Fed’s Favorite Inflation Indicator Slides To 30 Month Lows, Savings Rate Ticks Higher

One of The Fed’s favorite inflation indicators – Core PCE Deflator – fell to +3.5% YoY in October from +3.7% in Sept (its lowest since April 2021). Headline PCE tumbled to +3.00% YoY (below the 3.1% exp)…

Source: Bloomberg

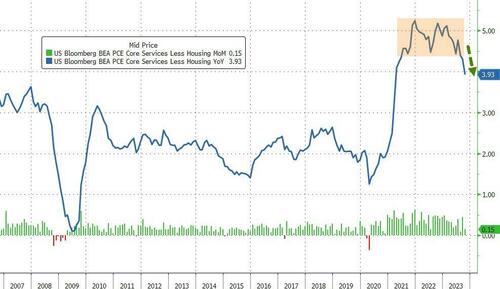

Even more focused, is the Fed’s view on Services inflation ex-Shelter, and the PCE-equivalent shows that it has broken down from its ‘sticky’ levels to its lowest since March 2021…

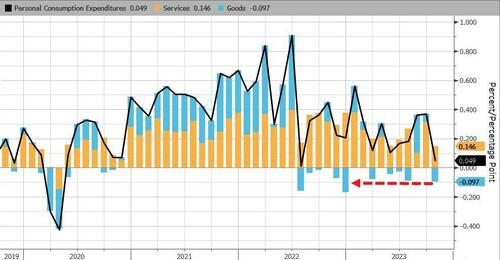

The Goods sector saw deflation in October (-0.1% MoM – biggest MoM decline since Dec 2022) while Services slowed to +0.15% MoM…

Source: Bloomberg

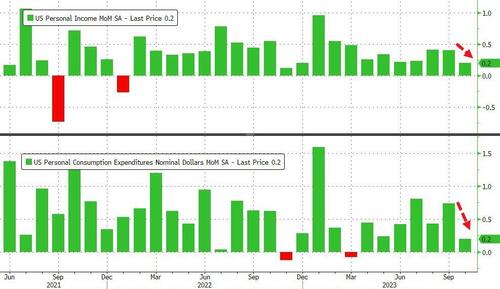

Both income and spending growth slowed on a MoM basis (both +0.2% MoM)…

Source: Bloomberg

Income growth at 4.5% YoY is the slowest since Dec 2022 and Spending growth at +5.3% YoY is the slowest since Feb 2021…

Source: Bloomberg

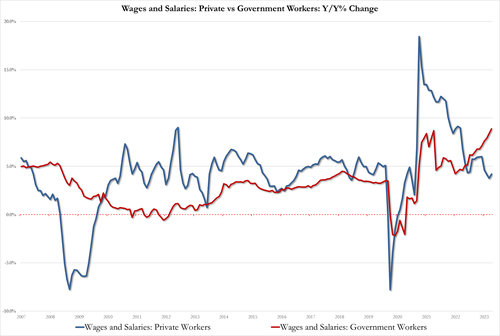

But government wage growth continued to accelerate at a record pace…

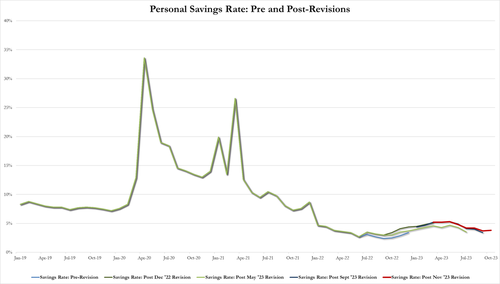

The savings rate ticked up to 3.8% of DPI in October…

Source: Bloomberg

Yet another revision with September’s rate pulled up from 3.4% to 3.7%…

Is the consumer finally pulling back… or just reaching the limit on every source of credit?

Tyler Durden

Thu, 11/30/2023 – 08:43

via ZeroHedge News https://ift.tt/4hrV1DM Tyler Durden