Next Recession Might Be A Brutal One For Stocks

Authored by Simon White, Bloomberg macro strategist,

The next US recession, when it hits, threatens greater downside for stocks as the Federal Reserve is constrained by how much it can cut interest rates.

The creative destruction of a recession may not be imminent, but it will assuredly come.

The most important questions for investors are: how deep will it be, and how far will risk assets fall?

The answer to the first one is nuanced, but the yield curve errs on the side of a deeper-than-average recession. That, paradoxically, has historically meant a less severe selloff in stocks, but the risk in this cycle is that the Fed may not be able to cut rates sufficiently to avert a more serious drop in the equity market.

First, to re-iterate, I don’t see an NBER recession as imminent, and there is maybe another 6-9 months before one occurs. Nonetheless, one will hit at some point, and equities will sell off beforehand. Fortune favors the prepared, so now is as good a time as any to look closer at what might happen.

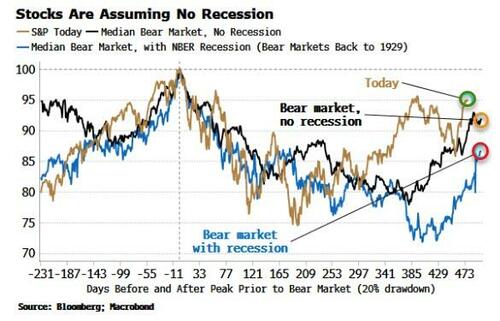

Equities are heavily banking on a soft landing.

If we look at bear markets going back to 1929 and split them into those with and without recessions, the current state of play is very much in line with historical bear markets without a downturn. Indeed, even in bear markets which have featured a recession, in most cases it would have been and gone by this point.

But let’s not make that assumption, and instead try to gauge how deep the next recession will be. It turns that’s not an easy question to answer.

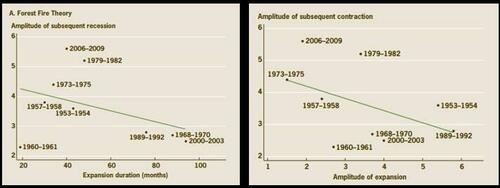

Economists have two main competing theories of recessions, colorfully called the forest fire theory and the plucking theory.

The first posits that the depth of a recession is related to the length of the previous expansion. As with forest fires, fewer smaller fires that burn undergrowth mean more frequent catastrophic fires. Analogously, long expansions mean more “inefficient relationships” can build up, e.g. between employers and unsuitable employees, that have significant room to correct when the downturn hits.

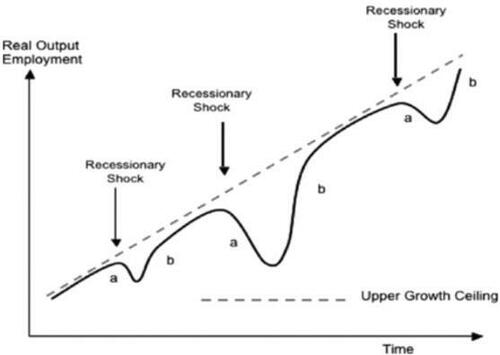

The plucking theory, proposed by Milton Friedman, supposes output is like a guitar string that is plucked downward in a recession. The string can ping back, but only as far as the ceiling of potential output.

Source: Researchgate.net

Using US recessions, the data do not support the forest fire theory, showing a slightly negative relationship between the length of the expansion and the depth of the subsequent recession – however it is not one that is statistically that significant (left-hand chart below). On other hand, the data do support the plucking theory (right-hand chart), which means the amplitude of the subsequent expansion is related to the depth of the preceding recession.

Source: Federal Reserve Bank of St Louis

That doesn’t help us with the question in hand. The forest fire theory is appealing, though, so it would be a shame to jettison it altogether.

