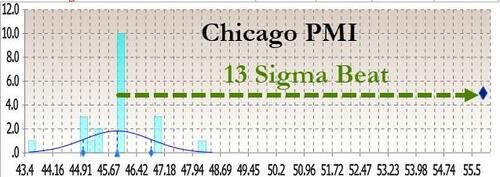

WTF Chart Of The Day: Chicago PMI Beats Expectations By 13 Standard Deviations…

‘Soft’ survey data has been serially disappointing in recent weeks, catching down to the reality of ‘hard’ data…

Source: Bloomberg

So, it was not surprising that analysts forecast for this morning’s Chicago PMI to remain in contraction at 46 (up very modestly from 44 in October).

However, when the actual print hit – many traders double-take’d as the 55.8 print was a 13 standard deviation beat to expectations…

Source: Bloomberg

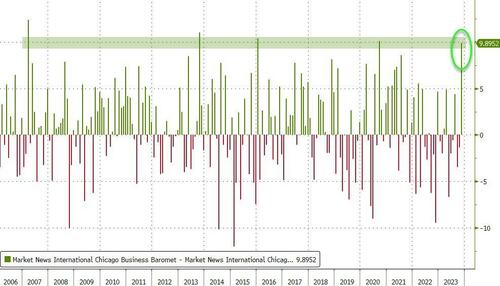

It is one of the biggest beats in the series history…

Source: Bloomberg

And one of the biggest MoM increases in the economic series’ history.

Source: Bloomberg

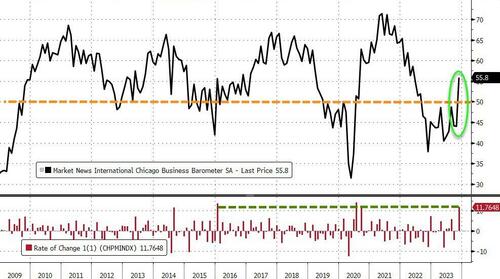

This is the first reading above 50 (manufacturing economic expansion) since August 2022.

Under the hood, 6 of the components increased MoM…

-

Prices paid rose at a slower pace; signaling expansion

-

New orders rose and the direction reversed; signaling expansion

-

Employment rose at a faster pace; signaling expansion

-

Inventories rose and the direction reversed; signaling expansion

-

Supplier deliveries rose and the direction reversed; signaling expansion

-

Production rose and the direction reversed; signaling expansion

-

Order backlogs fell at a slower pace; signaling contraction

Finally, we note some have suggested this ‘beat’ is due to the return of autoworkers after the lengthy strikes.

Could be.

But we ask, were the analysts – who consensus expectations were for contraction to continue – unaware that the strike was over?

Tyler Durden

Thu, 11/30/2023 – 10:45

via ZeroHedge News https://ift.tt/QPa27UI Tyler Durden