US Clean Energy Stocks Have Lost $30 Billion In Value In The Last 6 Months

While the U.S. government continues to try and micromanage markets and subsidize their virtue signaling preferences, 5% interest rates have been busy offering up a reality check to the Biden administration’s green energy pipe dream.

That pipe dream is, of course, that green energy companies could survive in an environment where rates are high; also referred to as an environment where you actually have to turn a consistent profit and generate cash to survive.

According to a new Bloomberg report, that’s just too much reality for some clean energy stocks. A year after President Joe Biden’s significant climate legislation pledged substantial funding for the U.S.’s transition to clean energy, the sector has seen a sharp $30 billion decline in the value of its stocks over the past six months.

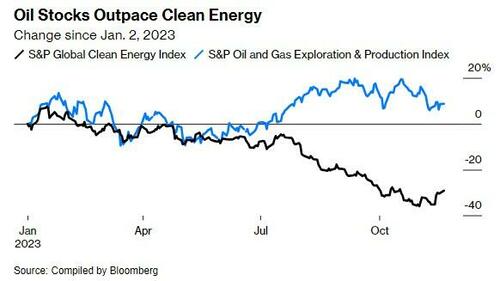

Rate hikes, which affect the profitability of large-scale projects like solar and wind farms, have led to project cancellations and even bankruptcies in the field, the report says. The optimism spurred by the Inflation Reduction Act has faded, resulting in a 25% reduction in the market value of U.S. companies listed in the S&P Global Clean Energy Index in the half-year period ending November 27.

The report noted that the downturn highlights the significant challenges facing Biden’s climate objectives. Clean energy firms not only grapple with steep financing costs but also face hurdles in community acceptance, obtaining government permits, and integrating into an aging power grid that struggles to support the influx of renewable energy.

Meanwhile, oil and gas companies are intensifying their extraction activities – and, according to Biden, making ‘more money than God’ in the process. Either way the message is clear: the U.S.’s journey towards a carbon-neutral electricity grid by 2035 is becoming increasingly difficult.

Eric Scheriff, senior managing director at Capstone, told Bloomberg: “We’re in the moment of realization now where some of the euphoria has worn off and we’re starting to realize it’s still not going to be easy.”

“In the final analysis, green investing has to be based on economic realities,” Jerome Dodson, the now-retired founder of Parnassus Investments added.

And so that’s why we’ve seen the clean energy sector facing a wave of financial challenges. Proterra Inc., an electric bus manufacturer, and Sunlight Financial Holdings Inc., a solar financing firm, both sought Chapter 11 protection. Additionally, planned mergers and projects have been derailed, including Ares Acquisition Corp.’s merger with X-Energy Reactor Co. and Avangrid Inc.’s wind projects in Connecticut and Massachusetts, the report says.

Garvin Jabusch, chief investment officer at Green Alpha Advisors, concluded: “The timeline we have to get to net-zero is quite short. Everything that’s invested in new exploration, new discovery, new extraction, new burning, new internal combustion engines, new fossil-fired electricity plants—all these long-life assets—puts us much further away from any climate goals.”

Recall, we pointed out just days ago how the ESG grift was reaching endgame after Markus Müller, chief investment officer ESG at Deutsche Bank’s Private Bank stated that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

“When we think about clean energy, these are business models which are quite new and sensitive to interest rates,” he said.

Since the surge in fossil fuel prices following Russia’s invasion of Ukraine in February 2022, fossil fuel stocks have seen significant growth, resulting in environmental, social, and governance (ESG) funds underperforming in comparison.

Müller emphasized that investors focused on sustainability require more detailed disclosures from companies about their shift to lower-carbon operations and clearer regulations for labeling funds concentrating on the transition.

He said that ESG strategies vary, with many funds currently investing in fossil fuels, but impending stricter regulations may lead to more exclusions. For instance, France plans to prohibit ‘ISR’ labeled funds from investing in new fossil fuel projects from 2025. Currently, about 45% of funds, amounting to 7 billion euros, have traditional energy investments.

Deutsche Bank’s Chief Investment Office ESG survey indicates sustained investor interest in sustainability, with energy transition being the top investment choice, surpassing artificial intelligence. However, confidence in ESG factors for risk management is declining, with only 37% agreeing it’s effective, down from previous years.

It’s not surprising, as we have been calling out ESG as a grift since the virtue signaling “trend” was born from the soil of near-unlimited liquidity during the Covid years. Recall, back in August we noted that companies with good ESG scores polluted just as much as those with low ones.

You can read Bloomberg’s full report here.

Tyler Durden

Thu, 11/30/2023 – 06:55

via ZeroHedge News https://ift.tt/RUyjVLF Tyler Durden