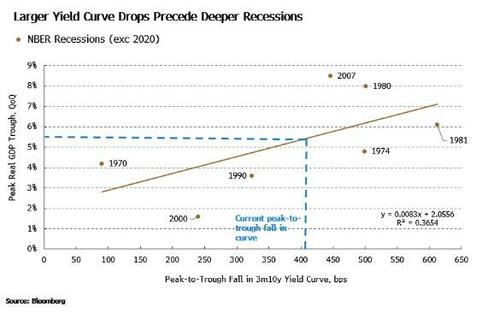

It turns out we can resurrect a version of it by looking at the depth of the yield-curve’s fall in the cycle before the recession instead of the length of the expansion.

Specifically, there is a positive relationship between the peak-to-trough fall in the 3m versus 10y yield curve and the peak fall in quarterly real GDP for US recessions going back to 1970.

In other words, it’s not the length of time that captures the degree of imbalances that have built up during the expansion, but how far the yield curve has fallen.

Based on the current peak-to-trough drop of ~415 bps in the 3m-10y yield curve, that would project a maximum trough in quarterly real GDP of 5.5% in the next recession, which puts it roughly mid table historically.

What does that mean for equities?

There is little of a direct relationship between the peak drawdown of the stock market and the depth of GDP in a recession as equities typically sell off before the contraction starts and start rallying before it ends.

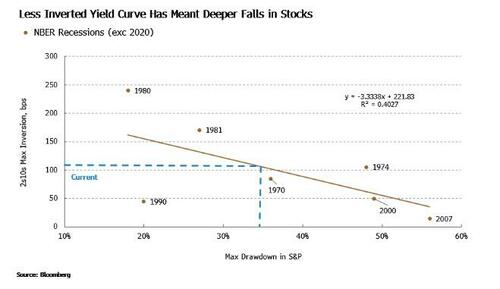

Instead, once again, it’s the yield curve that gives us some insight. This time there is a relationship between the maximum inversion of the 2s10s curve before the recession and the S&P’s maximum drawdown (again for US recessions going back to 1970).

Counter-intuitively, though, the relationship is negative, i.e. shallower inversions in the yield curve have historically been associated with bigger falls in stocks – with the current maximum inversion of the 2s10s curve of ~110bps projecting a peak drawdown in the S&P of ~35%, more than 30% down from the current price.

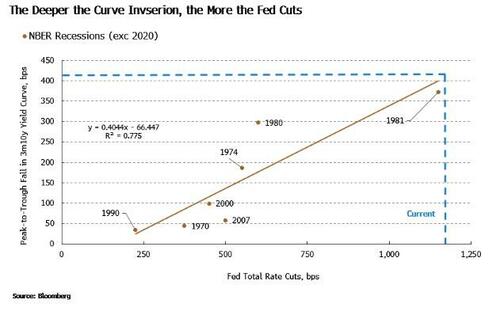

The negative relationship is explained by deeper yield-curve inversions typically leading to steeper rate cuts from the Fed, significantly easing restrictive conditions and allowing stocks to limit their downside (see chart below).

Here lies the rub. The current peak-to-trough decline in the 3m-10y yield curve would project a ~1,200 bps fall in the Fed’s policy rate. That’s more than the 1981 recession and clearly impossible today with nominal rates unable to go negative (under current legislation).

Both the 1980 and 1981 inflationary recessions were among the deepest post-war recessions. They also saw among the shallowest drawdowns in the S&P. But that was likely in no small part due to the significant cuts the Fed was able to make to a very elevated policy rate.

The usual caveats apply: recession sample sizes are limited, and no relationship is perfect. But based on the historical record, we should at least be prepared for the possibility that the size of the yield curve’s fall is telling us the next recession may be on the deep side.

The Fed may then not have enough room to cut nominal rates sufficiently from their current level (note, fed funds is only marginally above its long-term average) to prevent a much deeper than average decline in stocks (notwithstanding re-starting QE or some sort of financial repression, both of which are possibilities in the event financial assets are facing steep falls).

The recession is likely delayed, but boom and bust is alive and well. We just need be ready in case the bust delivers an unusually vicious punch.

Tyler Durden

Thu, 11/30/2023 – 09:00

via ZeroHedge News https://ift.tt/PqOE5da Tyler Durden