WTI Holds Gains After API Reports First Crude Draw In 6 Weeks

Oil prices rallied for the first time in five sessions as traders shrugged off early OPEC+ rumors to ramp back to last week’s highs.

Which way the oil market breaks will largely depend on if OPEC+ can “show continued unity as a group and commitment to ‘ stable’ (or really ‘higher’) prices over the long run,” analysts at Sevens Report Research wrote in Tuesday’s newsletter.

“If Thursday’s decision instills confidence in their ability to support prices effectively, then oil could make a run back into the mid-$80s or beyond,” they said.

“However, if the group shows a fractured membership, then new 2023 lows are almost a certainty with a drop into the $50s well within the realm of possibility.”

For now, all eyes are on the inventory data for signs of strength after weeks of crude builds.

API

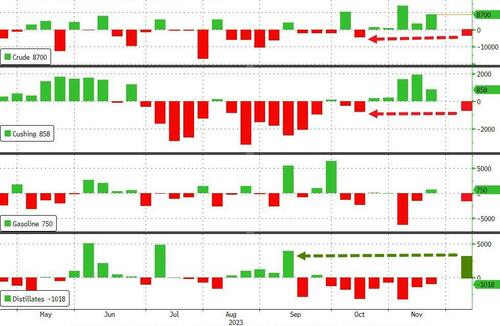

-

Crude -817k (-700k exp)

-

Cushing -465k

-

Gasoline -898k (+200k exp)

-

Distillates +2.81mm (-100k exp)

Crude stocks declined last week according to API. The 817k draw is the first in six weeks, and Cushing stocks also declined. Distillates saw a large 2.8mm barrel build – the first in 9 weeks

Source: Bloomberg

WTI was hovering just below $76.50 ahead of the API print and edged higher after the crude draw…

“The Saudis and OPEC+ have made a habit of surprising markets in recent years when it comes to their meetings. However, with aggressive cuts already in place, it does leave one wondering the degree to which the group could surprise the market with deeper-than-expected cuts,” Warren Patterson and Ewa Manthey, commodity analysts at ING, said in a Tuesday note.

Tyler Durden

Tue, 11/28/2023 – 16:36

via ZeroHedge News https://ift.tt/DKS9OLx Tyler Durden