Bumpy Inflation Says There’s More Rate Volatility To Come

Authored by Simon White, Bloomberg macro strategist,

An acceleration in inflation volatility points to the implied volatility of fixed-income rising again.

Inflation in the US may be falling, but when the price-growth genie is out of the bottle, it’s how volatile inflation is that matters.

At heart, heightened inflation creates uncertainty. Long-term investment is deterred.

Consumers tend to save more and spend less in what is known as the Katona effect.

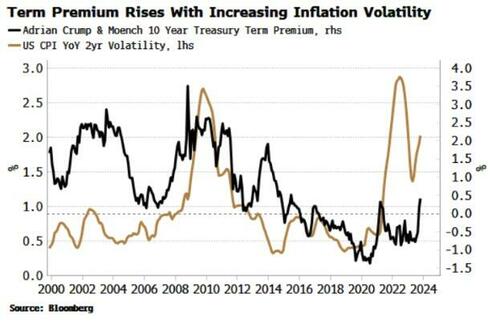

Bond holders typically demand greater premium for the extra inherent uncertainty associated with a greater variance in inflation, which is amplified when inflation is elevated. The chart below shows how the term premium and inflation volatility are positively related, with the recent rise in term premium coinciding with rising variance in inflation (aka how much it moves around its mean).

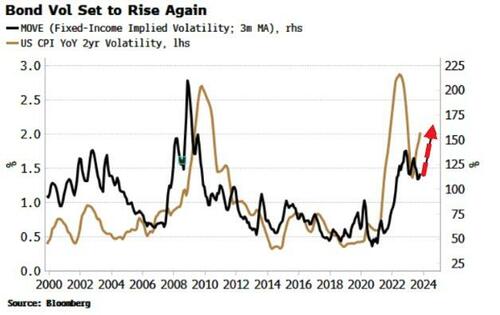

The rise in term premium to compensate bond holders for greater uncertainty typically means bond volatility picks up.

We can see below that bond volatility may not yet have fully reflected the recent increase in inflation’s variance, and it may soon begin climbing again.

As with other financial variables, we should consider real and nominal versions when inflation is elevated.

In this cycle, the rise in real-yield volatility foreshadowed the rise in nominal-yield vol (as captured by the MOVE index in the chart above).

The risk is that the rise in inflation volatility catalyzes a re-acceleration in real-yield volatility, and reinforces already-rising nominal-rate vol.

As the chart shows, the inflationary recessions of the 1970s and early 80s were almost all accompanied by spikes in both real and nominal-yield volatility.

It’s possible the next recession – when it hits – will see the same effect, leaving fixed-income vol and yields with potentially sizable upside risks.

Tyler Durden

Fri, 12/01/2023 – 10:55

via ZeroHedge News https://ift.tt/yghKw4E Tyler Durden