2023 – 16:00

via ZeroHedge News https://ift.tt/y3MOU2R Tyler Durden